News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget US Stock Daily Brief | Trump Plans to Sue Powell; Meta Acquires Manus; Tesla Orders Sharply Decline (December 30, 2025)2Bitget Daily Digest (Dec.30)|Meta acquires Manus for billions of dollars; RWA protocols become the 5th largest DeFi category; Strategy purchases another 1,229 BTC3 Chainlink Is Stuck Around $12 as Selling Pressure Fades: Here’s What Next for LINK Price Rally

Bitcoin hikes volatility into ‘tricky’ FOMC as $93.5K yearly open fails

Cointelegraph·2025/12/10 16:36

New Ethereum Privacy Infrastructure: In-depth Analysis of How Aztec Achieves "Programmable Privacy"

From the Noir language to Ignition Chain: a comprehensive breakdown of Ethereum's full-stack privacy architecture.

ChainFeeds·2025/12/10 16:34

CARV In-depth Analysis: Cashie 2.0 Integrates x402, Transforming Social Capital into On-chain Value

Today, Cashie has evolved into a programmable execution layer, enabling AI agents, creators, and communities not only to participate in the market, but also to actively initiate and drive the building and growth of markets.

BlockBeats·2025/12/10 16:15

Trump Takes Control of the Federal Reserve: The Impact on Bitcoin in the Coming Months

A once-in-a-century major transformation is taking place in the U.S. financial system.

BlockBeats·2025/12/10 16:13

Gensyn launches two initiatives: A quick look at the AI token public sale and the model prediction market Delphi

Gensyn previously raised over 50 million dollars in total through its seed and Series A rounds, led by Eden Block and a16z, respectively.

BlockBeats·2025/12/10 16:12

Verse8's Story: How to Support Creative Expression in the Age of AI

Creativity will continue to increase in value through collaboration, remixing, and shared ownership.

BlockBeats·2025/12/10 16:12

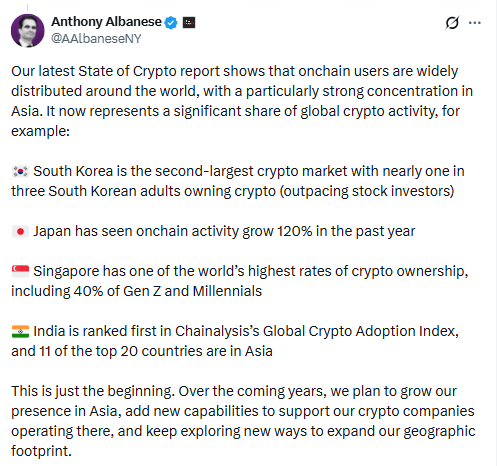

A16z Crypto Targets Asia With New Seoul Crypto Office

Kriptoworld·2025/12/10 16:00

$70,000 Incoming? Trader Who Nailed 2021 Bitcoin Collapse Says ‘Stress Test’ Could Hammer BTC

Daily Hodl·2025/12/10 16:00

Wall Street vs. Crypto: The Battle for Tokenized Stocks Hits Fever Pitch

Kriptoworld·2025/12/10 16:00

Memecoins Hit the Ice Age: Dominance Craters to 2022 Zombie Levels

Kriptoworld·2025/12/10 16:00

Flash

10:16

DWF Labs: $75 million DeFi fund will support perpetual contracts and lending market infrastructureAccording to Odaily, DWF Labs stated on the X platform that the perpetual contract market will attract a large influx of new liquidity by 2026. The $75 million DeFi fund established by DWF Labs aims to support the construction of related infrastructure, covering perpetual contracts, money markets, and yield protocols that expand according to actual demand.

10:14

Sun Yuchen's address purchased 1.66 million LIT, with an unrealized loss of about $550,000PANews reported on December 30 that, according to MLM, a wallet address controlled by Justin Sun withdrew $5.2 million USDC from approximately $200 million injected into LLP and used it to purchase about 1.66 million LIT tokens, currently valued at around $4.65 million, resulting in an unrealized loss of approximately $550,000. Additionally, about $1.2 million USDC remains in his spot account.

09:58

Lighter's LIT token FDV exceeding $3 billion sparks controversyLighter's LIT token has not yet started public trading, but its pre-market valuation has already sparked controversy, with predictions ranging from 2 billion to over 3 billion USD. The fully diluted valuation (FDV) of LIT has become a focal point of discussion, as its potential market value based on the maximum token supply may be misleading. Pre-market trading shows a valuation exceeding 3 billion USD, but prediction markets on Polymarket indicate uncertainty, with traders equally divided on whether LIT can surpass this valuation.

News