News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

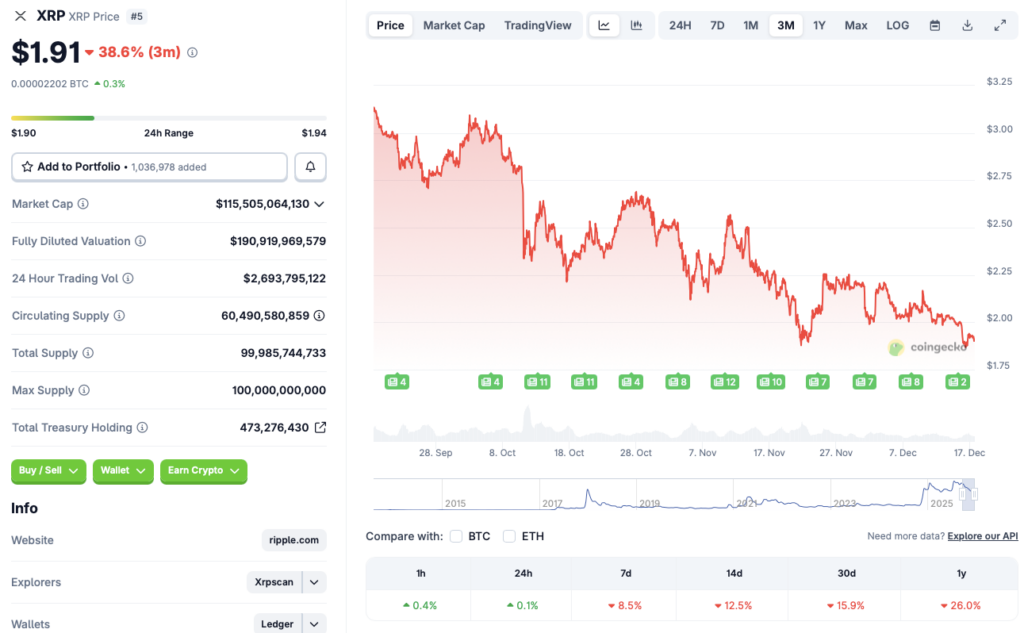

XRP may fall below $1 as whales sell: Here’s what you need to know

币界网·2025/12/17 16:29

Stunning Bitcoin Whale Transfer: $380 Million in BTC Vanishes Into New Wallet

Bitcoinworld·2025/12/17 16:27

Bitcoin Price Plummets: BTC Falls Below $88,000 in Sharp Market Correction

Bitcoinworld·2025/12/17 16:12

DOGE Hangs on $0.074 “Supply Wall” as Traders Watch for a Bounce

BlockchainReporter·2025/12/17 16:12

Bitcoin Miner Hut 8's Stock Soars After Inking $7 Billion Google-Backed AI Deal

Decrypt·2025/12/17 16:12

Analyst Who Accurately Forecasted XRP Price Crash to $1.88 Sets Next Price Target

