News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.15)|Bitget partners with World Cup champion Julián Álvarez to launch a promotional video; nearly 30% of Ethereum’s total supply is now locked in staking; FOGO will begin trading on the secondary market today2Bitget UEX Daily | White House Imposes 25% Chip Tariff; Trump Signs Rare Earth Security Order; Rare Earth Stocks Surge Against Trend;TSMC to Release Earnings (Jan 15, 2026)3$46B Flows Into ETF, But Bitcoin Struggles

Former BlackRock Executive Joseph Chalom: Why Ethereum Will Reshape Global Finance

Could Ethereum become one of the most strategic assets of the next decade? Why do DATs offer a smarter, higher-yield, and more transparent way to invest in Ethereum?

Chaincatcher·2025/09/17 15:29

Elizabeth Warren raises ethics concerns over White House crypto czar David Sacks’ tenure

CryptoSlate·2025/09/17 15:07

CME Group to launch Solana and XRP options amid surging futures demand

CryptoSlate·2025/09/17 13:56

Bitcoin price gains 8% as September 2025 on track for best in 13 years

Cointelegraph·2025/09/17 13:33

Ethereum unstaking queue goes ‘parabolic’: What does it mean for price?

Cointelegraph·2025/09/17 13:33

Solana Price Eyes Next Leg Up Amid Growing Social Interest and New Demand

Solana holds steady after a recent surge, but rising demand and stronger social buzz suggest momentum could soon lift prices higher.

BeInCrypto·2025/09/17 13:00

ETH’s run vs. BTC: Finished, or early days?

