News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1 Bitget Daily Digest (Dec. 18)|U.S. SEC issues a Statement on the Custody of Crypto Asset Securities by Broker-Dealers; LayerZero (ZRO) to unlock ~25.71 million tokens on Dec. 202Bitget US Stock Morning Brief | S&P 500 Four-Day Decline; Oracle AI Financing Stalls; Energy & Precious Metals Rally; Micron Crushes Guidance, Surges After Hours (December 18, 2025)3SEC says broker-dealers need to maintain crypto private keys to comply with customer protection rules

Telegram Founder Pavel Durov Slams France Over “Absurd” Criminal Probe as TON Token Struggles

Telegram founder Pavel Durov has lashed out at French authorities, accusing them of pursuing a baseless criminal investigation that has dragged on for more than a year and left him tethered to legal obligations in Paris.

DeFi Planet·2025/08/25 13:30

Galaxy Digital, Jump Trading, Multicoin Capital in Talks for $1B Solana Token Purchase

Galaxy Digital, Jump Trading, and Multicoin Capital are reportedly in discussions to raise $1 billion for the purchase of Solana’s SOL tokens, according to Bloomberg.

DeFi Planet·2025/08/25 13:30

Pavel Durov Slams French Handling of Telegram Case, Citing Damage to France’s Image

Cointribune·2025/08/25 13:30

Apple Rushes Emergency Patches for Crypto-Stealing Vulnerability

Cointribune·2025/08/25 13:30

Saylor Makes Third Straight Bitcoin Buy in August

Cointribune·2025/08/25 13:30

Metaplanet Adds 103 BTC, Holdings Soar to 18,991 Bitcoins

Cointribune·2025/08/25 13:30

Hyperliquid (HYPE) On-Chain Metrics Surge — Hits Multiple New All-Time Highs

CoinsProbe·2025/08/25 13:25

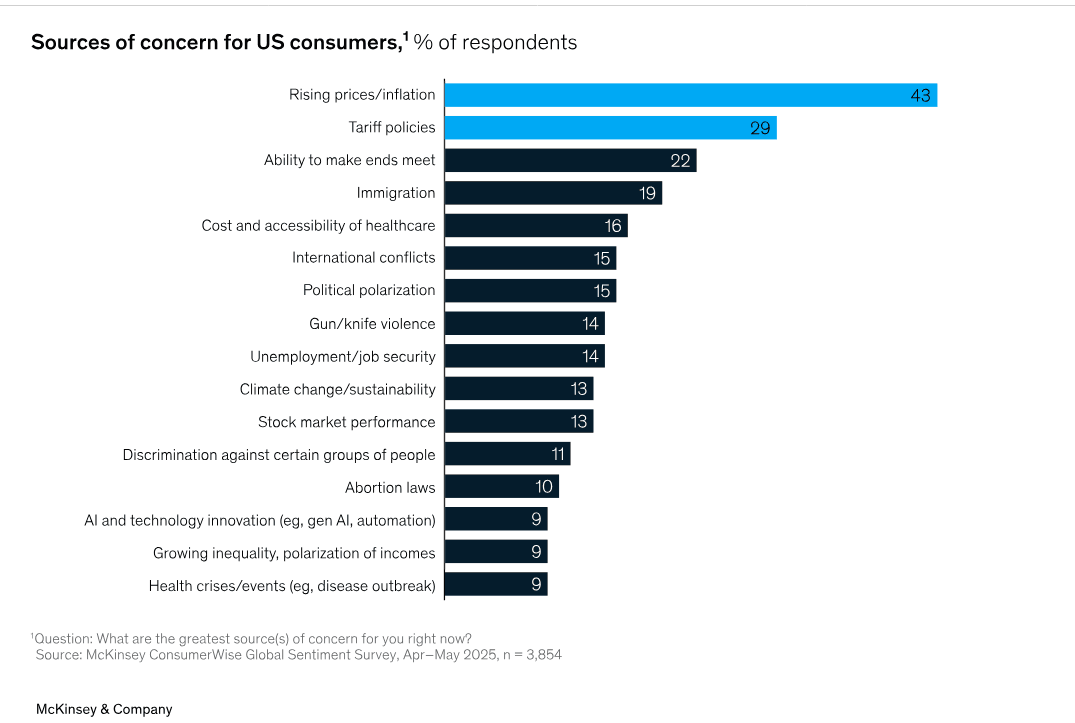

Shiba Inu Crash Ahead? Why Tight Budgets Could Hit SHIB Hard?

Cryptoticker·2025/08/25 13:15

Trump family went pro-crypto after Biden ‘weaponized banks’ — WSJ

Cointime·2025/08/25 13:05

One year since Durov’s arrest: What’s happened and what’s ahead?

Cointime·2025/08/25 13:05

Flash

07:09

"BTC OG insider whale" unstaked another 449,000 ETH last night, with a total holding now reaching 615,000 ETH.BlockBeats News, December 18, according to monitoring by Arkham analyst Emmett Gallic, the "BTC OG Insider Whale" once again unstaked 449,000 ETH last night, bringing its total holdings to 615,000 ETH (worth approximately $1.8 billions). Previously, it was reported that the "BTC OG Insider Whale" had unstaked part of its ETH eight days before publicly going long.

07:07

「BTC OG Insider Whale」 once again unbonded 449,000 ETH last night, bringing their total holdings to 615,000 ETHBlockBeats News, December 18th, according to Arkham analyst Emmett Gallic's monitoring, the "BTC OG Insider Whale" once again unbonded 449,000 ETH last night, bringing its total holdings to 615,000 ETH (valued at approximately $1.8 billion).

Previous reports indicated that the "BTC OG Insider Whale" had partially unbonded some of its ETH 8 days before openly going long.

06:52

glassnode: Options market reinforces bitcoin's range-bound pattern, with the fluctuation range between $81,000 and $95,000BlockBeats News, December 18, glassnode released its weekly market analysis stating that the market continues to fluctuate within a fragile and time-sensitive structure, affected by heavy supply, rising realized losses, and persistently weakening demand. The price was blocked near $93,000 before falling back to $85,600, reflecting the dense supply accumulated in the $93,000 to $120,000 range, with previous strong buyers continuously suppressing price rebounds. As long as the price remains below the 0.75 quantile (around $95,000) and fails to reclaim the short-term holder cost basis of $101,500, the upside potential may remain limited. Despite the pressure, patient demand has so far kept the true market mean near $81,300, preventing further price declines. Spot demand remains selective, corporate capital flows are intermittent, and futures positions continue to reduce risk rather than rebuild confidence. The options market reinforces this range-bound pattern, with near-term contract volatility narrowing, downside risks still present but relatively stable, and expiry-driven positioning keeping price movements constrained into late December. In summary, bitcoin currently remains between structural support near $81,000 and ongoing selling pressure above. For a substantial shift to occur, either sellers must exhaust all selling above $95,000, or new liquidity must flow in to absorb supply and reclaim key cost basis levels.

News