News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget US Stock Daily Brief | US Stocks Close Lower for Third Straight Day; Fed Rate Cut Divisions Significant; Gold and Silver Prices Rebound (December 31, 2025)2Bitget Daily Digest (Dec.31)|Bitwise Files ETF Applications for AAVE and 11 Other Cryptos; Strategy Seeks Untapped Capital to Increase BTC Holdings3Crypto sentiment turns fearful as Bitcoin consolidates – Panic or patience?

The "Five Tigers Competition" concludes successfully | JST, SUN, and NFT emerge as champions! SUN.io takes over as the new driving force in the ecosystem

JST, SUN, and NFT are leading the way, sparking increased trading and community activity, which is driving significant capital inflows into the ecosystem. Ultimately, the one-stop platform SUN.io is capturing and converting these flows into long-term growth momentum.

深潮·2025/12/05 10:47

The End of Ethereum's Isolation: How EIL Reconstructs Fragmented L2s into a "Supercomputer"?

EIL is the latest answer provided by the Ethereum account abstraction team and is also the core of the "acceleration" phase in the interoperability roadmap.

深潮·2025/12/05 10:47

Research Report|In-Depth Analysis and Market Cap of Stable (STABL)

Bitget·2025/12/05 10:42

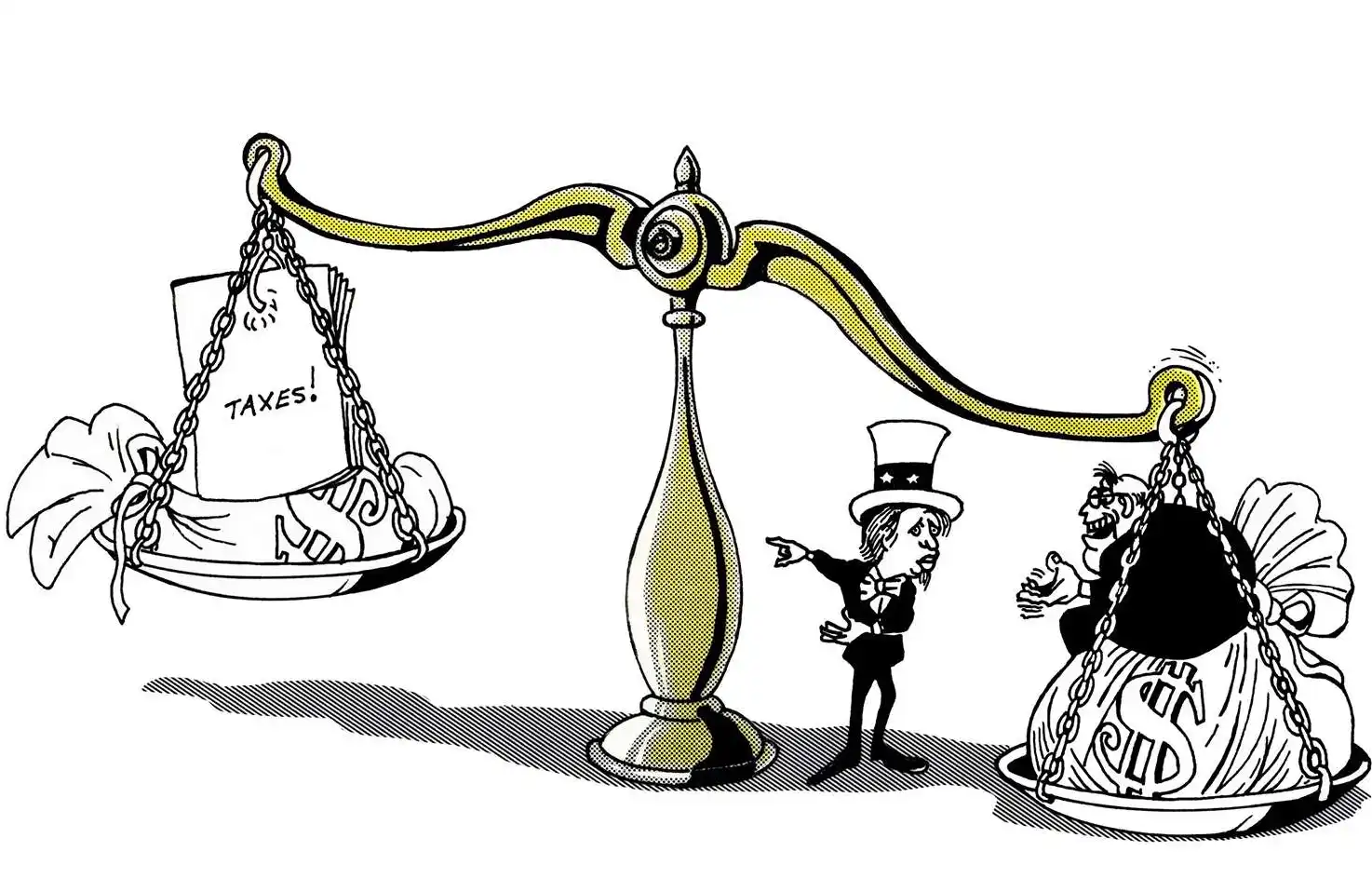

The IMF warns about the global impact of dollar stablecoins

Cointribune·2025/12/05 10:27

Ether Outperforms Bitcoin In ETF And Technicals

Cointribune·2025/12/05 10:27

Stunning SpaceX Bitcoin Transfer: $99.8M Move Signals Major Institutional Crypto Strategy

BitcoinWorld·2025/12/05 10:24

Exposed: Bunni DEX Hacker Launders $7.3M in Stolen ETH Through Tornado Cash

BitcoinWorld·2025/12/05 10:24

HashKey Holdings Hong Kong IPO: A Bold $200 Million Move to Legitimize Crypto

BitcoinWorld·2025/12/05 10:24

US-Japan Policy Divergence: Japan's 80% Interest Rate Hike Implemented, Global Market Fund Flows Shifted?

Japanese Interest Rate Hike, Fed Rate Cut, End of Balance Sheet Reduction – Where Will Global Capital Flow?

BlockBeats·2025/12/05 10:09

OpenAI Ordered to Hand Over 20M ChatGPT Logs in NYT Copyright Case

Cointime·2025/12/05 09:45

