News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget US Stock Daily Brief | US Stocks Close Lower for Third Straight Day; Fed Rate Cut Divisions Significant; Gold and Silver Prices Rebound (December 31, 2025)2Bitget Daily Digest (Dec.31)|Bitwise Files ETF Applications for AAVE and 11 Other Cryptos; Strategy Seeks Untapped Capital to Increase BTC Holdings3Crypto sentiment turns fearful as Bitcoin consolidates – Panic or patience?

Harvard Bought Bitcoin: The Smart Money Move During Market Dips Revealed

BitcoinWorld·2025/12/05 01:54

Crypto Fear & Greed Index Climbs to 28: Is the Market’s Fear Starting to Fade?

BitcoinWorld·2025/12/05 01:54

Aster Burns $80M in ASTER Tokens: A Bold Move to Boost Value

BitcoinWorld·2025/12/05 01:54

Crucial $3.4 Billion in Bitcoin Options Expire Today: What Traders Must Know

BitcoinWorld·2025/12/05 01:54

Altcoin Season Index Stalls at 23: Bitcoin’s Dominance Remains Unshaken

BitcoinWorld·2025/12/05 01:54

Stunning Confidence: Suspected Bitmine Wallet Buys a Massive $130.8M in Ethereum

BitcoinWorld·2025/12/05 01:54

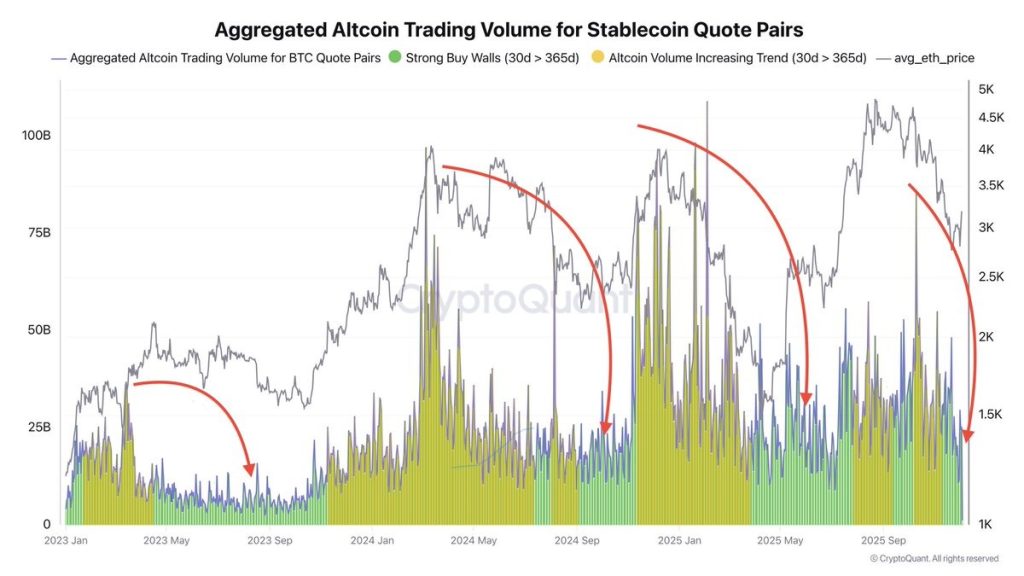

Altcoin Market Enters Historic Buying Zone — 5 Coins to Watch Before the Next Breakout

Coinpedia·2025/12/05 01:36

Crypto News: CZ Denies Trump Ties, But His Bitcoin Moment With Schiff Breaks the Internet

Coinpedia·2025/12/05 01:36

Russia to Include Crypto Payments in Balance-of-Payments Data

Coinpedia·2025/12/05 01:36

Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?

Cointelegraph·2025/12/04 22:09

Flash

08:53

Head of Research at an Exchange: Factors such as regulation, ETFs, and stablecoins driving crypto development will become even stronger in the futurePANews, January 1st – According to Cointelegraph, David Duong, Head of Institutional Research at an exchange, stated that the momentum brought by crypto ETFs, stablecoins, tokenization, and clearer regulations will further strengthen in 2026, accelerating the adoption of cryptocurrencies. In his year-end summary, David Duong pointed out that spot ETFs in 2025 will create regulated channels for cryptocurrencies, digital asset treasuries will emerge as new corporate balance sheet tools, and tokenization and stablecoins will become more deeply integrated into core financial workflows. On the regulatory front, the United States is clarifying stablecoins and market structure through the GENIUS Act, while Europe is advancing the MiCA regulatory framework, providing clearer policy boundaries for institutional participation. Duong believes this marks an important stage in the transition of crypto from a niche market to a part of global financial infrastructure. Additionally, David Duong emphasized that demand for crypto is no longer driven by a single narrative, but is instead propelled by macroeconomics, technology, and geopolitics, with capital structures becoming more long-term and less speculative.

08:48

Several countries including the UK have implemented the "Crypto Asset Reporting Framework" starting from January 1st, with cryptocurrency transaction data being shared across borders.BlockBeats News, January 1st. According to the Financial Times, the UK and over 40 other countries have implemented new cryptocurrency tax regulations starting from January 1st. Based on the OECD's Crypto Asset Reporting Framework (CARF), major crypto exchanges are required to collect complete transaction records for UK users and report users' transaction activities and tax residency status to Her Majesty's Revenue and Customs (HMRC) in the UK.

The UK is one of the first 48 countries to implement this framework. As part of the arrangement, starting from 2027, HMRC will automatically share relevant data with EU member states, Brazil, the Cayman Islands, South Africa, and other participating countries. A total of 75 countries have committed to implementing CARF, with the United States planning to implement it in 2028 and begin information exchange in 2029.

08:34

More than 40 countries, including the UK, have implemented new cryptocurrency tax rules requiring exchanges to collect and report user transaction records. according to the Financial Times, the UK and more than 40 other countries have implemented new tax regulatory rules for crypto assets. According to the Crypto-Asset Reporting Framework (CARF) established by the Organisation for Economic Co-operation and Development (OECD), major crypto exchanges are required to collect complete transaction records for UK users and report user transaction details and tax residency status to Her Majesty's Revenue and Customs (HMRC).

News