News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.9)|Zcash team mass resignations trigger ZEC oversold conditions; approx. $2.22B worth of BTC and ETH options expire today; U.S. initial jobless claims for the week ending Jan 3 came in at 208K2Bitget UEX Daily | Non-Farm Eve Market Split; Trump Picks Fed Chair; CME Hikes Precious Metals Margins (Jan 08, 2026)3Hyperliquid: How whale transfers have stressed HYPE’s fragile price structure

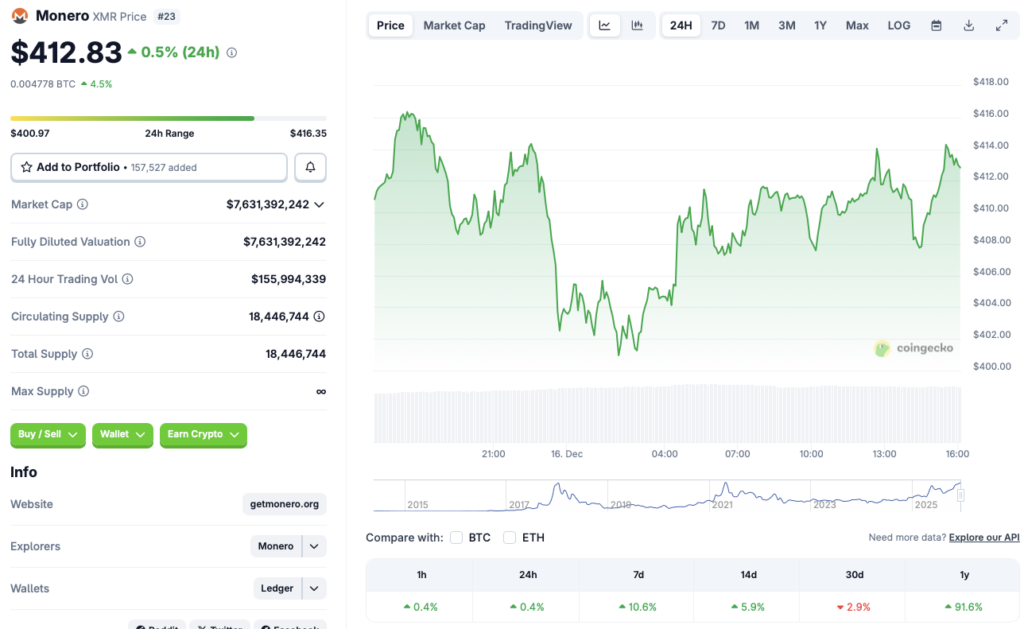

Monero bucks the market trend and continues to strengthen: What are the reasons?

币界网·2025/12/16 17:28

Bank of America Urges Onchain Transition for U.S. Banks

Bitcoininfonews·2025/12/16 17:09

Hong Kong Court Adjourns $206M JPEX Fraud Case Until March: Report

Decrypt·2025/12/16 17:07

Cardano Price Prediction: SuperTrend Indicator Flips Bearish – 80% Crash If This Happens Next

Coinspeaker·2025/12/16 17:03

Bitcoin Partially Recovered, So What Happens Next? Analyst Says Risk Persists, Gives Level

BitcoinSistemi·2025/12/16 17:00

Zero Knowledge Proof Makes Q4’s Biggest Move With a $22M FC Barcelona Deal as BCH and UNI Stay on the Sidelines!

BlockchainReporter·2025/12/16 17:00

Flash

02:55

Data: Since December 5 last year, there has been a net outflow of 80 trillion SHIB from exchanges.Foresight News reported, according to TKResearch Trading data, since December 5 last year, there has been a net outflow of 80 trillion SHIB from exchanges, with the exchange SHIB balance dropping from 370.3 trillion to 290.3 trillion. In the past 60 days, some new wallets have withdrawn 82 trillion SHIB from certain exchanges and other CEXs, at a price of around $0.0000085, accounting for about 28% of the exchange supply and 28.4% of the net circulating supply.

02:54

South Korea ends 9-year corporate crypto ban, allowing listed companies to invest up to 5% of equity in cryptocurrenciesAccording to ChainCatcher, local media reports that the Korean Financial Services Commission (FSC) has finalized guidelines allowing listed companies and professional investors to trade cryptocurrencies, ending a nine-year ban on corporate crypto investments. Eligible companies can invest up to 5% of their equity annually in cryptocurrencies ranked in the top 20 by market capitalization on Korea's five major exchanges. Approximately 3,500 entities, including listed companies and registered professional investment institutions, will gain market access, potentially unlocking tens of trillions of Korean won in capital. While the policy shift has been welcomed, industry insiders criticize the 5% cap as overly conservative. The United States, Japan, Hong Kong, and the European Union do not impose such restrictions on corporate crypto holdings. Critics warn that this may hinder the emergence of digital asset treasury companies in Korea similar to Japan's Metaplanet.

02:48

Base replied to the X product manager with a picture: The token has not yet been launched and is still under exploration. Base responded to the “Base token appearing in a screenshot of the Smart Cashtags feature revealed by X product lead Nikita Bier” by saying they are glad to see Nikita Bier thinking about them, but the token has not been launched yet and is still under exploration.

Previously, the Base token appeared in a screenshot of the new Smart Cashtags feature released by Nikita Bier, showing a market value of $373 billion and a token price of $130 each. This post was interpreted by some community users as an abstract prophecy of Base’s upcoming token launch.

News