News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

Dogecoin Might Add Extra Zero if This Crucial Support Gives Way

UToday·2025/12/21 17:24

XRP Could Add Zero If Rally Is Short-Lived

UToday·2025/12/21 17:24

'New ADA' Goes Parabolic With 357% Ratio, Cardano Creator Teases Storm Incoming

UToday·2025/12/21 17:24

Selling Bitcoin (BTC) in January May Be Bad Idea, Price History Warns

UToday·2025/12/21 17:24

Zcash Founder Reveals Biggest Reason Why He’s Bearish on Bitcoin

UToday·2025/12/21 17:24

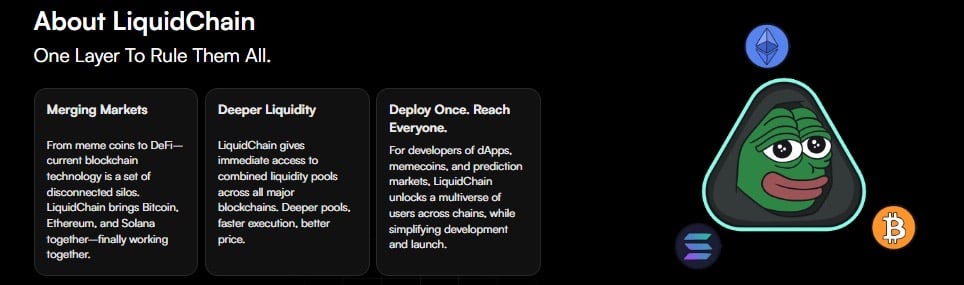

Why LiquidChain’s Layer-3 Network Is Becoming the Best Crypto to Buy for 2026

Cryptonomist·2025/12/21 17:15

Canary Capital CEO Drops XRP Truth Bomb

TimesTabloid·2025/12/21 17:03

Elizabeth Warren is using PancakeSwap to force Trump’s regulators into a conflict trap they can’t escape

CryptoSlate·2025/12/21 17:00

When Will Bitcoin Prices Recover? Analysis Firm Explains – “The Honeymoon Period Is Coming”

BitcoinSistemi·2025/12/21 16:36

Flash

11:46

Pre-market Crypto Stock Movement Mixed, MSTR Up 1.01%BlockBeats News, December 26th, pre-market trading of US stock/crypto concept stocks saw mixed results, including:

· MSTR up 1.01%;

· 某交易所 up 0.23%;

· HOOD up 0.17%;

· SBET down 0.11%;

· BMNR up 0.34%;

· CRCL down 0.45%.

11:43

Arthur Hayes address increases holdings by 1.855 million LDOOn December 26, according to monitoring by lookonchain, the Arthur Hayes address purchased 1.855 million LDO, worth approximately $1.03 million.

11:40

Arthur Hayes Acquires 1.855M LDO, Worth Around $1.03MBlockBeats News, December 26, according to lookonchain monitoring, the address of Arthur Hayes just bought 1,855,000 LDO, worth about $1.03 million.

News