News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.15)|Bitget partners with World Cup champion Julián Álvarez to launch a promotional video; nearly 30% of Ethereum’s total supply is now locked in staking; FOGO will begin trading on the secondary market today2Bitget UEX Daily | White House Imposes 25% Chip Tariff; Trump Signs Rare Earth Security Order; Rare Earth Stocks Surge Against Trend;TSMC to Release Earnings (Jan 15, 2026)3$46B Flows Into ETF, But Bitcoin Struggles

The Federal Reserve's First Rate Cut of the Year: A Summary of Dovish and Hawkish Analysts' Comments and Views

More than 70% of officials tend to favor 1 to 3 rate cuts in 2025. How do dovish and hawkish analysts view this rate cut?

链捕手·2025/09/18 18:33

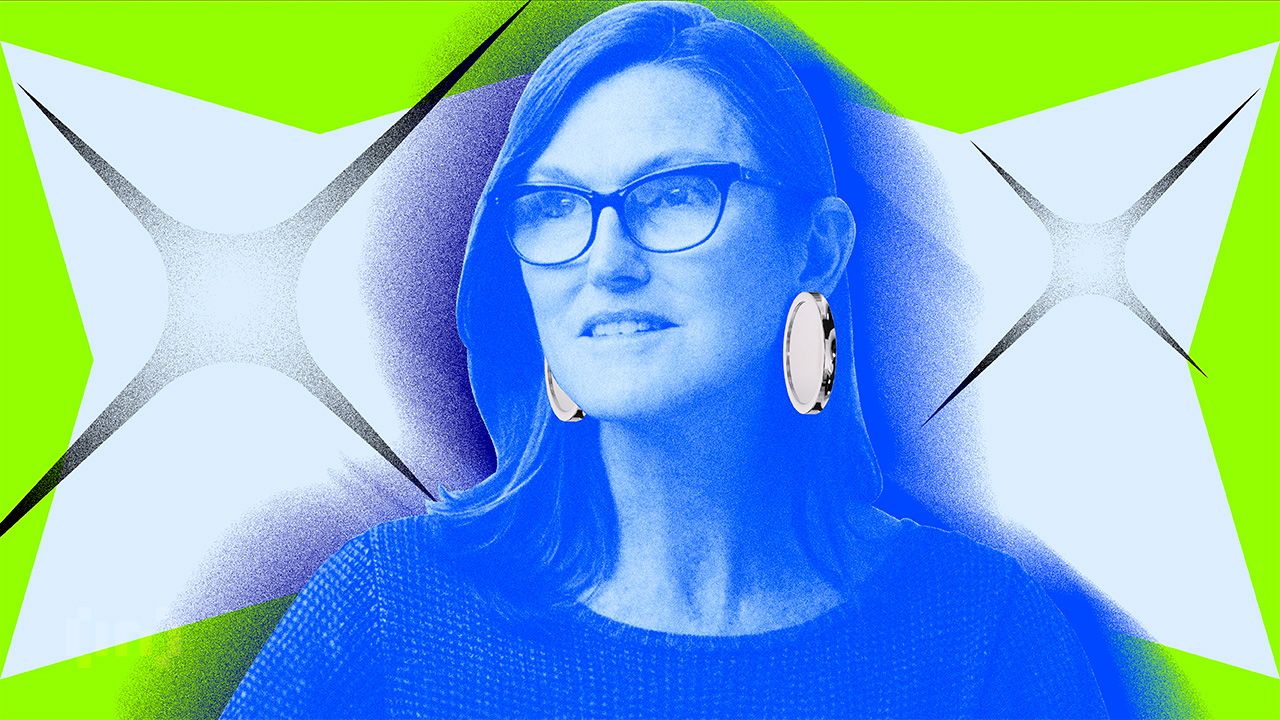

Cathie Wood Backs $300M Solana Deal on Italian Soccer Team Owner

Brera Holdings becomes Solmate with ARK Invest and Pulsar’s $300M funding, pursuing Solana (SOL) accumulation; SOL price rose ~8.5% to ~$247.50 USD.

BeInCrypto·2025/09/18 18:27

Australia Regulates Stablecoin Distribution Without Additional Licensing

In Brief Australia allows licensed firms to distribute stablecoins without extra approval. The exemption is effective until June 2028 and includes consumer protections. This decision aligns with global trends in expanding stablecoin regulations.

Cointurk·2025/09/18 18:21

Solana Rebounds From $235 Low With Charts Indicating Potential 82% Move Toward $457.97

Cryptonewsland·2025/09/18 18:15

PEPE Consolidates Above $0.00001073 as Market Eyes Break Above Resistance

Cryptonewsland·2025/09/18 18:15

GraphAI Price Holds $0.4774 After Resistance Breakout, Eyes $0.5008 Next

Cryptonewsland·2025/09/18 18:15

Dogecoin Holds Key Range as Q4 Momentum Builds Beyond $0.2847

Cryptonewsland·2025/09/18 18:15

Australia adopts licensing exemption for stablecoin intermediaries

Portalcripto·2025/09/18 18:12

PGI CEO Admits to Fraud in $200 Million Bitcoin Ponzi Scheme

Portalcripto·2025/09/18 18:12

Tristan Thompson Taps Somnia to Bring Basketball Fandom On-Chain

CryptoNewsNet·2025/09/18 18:00

Flash

03:29

The Governor of the Bank of Korea stated that if they want to stabilize the foreign exchange market through policy interest rates, interest rates must be raised by approximately 200 to 300 basis point Bank of Korea Governor Lee Chang-yong: If we want to stabilize the foreign exchange market through policy rates, the interest rate must be raised by about 200 to 300 basis points.

03:23

Santiment: The current whale buying/retail selling pattern is the ideal setup for a bull market kickoffBlockBeats News, January 15, market research institution Santiment posted on social media that since January 10, "whale" and "shark" addresses holding between 10 and 10,000 bitcoin have accumulated an additional 32,693 BTC, with their total holdings increasing by 0.24%. Since January 10, "shrimp" addresses holding less than 0.01 bitcoin have cumulatively sold 149 BTC, with their total holdings decreasing by 0.30%. This set of data sends a signal: smart money continues to buy in, while micro funds are choosing to exit. This is the ideal setup pattern for the start of a bull market. How long this trend can last depends on how long retail investors remain skeptical of the currently emerging upward trend. At present, the "extremely bullish" green zone is still ongoing.

03:22

Santiment: The current Whale Accumulation/Distribution to Retailers setup is an ideal bull market ignition patternBlockBeats News, January 15th, Market research firm Santiment posted on social media that since January 10th, the "Whale" and "Shark" addresses holding between 10 to 100,000 BTC have accumulated an additional 32,693 BTC, a 0.24% increase in their total holdings.

Since January 10th, the "Shrimp" address holding less than 0.01 BTC has sold a total of 149 BTC, a 0.30% decrease in their total holdings.

This data release sends a signal: smart money continues to buy in, while small-scale funds choose to exit. This is the ideal setup for the start of a bull market. How long this trend will continue depends on how long retail investors remain skeptical of the emerging uptrend. Currently, the "extreme bullish" green zone continues.

News