News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.9)|Zcash team mass resignations trigger ZEC oversold conditions; approx. $2.22B worth of BTC and ETH options expire today; U.S. initial jobless claims for the week ending Jan 3 came in at 208K2Bitget UEX Daily | Non-Farm Eve Market Split; Trump Picks Fed Chair; CME Hikes Precious Metals Margins (Jan 08, 2026)3Hyperliquid: How whale transfers have stressed HYPE’s fragile price structure

FDIC proposes stablecoin application framework rule as it moves forward with GENIUS Act

The Block·2025/12/16 16:57

Top investors announce large-scale shorting of XRP

币界网·2025/12/16 16:47

Maker gets backing from a16z Crypto, but the move raises questions

The Block·2025/12/16 16:18

Solana tests quantum-resistant signatures in a milestone security upgrade.

币界网·2025/12/16 16:14

Bitcoin and Ethereum Wobble as US Reports Highest Unemployment Rate Since 2021

Decrypt·2025/12/16 16:13

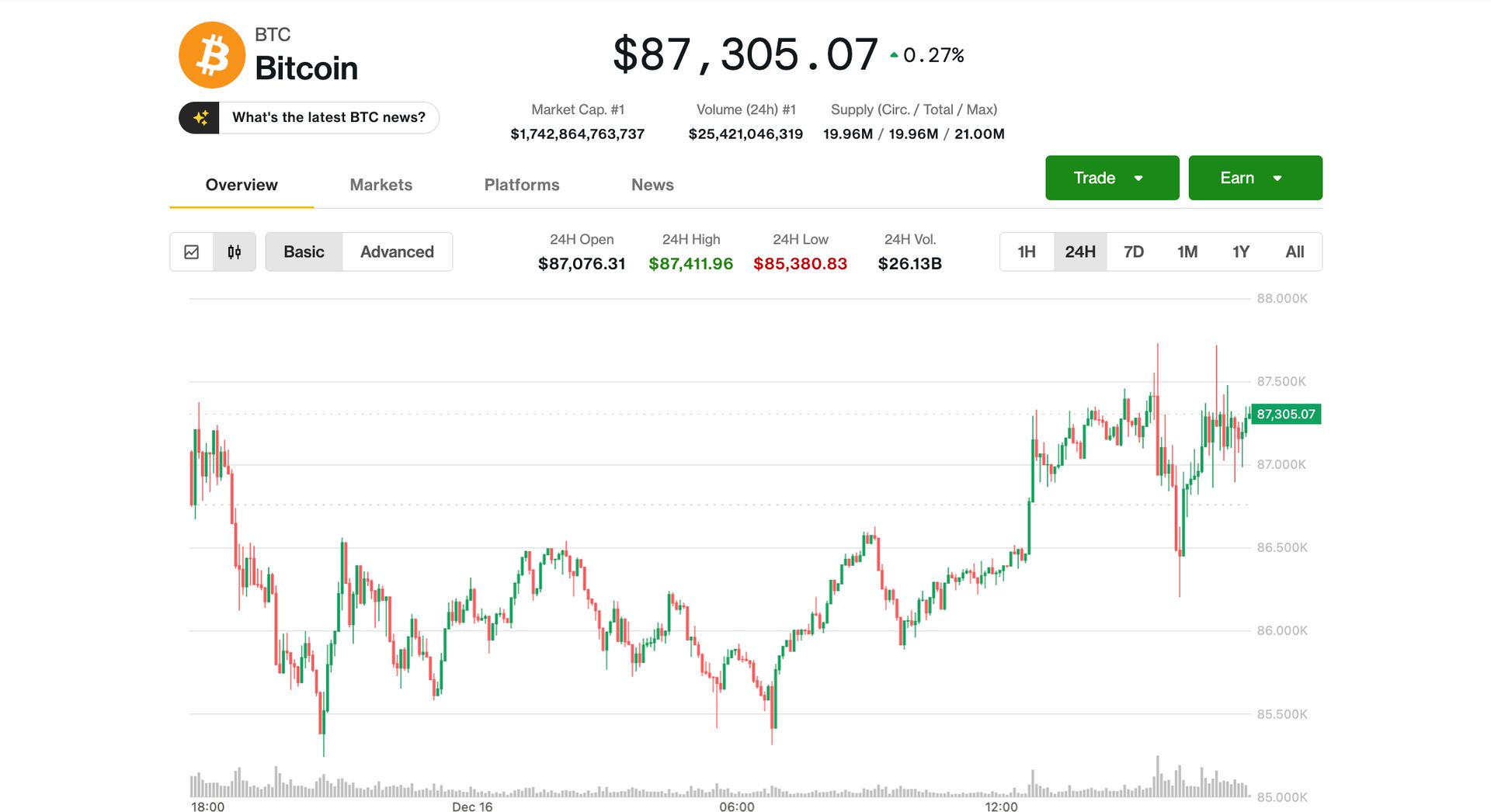

Bitcoin rebounds from Monday’s lows, but analysts say a drop below $80,000 is possible.

AIcoin·2025/12/16 16:03

Strategy CEO Phong Le Predicts BTC Surge in 2026 Despite MSTR Decline

Cryptotale·2025/12/16 16:00

Flash

02:06

Goldman Sachs: The Federal Reserve will cut interest rates twice more in 2026, by 25 basis points each in June and September.BlockBeats News, January 12, Goldman Sachs released its 2026 economic outlook, predicting that strong economic growth and moderate inflation will coexist in the United States. The Federal Reserve is expected to cut interest rates two more times, with 25 basis point cuts in both June and September.

02:06

Pump.fun Introduces Creator Fee Splitting FeatureBlockBeats News, January 12, Pump.fun indicated that a number of creator revenue reform measures will be introduced soon. The platform has currently introduced creator fee splitting, supporting sharing of fees with up to 10 wallets, transferring token ownership, and revoking upgrade permissions. More updates are coming soon.

02:04

Goldman Sachs: Fed to Cut Rates Twice More in 2026, by 25 Basis Points Each in June and SeptemberBlockBeats News, January 12, Goldman Sachs released its 2026 economic outlook, expecting robust economic growth in the U.S. coexisting with mild inflation. The Federal Reserve will cut interest rates twice more, with 25 basis points cuts in June and September.

News