Flash

15:53

Forbes: Bitcoin Price Predictions for 2026 Focus on $120,000-$170,000, Institutional Capital Deployment Becomes Key VariablePANews, January 1st – Forbes published an article titled "What Is Bitcoin’s Price Prediction For 2026," which points out that currently, public predictions for Bitcoin’s price in 2026 vary widely. Analysts from Tom Lee, Standard Chartered, and Bernstein are all bullish, but there are also some institutions with bearish outlooks. Although there is not yet a single target price for Bitcoin in the market, forecasts are concentrated in the $120,000 to $170,000 range, indicating that Bitcoin’s price discovery is increasingly influenced by structural factors such as ETF capital flows and corporate treasury assets. If macroeconomic tailwinds strengthen and institutional participation accelerates, the potential upside could reach $250,000 or higher. How institutions choose to deploy capital will become a key factor in the rise of Bitcoin’s price.

15:40

Charles Schwab optimistic about Bitcoin's performance in 2026, plans to launch spot cryptocurrency trading servicesCharles Schwab CEO Rick Wurster stated that the company is optimistic about bitcoin's performance in 2026. Despite the recent market downturn, factors such as quantitative easing, the Federal Reserve's bond purchase program, and weak demand for U.S. government bonds are making the macro environment more favorable for bitcoin. Charles Schwab currently supports the purchase of Solana and Micro Solana futures products and plans to launch spot cryptocurrency trading services in the first half of 2026.

15:40

Charles Schwab: Bullish on Bitcoin's Performance in 2026, Quantitative Easing and Other Factors Favorable for BitcoinChainCatcher reported that Rick Wurster, CEO of Charles Schwab, stated in an interview that the company is optimistic about bitcoin's performance in 2026. Despite the recent market downturn, factors such as quantitative easing policies, the Federal Reserve's bond purchase program, and weakening demand for U.S. government bonds are making the macro environment increasingly favorable for bitcoin.

News