News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

BONAD.fun marks a new starting point for the expansion of the BONK ecosystem.

The Trump family's wealth has shrunk by 1.1 billions US dollars, with ordinary investors becoming the biggest losers.

Is the DAT model truly a bridge connecting TradFi, or is it a "death spiral" for the crypto market?

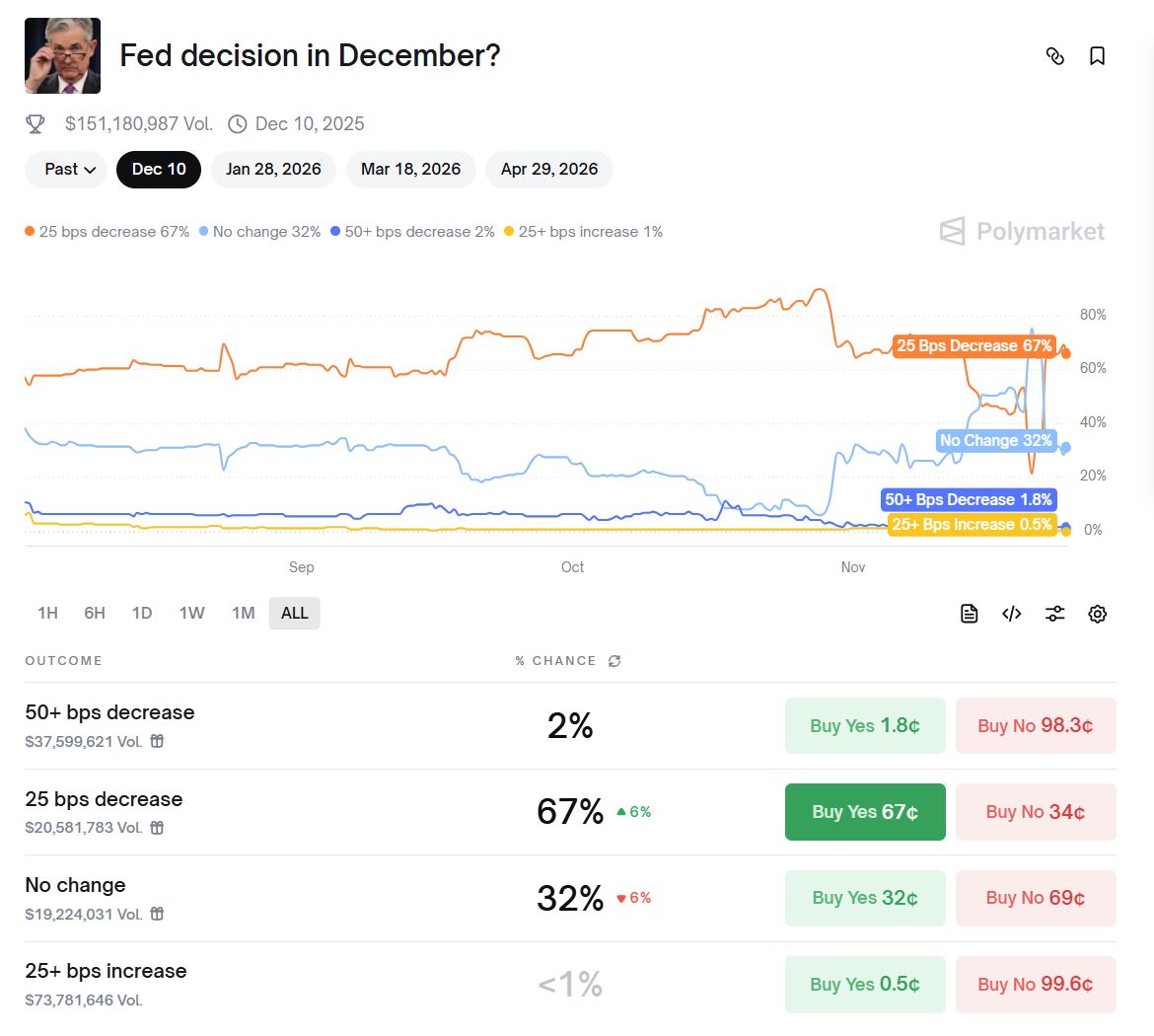

Economists point out that three of the most influential officials have formed a strong coalition in support of interest rate cuts, which will be difficult to challenge.

Now, thanks to the team's efforts, Boundless has become the first truly decentralized and permissionless protocol capable of handling any general-purpose ZKVM proof request.

The latest on-chain rich list shows that crypto assets are highly concentrated in the hands of a few whales, making the wealth distribution pattern increasingly clear.

Based on the pre-market price of around $0.032-0.034 at the time of publication, the public offering participants' notional returns are between 28% and 36%.

Significant policy divisions have emerged within the Federal Reserve, making the question of whether to cut interest rates in December a key focus. Powell’s silence has increased market uncertainty, while political pressure and the lack of economic data have further complicated decision-making.