News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Major Earthquake in Digital Assets: Billion-Dollar Compensation Storm from Mt.Gox and FTX

AICoin·2025/11/19 14:27

U.S. state governments are betting on Bitcoin ahead of regulatory storms

AICoin·2025/11/19 14:27

Why 26.5 billion XRP tokens are now sitting at a loss despite a $2 price tag

CryptoSlate·2025/11/19 11:30

8 Shitcoin ETFs Entry Record: Only $700 Million Raised, Unable to Stop Price Decline

Although Shitcoin ETFs like Solana are quickly making their way to Wall Street, their ability to attract funds in a market downturn is limited, and their prices are generally declining. Therefore, it is unlikely that they will significantly boost market performance through ETFs in the short term.

BlockBeats·2025/11/19 11:30

![[English Long Tweet] Understanding the Evolution of the Crypto Market with an Integrated Framework](/news-static/client/media/cover-placeholder.101bcc72032a7c4f0a397f15f3252c92.svg)

[English Long Tweet] Understanding the Evolution of the Crypto Market with an Integrated Framework

ChainFeeds·2025/11/19 11:22

![[Long English Thread] "Stablecoins" Are Not Stable at All: Why Do Stablecoins Always Die in the Same Way?](/news-static/client/media/cover-placeholder.101bcc72032a7c4f0a397f15f3252c92.svg)

[Long English Thread] "Stablecoins" Are Not Stable at All: Why Do Stablecoins Always Die in the Same Way?

ChainFeeds·2025/11/19 11:21

5 Charts to Understand the Current State of the Bitcoin Market

ChainFeeds·2025/11/19 11:21

Bitcoin to $73k? Be prepared with the price levels to watch during a bear market

CryptoSlate·2025/11/19 10:30

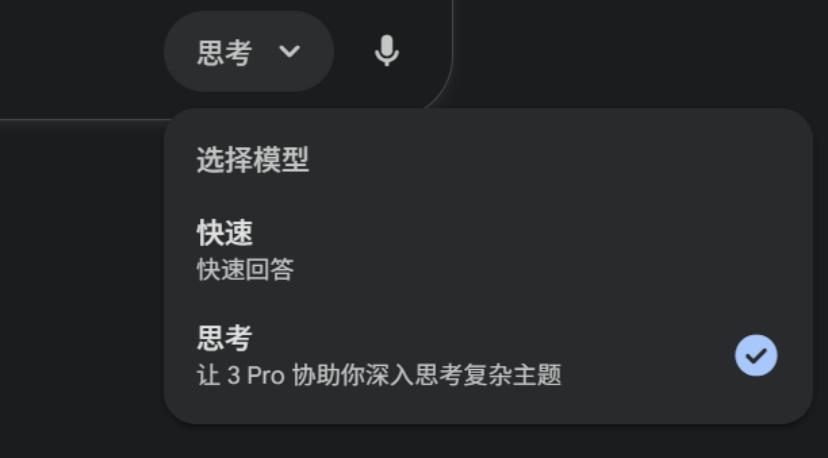

Even Altman gave it a thumbs up: What makes Google Gemini 3 Pro so powerful?

After 8 months of pretending to be asleep, Google suddenly dropped a bombshell with Gemini 3 Pro.

深潮·2025/11/19 10:21

Flash

03:28

Cardano proposes naming the 2026 protocol version 11 hard fork as the "van Rossem Hard Fork"PANews, January 14—According to Cryptopolitan, the Cardano community hard fork working group has proposed naming the 2026 protocol version 11 hard fork the "van Rossem Hard Fork" in honor of the late governance representative (DRep) Max van Rossem. Van Rossem served as a member and co-leader of the Constitutional Committee Election Working Group, participated in drafting Cardano's first constitution, and played a key role in the inclusion of Article 8 of the constitution. He also founded the AdaMoments project, which aims to permanently preserve users' personal histories, and was active in building the Dutch community. The community will vote on the naming proposal from January 13 to February 14, 2026. The protocol version 11 upgrade is expected to enhance node security, ledger consistency, and Plutus performance.

03:21

Bitcoin further decouples from global M2 money supply, analysts divided on outlook for 2026According to ChainCatcher, since mid-2025, Bitcoin has begun to decouple from the growth of the global M2 money supply (i.e., the total amount of money in circulation in the market, including cash, demand deposits, time deposits, etc.), and this trend became even more pronounced at the beginning of 2026. Historically, the correlation between the two was the basis for bullish predictions, but now analysts are deeply divided on this phenomenon. Fidelity Digital Assets maintained an optimistic outlook in its January report, believing that as the global monetary easing cycle begins and the Federal Reserve's QT program ends, the M2 growth rate will continue to rise in 2026, which will be favorable for Bitcoin prices. Analyst MartyParty predicts that Bitcoin prices will rebound to catch up with M2 growth. However, Mister Crypto pointed out that the decoupling of Bitcoin prices from M2 usually signals a market top, followed by a 2-4 year bear market. The founder of Capriole Investments believes that the decoupling reflects the risk of quantum computing breaking Bitcoin encryption. Despite the uncertainty, investors still regard Bitcoin as a long-term store of value.

03:19

A trader shorted 42.25 BTC and is currently facing unrealized losses, with an average entry price of $94,680.1.PANews reported on January 14 that, according to HyperInsight monitoring, the trader known as "百胜战神" is currently shorting 42.25 BTC with 40x leverage, with an average entry price of $94,680.1 and an unrealized loss of $26,000. Previously, this address had completed 159 trades, with only 4 trades recording a total loss of $5,191.12, while the remaining 155 trades were all closed in profit, bringing the total account profit to $291,200.

News