News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget US Stock Daily Brief | US Stocks Close Lower for Third Straight Day; Fed Rate Cut Divisions Significant; Gold and Silver Prices Rebound (December 31, 2025)2Bitget Daily Digest (Dec.31)|Bitwise Files ETF Applications for AAVE and 11 Other Cryptos; Strategy Seeks Untapped Capital to Increase BTC Holdings3Crypto sentiment turns fearful as Bitcoin consolidates – Panic or patience?

Crypto Giants Clash: Faith, Utility, and Macro

AICoin·2025/12/04 16:14

Who is redefining the regulatory boundaries of prediction markets and gambling

Bitpush·2025/12/04 16:13

BlackRock moves another 135 million ETH, is a storm coming?

AICoin·2025/12/04 16:13

The wave of ETF approvals coincides with falling crypto prices—has the market logic changed?

Bitpush·2025/12/04 16:13

The new Federal Reserve chairman's dovish policy may ignite the market

Bitpush·2025/12/04 16:11

Zcash Price Regains Footing Above $375 as Founder Responds to Michael Saylor’s Criticism

Zcash surged past $375 following a public debate between founder Eli Ben-Sasson and Michael Saylor, reigniting interest in the privacy-focused cryptocurrency.

Coinspeaker·2025/12/04 16:00

Ethereum Price Prediction: ETH Traders Quietly Lost Millions in ‘Sandwich Attacks’ – New Signal Hints at a Safer, More Bullish ETH

A new study has revealed that Ethereum traders lost millions to sandwich attacks over the past year, quietly draining value from everyday users and favoring stealthy exploiters.

Coinspeaker·2025/12/04 16:00

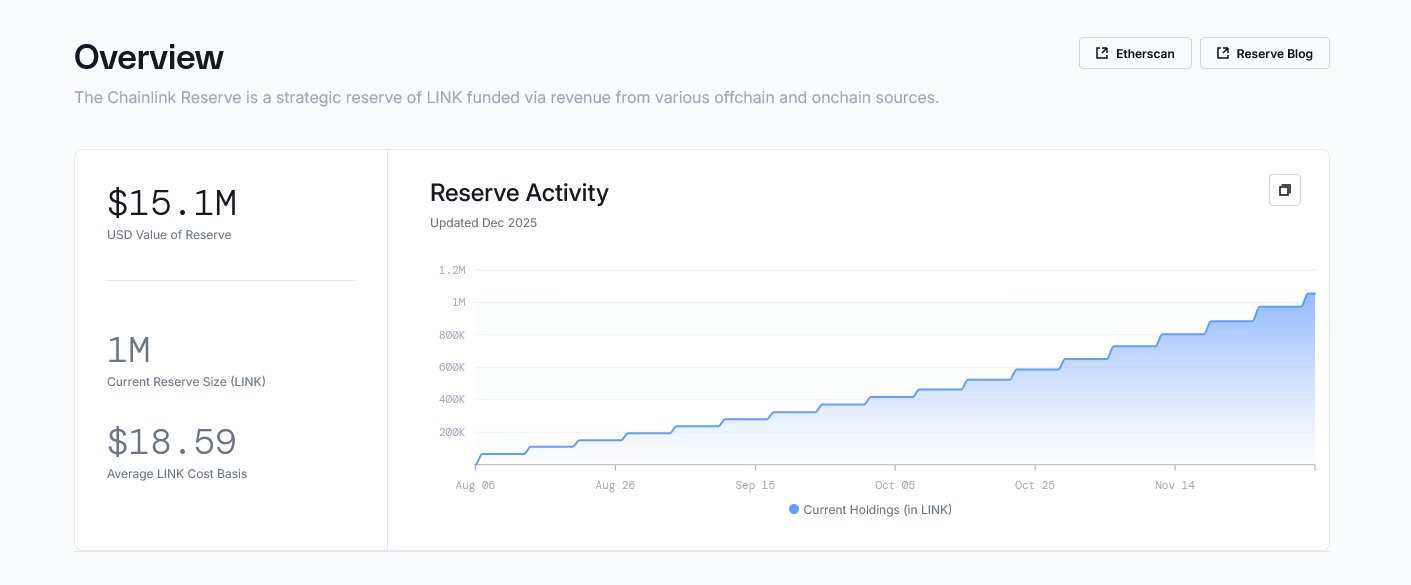

Chainlink Reserve Hits 1 Million, Expert Calls for 1000% LINK Price Rally

Chainlink Reserve has surpassed 1 million LINK holdings, within four months of launch, despite the LINK price volatility.

Coinspeaker·2025/12/04 16:00

XRP Downtrend Meets Support As Bullish Divergence Appears

Kriptoworld·2025/12/04 16:00

Solana And Base Seal Powerful Chainlink Bridge To Move Liquidity

Kriptoworld·2025/12/04 16:00

Flash

16:42

Turkmenistan legalizes cryptocurrency mining and trading, but still prohibits its use as a means of paymentAccording to Odaily, Turkmenistan's President Serdar Berdimuhamedov has signed a decree officially legalizing cryptocurrency mining and trading. This legislation incorporates virtual assets into the scope of civil law and establishes a licensing system for cryptocurrency exchanges regulated by the country's central bank. Nevertheless, digital currencies are still not recognized as a means of payment, legal tender, or securities in Turkmenistan. Currently, the country's internet remains under strict government control. As an economy highly dependent on natural gas exports, this move is seen as a significant shift in Turkmenistan's economic policy. (The Washington Post)

16:34

Data: ETH inflows to a certain exchange hit the highest level since July, possibly indicating that whales are preparing to sell.BlockBeats News, on January 2, CryptoOnchain released data on social media indicating that Ethereum has seen a large-scale capital inflow into a certain exchange, with net inflows surging to 24,500 ETH, marking the highest level since July. Such a significant net inflow usually means more ETH is being transferred to trading platforms, often a precursor to increased selling pressure. This phenomenon may reflect that whales are preparing to sell, or that traders are adjusting their positions for derivatives hedging. Currently, ETH is consolidating around $2,980, and the increase in exchange supply may limit short-term upside potential. Historically, similar surges in capital inflows have often been accompanied by higher volatility or downward trends. Overall, the current pattern remains short-term bearish, and those holding long positions should remain cautious.

16:02

Data: 20,000 SOL transferred out from Fireblocks Custody, routed through an intermediary, and deposited into an exchangeAccording to ChainCatcher, Arkham data shows that at 23:54, 20,000 SOL (worth approximately $2.4956 million) were transferred from Fireblocks Custody to an anonymous address (beginning with 3SHrC...). Subsequently, at 23:56, this address transferred 20,000 SOL to an exchange.

News