TimesTabloid·2025/12/17 16:06

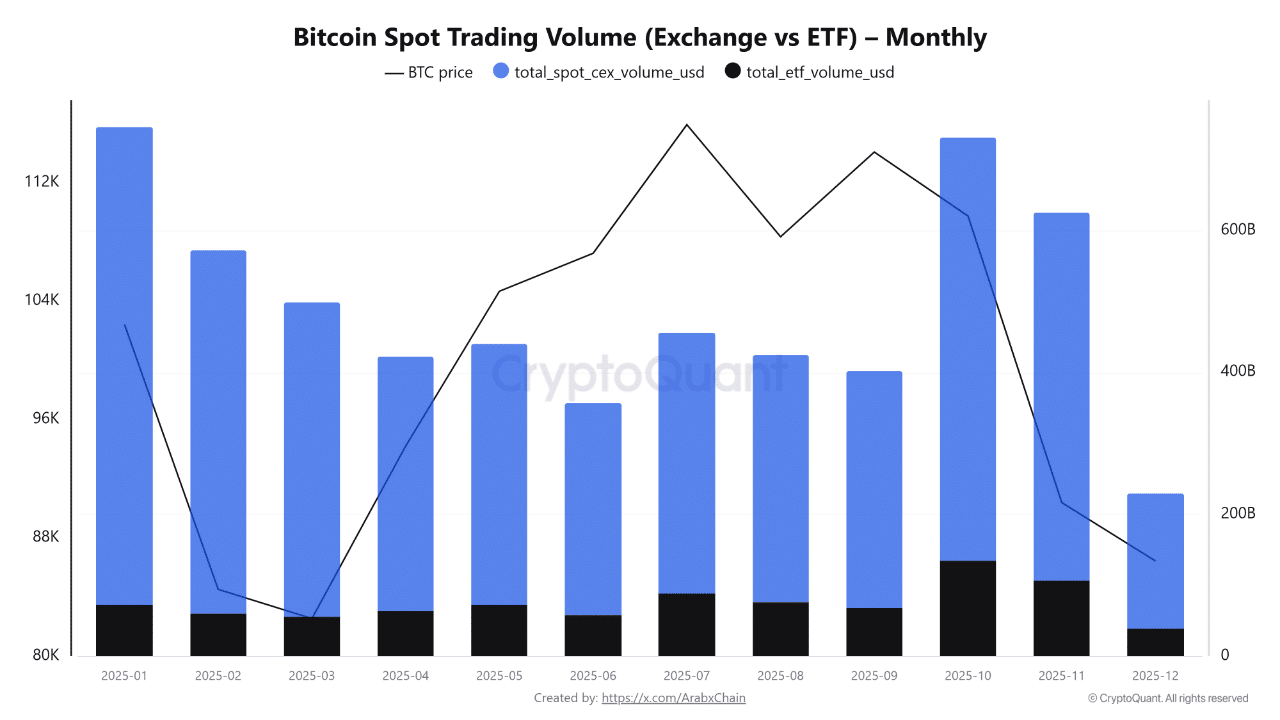

Mapping Bitcoin’s year-end slowdown as leverage exits the market

AMBCrypto·2025/12/17 16:03

Two Key Reasons Why Bitcoin Has Entered a Bear Market: Wall Street Veteran

币界网·2025/12/17 16:02

Bitcoin bears scramble to retreat as BTC surges

AIcoin·2025/12/17 16:02

Top Crypto Presales With Rising Search Volume IPO Genie ($IPO) Gains Global Attention

BlockchainReporter·2025/12/17 16:00

Flash

05:56

In the past 24 hours, the crypto market saw total liquidations of $66.62 million across the network, with short positions accounting for over 60%.According to Odaily, citing Coinglass data, a total of 67,749 traders were liquidated across the network in the past 24 hours, with total liquidations amounting to 66.6195 millions USD. Of these, long positions accounted for 26.4221 millions USD in liquidations, while short positions accounted for 40.1974 millions USD. The largest single liquidation occurred on Hyperliquid's ORCL-USD trading pair, valued at 893,600 USD.

05:54

The Japanese government and private enterprises launch a $19 billion national artificial intelligence project.PANews, December 21 — According to Golden Ten Data, the Japanese government will cooperate with the private sector to launch a large-scale project to develop a national artificial intelligence system with a total value of about 3 trillion yen (approximately $19 billion). It is expected that next spring, SoftBank Group and more than a dozen other Japanese companies will establish a new company to develop Japan's largest foundational artificial intelligence model. The new company will be led by SoftBank Group and will bring together about 100 experts selected through company competitions, including SoftBank engineers and developers from Preferred Networks. The Japanese government emphasized that artificial intelligence directly affects industrial competitiveness and national security, and excessive reliance on foreign technology poses strategic risks, which is one of the reasons for launching this project.

05:53

Data: 150.07 BTC transferred from an anonymous address, routed through intermediaries, and deposited into an exchangeChainCatcher News, according to Arkham data, at 13:42 (UTC+8), 150.07 BTC (worth approximately $13.2183 million) was transferred from an anonymous address (starting with 1HCvmgVe...) to another anonymous address (starting with 14ACHYD...). Subsequently, this address transferred 1 BTC to a certain exchange.

News