News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget US Stock Daily Brief | US Stocks Close Lower for Third Straight Day; Fed Rate Cut Divisions Significant; Gold and Silver Prices Rebound (December 31, 2025)2Bitget Daily Digest (Dec.31)|Bitwise Files ETF Applications for AAVE and 11 Other Cryptos; Strategy Seeks Untapped Capital to Increase BTC Holdings3Crypto sentiment turns fearful as Bitcoin consolidates – Panic or patience?

US Banks Abruptly Drain $25,000,000,000 From Federal Reserve’s Lifeline for Lenders

Daily Hodl·2025/12/05 16:00

Best Crypto Presale Opportunities After the Altcoin Drawdown: Why Mono Protocol’s Approach Stands Out

Cryptodaily·2025/12/05 16:00

Crypto Treasury Underwriter Clear Street Eyes $12B IPO Led By Goldman Sachs

Clear Street targets a $12B IPO led by Goldman Sachs as crypto-treasury underwriting demand reshapes U.S. equity and debt markets.

Coinspeaker·2025/12/05 16:00

French Bank BPCE Offers Direct Crypto Access for Millions of Clients

France’s second-largest bank, BPCE, will begin offering direct crypto purchases next week, emphasizing a trend of improved regulatory sentiment in Europe.

Coinspeaker·2025/12/05 16:00

Strategy CEO Says No Bitcoin Sale till 2065 Despite BTC Losing $90K SupportBitcoin Price Forecast: Cup-and-Handle Intact, Can BTC Reclaim $100k to Co

Bitcoin dipped below $90,000 after heavy liquidations. Strategy’s CEO vows not to sell.

Coinspeaker·2025/12/05 16:00

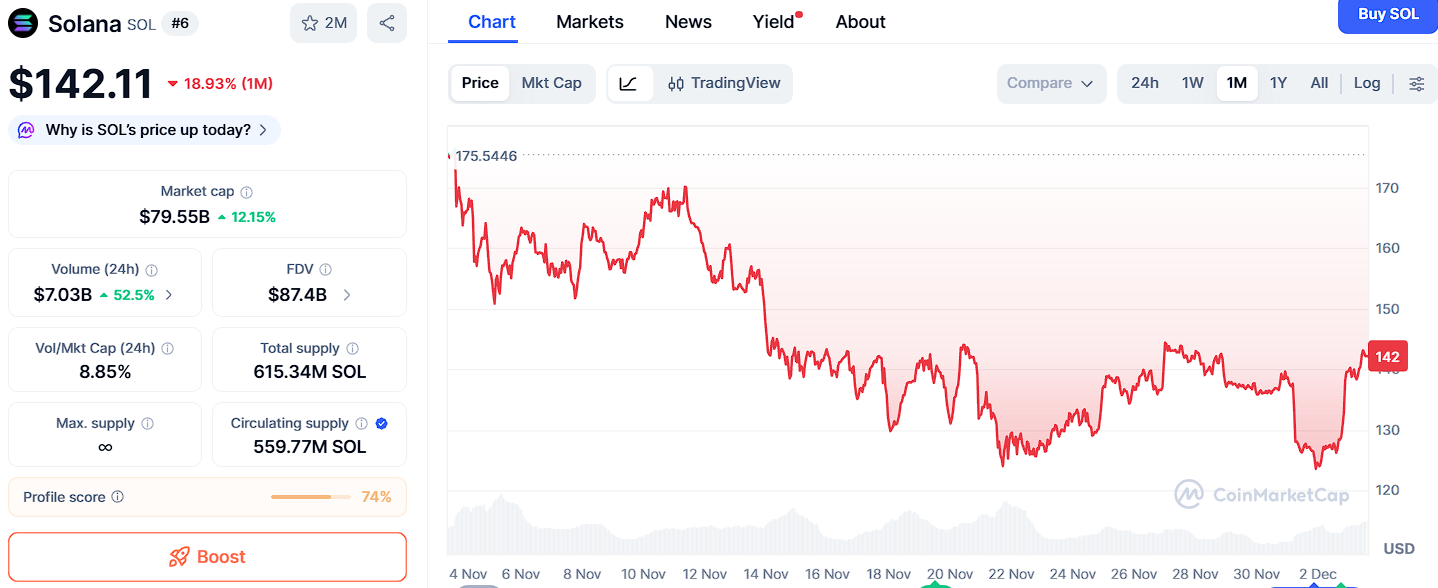

Top 3 Breakout Coins Before 2026: Ozak AI, BNB, and Solana Show Explosive Signs

Cryptodaily·2025/12/05 16:00

Polymarket’s New Play: Betting Against Its Own Users. Wait, What?

Kriptoworld·2025/12/05 16:00

Eric Trump’s Wealth Surges With His Family-Backed Crypto Companies

Eric Trump’s wealth has surged as crypto becomes the Trump family’s fastest-growing financial engine. Major stakes in American Bitcoin and World Liberty Financial have added hundreds of millions to his net worth. Eric remains committed to crypto as traditional Trump businesses expand globally.

CoinEdition·2025/12/05 16:00

Flash

01:43

The cryptocurrency class-action lawsuit against Mark Cuban and the Dallas Mavericks has been dismissed. a cryptocurrency class action lawsuit accusing Mark Cuban and the Dallas Mavericks of deceiving investors by promoting the now-bankrupt cryptocurrency lending platform Voyager Digital has been dismissed.

The lawsuit claimed that Cuban made multiple false statements about the company before Voyager filed for bankruptcy protection (Chapter 11) in 2022. At the time of Voyager's bankruptcy filing, the value of crypto assets on its platform was approximately $1.3 billion. Voyager's collapse was part of a broader market downturn triggered by the Terra blockchain crash, which wiped out about $40 billion in market value and ultimately led to its founder Do Kwon being sentenced to 15 years in prison earlier this month.

01:36

Delphi Digital: Bitcoin may be approaching a liquidity inflection point, while gold has completed repricing during the easing cycle.According to Odaily, digital asset market research institution Delphi Digital posted on X, stating that the price of gold has risen by 120% since the beginning of 2024, marking one of the strongest historical increases. This surge occurred without the backdrop of an economic recession, quantitative easing, or financial crisis. Central banks purchased over 600 tons of gold in 2025, and the purchase volume is expected to reach 840 tons in 2026. Since gold has historically led bitcoin by about three months at liquidity turning points, this trend is significant for the cryptocurrency market. Currently, gold has completed its repricing for the easing cycle, while bitcoin sentiment is still influenced by previous cycle simulations and recent pullbacks. The performance of precious metal assets is sending signals of policy easing and fiscal dominance. When precious metals outperform stocks, the market is pricing in currency devaluation rather than a collapse in growth. Volatility in the precious metals market could be a signal for the subsequent trends of other risk assets.

01:36

Vida intercepts hacker operations, earning approximately $1 millionOn-chain analyst AiYi detected a suspected exchange account theft. Due to risk control mechanisms, the hacker was unable to withdraw funds directly and attempted to transfer assets through wash trading, choosing the illiquid meme token BROCCOLI714 as the target to aggressively pump the spot price. Vida, founder of Formula News, noticed the abnormal price movement and, after the contract circuit breaker ended, accurately opened and closed long positions multiple times, intercepting the hacker's operations and profiting approximately $1 million. Subsequently, suspected exchange risk control intervened, preventing the hacker from placing further orders. The hacker attempted to operate with SOL but failed, eventually canceling orders and giving up.

News