News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

Anchorage Digital Acquires Securitize For Advisors to Expand Crypto Wealth Management

DeFi Planet·2025/12/16 09:33

MoveBit under BitsLab Releases Research|Belobog: A Move Fuzz Testing Framework for Real-World Attacks

TechFlow深潮·2025/12/16 09:31

Ripple Labs in South Africa? Top Exec Shares Crucial Hint

UToday·2025/12/16 09:30

Dogecoin Jumps 77% in Volume as Crucial Support Gets Tested

UToday·2025/12/16 09:30

'This Is Not Journalism': Ripple CEO Takes Aim at NYT

UToday·2025/12/16 09:30

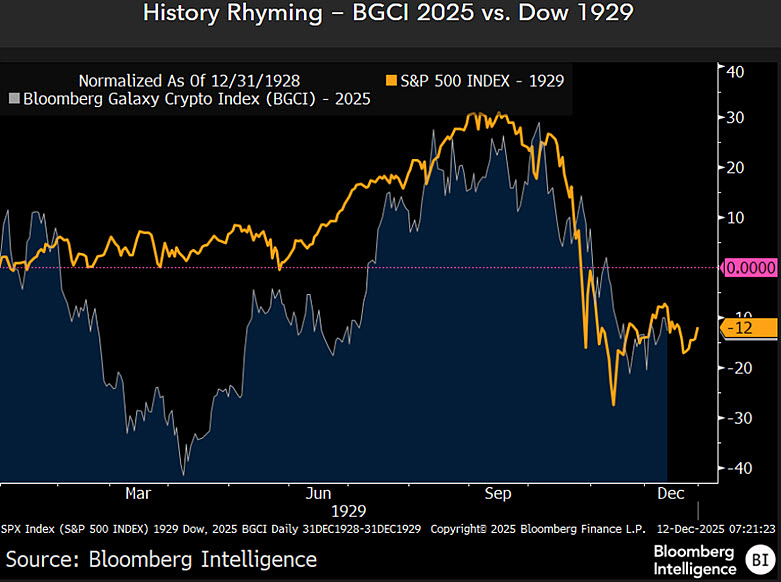

Bitcoin May Be Repeating 1929 Great Depression, Top Bloomberg Strategist Warns

UToday·2025/12/16 09:30

XRP Urgent Alert Issued to Node Operators: Reason

UToday·2025/12/16 09:30

Flash

16:10

Head of Research at an Exchange: Dedicated blockchain networks are rapidly emerging, reshaping the competitive landscape of crypto infrastructureAccording to ChainCatcher, David Duong, Head of Institutional Research at a certain exchange, stated in an article: "We believe that dedicated blockchain networks are rapidly emerging (including L2s, independent L1s, and application-specific chains), and are quickly reshaping the competitive landscape of crypto infrastructure. For example, the Arc platform built by Circle is specifically designed for institutional-grade applications centered around USDC, aiming to become a compliant and optimal institutional infrastructure; meanwhile, the Tempo network incubated by Stripe and Paradigm focuses on establishing institutional-level payment channels, with the goal of entering the vast cross-border payments and international trade market."

15:44

Hyperliquid Vesting Team Token Unlock Schedule: 1.2M HYPE to be unlocked on January 6thBlockBeats News, December 28th, Hyperliquid released an announcement on Discord clarifying the team token unlock schedule. 1.2 million HYPE will be unlocked on January 6th, with subsequent token unlocks to occur on the 6th of each month.

15:24

Michael Saylor hints that the company's valuation is returning to the fair value of its bitcoin holdings, while the author of "The Big Short" says large-scale BTC purchases are imminent.ChainCatcher news, Strategy Executive Chairman Michael Saylor posted the latest asset dashboard screenshot on the X platform, with the caption "Back to Orange".

News