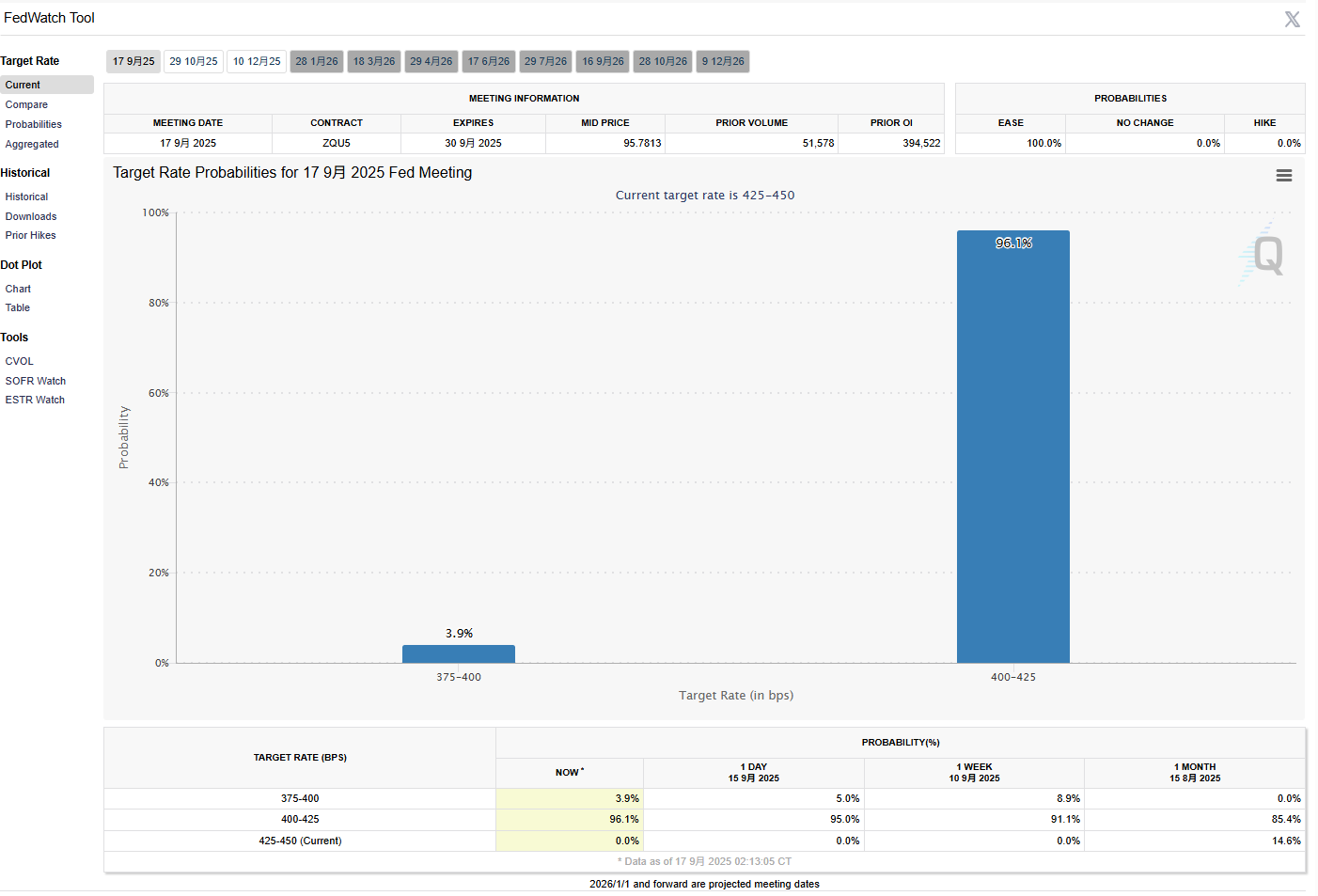

Any indication the FOMC is less dovish than anticipated could weigh on crypto, industry watcher says

Blockworks·2025/09/17 12:39

Pump.funs Viral Livestreams and Creator Capital Markets Surge

TheCryptoUpdates·2025/09/17 12:39

Camp Network brings global digital IP to its newly launched mainnet

Camp is unlocking new use cases for intellectual property (IP), laying the foundation for a future where rights, authorization, and commercial monetization are embedded within the creative process.

深潮·2025/09/17 12:35

Flash

05:03

Santiment: Social Media Platform 'Bearish' Sentiment Strengthens as Bitcoin Rebound Continues, Potentially Propelling Bitcoin Back to $100,000BlockBeats News, January 15th, Market analysis firm Santiment posted on social media that despite the Bitcoin price rebound this week, social media data shows an interesting change in sentiment — bearish volume continues to strengthen. As market trends often go against retail sentiment, the most intense fear sentiment in the past 10 days may ironically propel BTC back to the $100,000 mark.

04:58

Blockchain company plans to launch a $200 million tokenized water project in Asia, with the first stop in JakartaAccording to Odaily, blockchain infrastructure company Global Settlement Network has announced the launch of a water asset tokenization pilot project, with plans to expand the project across Southeast Asia over the next 12 months, targeting a scale of $200 million. The pilot will first tokenize eight government-contracted water treatment facilities in Jakarta, aiming to raise up to approximately $35 million for facility upgrades and the expansion of the local water supply network. During the project’s advancement, relevant parties will also test the Indonesian Rupiah stablecoin settlement channel and gradually expand to more foreign exchange settlement scenarios in a controlled environment. Mas Witjaksono, Chairman of the Indonesian Globalasia Infrastructure Fund, stated that Indonesia possesses a large number of tokenizable assets in the infrastructure and natural resources sectors, and the related model has growth potential. The report points out that the financing gap for water infrastructure in Southeast Asia continues to widen, with the required long-term investment expected to exceed $4 trillion by 2040. Some industry insiders predict that as adoption accelerates in emerging markets, the real-world asset (RWA) tokenization market is expected to see significant growth by 2026. Currently, the on-chain RWA scale has exceeded $21 billion. (Cointelegraph)

04:57

GSX to launch water treatment plant asset tokenization project in Indonesia, aiming to raise $35 millionChainCatcher reported that blockchain infrastructure company Global Settlement Network (GSX) has partnered with Indonesia-based Globalasia Infrastructure Fund to launch a pilot project in Jakarta, Indonesia. The project will tokenize assets for eight government-contracted water treatment plants, aiming to raise up to $35 million to upgrade water treatment facilities and expand the water supply network. These facilities currently serve more than 36,000 residents, supplying approximately 2,300 liters of clean water per second, and are expected to generate over $15 million in revenue by the end of 2026. Global Settlement Network plans to gradually expand the asset tokenization initiative across Southeast Asia over the next 12 months, targeting $200 million in tokenized water assets.

News