News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.29)|HYPE, SUI, and EIGEN tokens are set to undergo large unlocks this week; Bitcoin spot ETFs recorded a net outflow of $276 million in a single day, marking six consecutive days of net outflows2Bitget US Stock Daily Report | Spot Silver Continues to Surge, Refreshing 83 USD High; CME Raises Metal Performance Margins; US Stocks Focus on Fed Policy at Year-End (December 29, 2025)

Ripple Announces Major Update to Enhance Utilities for XRP and RLUSD

UToday·2025/12/16 09:30

SEC Chair Warns Crypto May Become Powerful Financial Surveillance Tool

Cryptotale·2025/12/16 09:30

Trust Wallet launches gas-sponsored gas-free Ethereum swap service

币界网·2025/12/16 09:22

Spot XRP ETFs surpass $1 billion in cumulative inflows since November launch

The Block·2025/12/16 09:21

![Reasons for the rise of Movement [MOVE] cryptocurrency—L1 migration, buybacks, and more!](/news-static/client/media/cover-placeholder.101bcc72032a7c4f0a397f15f3252c92.svg)

ICP falls back to recent lows as rebound attempt fails

币界网·2025/12/16 09:14

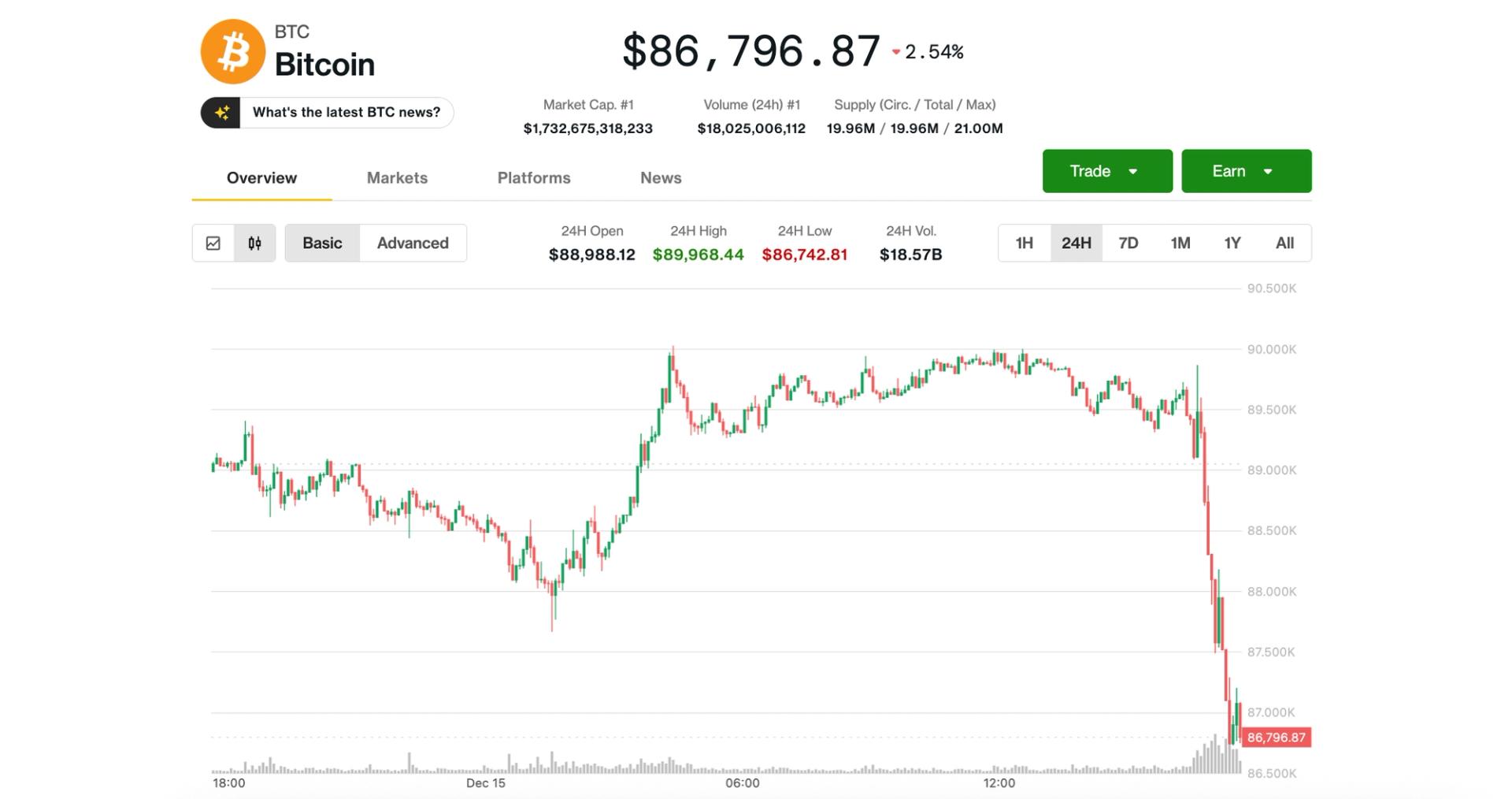

Bitcoin falls below $87,000 as cryptocurrency weakness intensifies

AIcoin·2025/12/16 09:10

Master Crypto Volatility: The Unshakeable Mindset of Successful Long-Term Investors

Bitcoinworld·2025/12/16 09:00

Flash

04:06

SlowMist CISO: The latest variant of the NPM supply chain attack, "Shai-Hulud 3," is coming—please be vigilant.ChainCatcher news, SlowMist Chief Information Security Officer 23pds has issued a security warning: the latest variant of the NPM supply chain attack, "Shai-Hulud 3," has resurfaced. All project teams and platforms are advised to take precautions. Previously, it was suspected that the Trust Wallet API key leak may have been caused by the Shai-Hulud 2 attack.

04:02

Caixin: Starting January 1, 2026, Interest Can Be Earned on Digital RMB Wallet BalanceBlockBeats News, December 29th, according to Caixin, the digital RMB will undergo a solution upgrade. Starting January 1, 2026, wallet balances will earn interest. Without changing the two-tier operational framework, bank-operated digital RMB will move from off-balance sheet to on-balance sheet, transitioning from 100% reserve to partial reserve; non-bank payment institutions will implement a 100% digital RMB reserve requirement. Bank institutions will pay interest on customers' real-name digital RMB wallet balances, complying with deposit interest rate pricing self-discipline agreements. They can autonomously conduct asset and liability management on digital RMB wallet balances and receive security protection equivalent to deposits provided by deposit insurance under the law. For non-bank payment institutions, the digital RMB reserve requirement is no different from customer prepayment funds held by non-bank payment institutions.

03:57

The long position floating loss of the "1011 Insider Whale" has narrowed to $24.86 million.PANews, December 29 – According to on-chain analyst @ai_9684xtpa, as BTC surpassed $90,000, the floating loss of the "insider whale who opened short positions after the 1011 flash crash" on long positions has narrowed to $24.86 million. ETH: Holding 203,340.64 tokens ($617 million), opening price $3,147.39, floating loss $22.65 million; BTC: Holding 1,000 tokens ($90 million), opening price $91,506.7, floating loss $1.64 million; SOL: Holding 511,000 tokens ($66 million), opening price $130.1911, floating loss $573,000.

News