News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Imposes 25% Tariffs on Iran's Trade Partners; Google Market Cap Breaks $4 Trillion for the First Time; Gold Surpasses $4600 Threshold (Jan,13, 2026)2Bitget Daily Digest (Jan.13)|Market Risk-Off Triggered by Fed Independence Dispute; Meta Plans to Cut Metaverse Investment; Strategy Added 13,627 BTC Last Week

Cathie Wood’s ARK Invest Buys Circle, BitMine, and Bullish Shares Amid Market Dip

Coinpedia·2025/11/15 23:24

Coinpedia Digest: This Week’s Crypto News Highlights | 15th November, 2025

Coinpedia·2025/11/15 23:24

Bitcoin Heads Into Weekend Under Pressure as Price Tests Key Support Levels

Coinpedia·2025/11/15 23:24

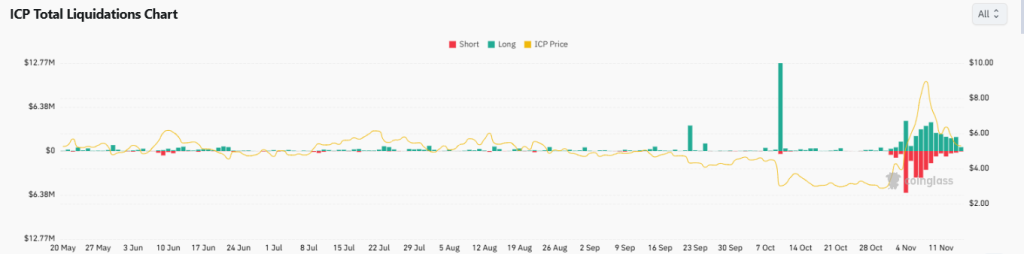

Internet Computer Price Prediction 2025: Is ICP Aimed for $1 Fall Before a Reversal Ahead?

Coinpedia·2025/11/15 23:24

Why XRP Price Didn’t Surge After the ETF Launch?

Coinpedia·2025/11/15 23:24

Bitcoin’s “Silent IPO”: A Sign of Market Maturity and Future Implications

AICoin·2025/11/15 22:06

AiCoin Daily Report (November 15)

AICoin·2025/11/15 22:05

Surviving Three Bull and Bear Cycles, Dramatic Revival, and Continuous Profits: The Real Reason Curve Became the “Liquidity Hub” of DeFi

Curve Finance has evolved from a stablecoin trading platform into a cornerstone of DeFi liquidity through its StableSwap AMM model, veTokenomics, and strong community resilience, demonstrating a sustainable development path. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

MarsBit·2025/11/15 21:59

SOL drops to 5-month low despite Solana spot ETF success: Is $100 next?

Cointelegraph·2025/11/15 20:18

Flash

09:11

「Strategy Opponent Play」 Once Again Increases Long Positions in ETH, SOL, and Other Assets, with Total Holdings Reaching $233 MillionBlockBeats News, January 13th, according to Coinbob Popular Address Monitor, the "Strategy Whale" address (0x94d) once again increased its long position in ETH, BTC, and other mainstream coins for a short period of time. As of the time of writing, it is still actively accumulating. This address currently holds long positions in 4 major coins, with a total size of approximately $233 million, making it the largest BTC long on the Hyperliquid platform. Earlier today, it closed out its short positions in ETH, BTC, SOL, and subsequently went long. The specific position information is as follows:

BTC Long: Position size of approximately $156 million, average price $92,081.4, current price $92,410, unrealized gain of approximately $557,600;

SOL Long: Position size of approximately $50.34 million, average price $140.998, current price $141.84, unrealized gain of approximately $298,800;

ETH Long: Position size of approximately $14.37 million, average price $3,130.55, current price $3,140.4, unrealized gain of approximately $45,100;

HYPE Long: Position size of approximately $1.03 million, average price $23.9207, current price $24.64, unrealized gain of approximately $30,100;

This address has been accumulating short positions in BTC, ETH, and other mainstream coins since December last year. Therefore, its previous trading direction is opposite to that of MicroStrategy, the publicly traded company continuously purchasing BTC. The market perceives this address as a clear "on-chain opponent." Recently, it has reversed its main positions multiple times with large opening positions, each reaching over a billion dollars.

09:06

Insight: Prior to the CLARITY Act Vote, Bitcoin Investors Opt for HodlBlockBeats News, January 13th, according to the analysis firm XWIN Research Japan, the U.S. Senate Banking Committee will review a crypto bill named the "CLARITY Act" on January 15th. This review should not be seen as a short-term price catalyst, but as a potential turning point for Bitcoin's status within the U.S. regulatory system. Despite relatively stable prices, on-chain data has already shown a shift in market behavior.

CEX net flow is a key signal. During regulatory uncertainty, Bitcoin typically flows into CEXs as investors prepare to sell. However, such inflows remain limited ahead of the "CLARITY Act" discussion. This indicates that market participants do not see the legislative process as an event requiring an immediate risk-off approach. The SOPR (Spent Output Profit Ratio) also confirms this.

In conclusion, these indicators suggest that the market is not in a defensive state but is maintaining patience. Investors seem to not be frequently rotating positions but rather choosing to hold Bitcoin, awaiting regulatory clarity. Their holding period is extending. The significance of the "CLARITY Act" goes far beyond policy debates. It could be a potential milestone for Bitcoin to integrate as a regulated digital commodity into the U.S. financial system. On-chain data has already reflected this shift: before any major price swings, Bitcoin's "stickiness" is increasing, indicating a shift in its transactional mode from speculative to institutional-grade holding.

09:01

Grayscale Q1 Assets Under Consideration List: Additions Include TRX, ARIAIPBlockBeats News, January 13th, Grayscale announced its latest "Assets Under Consideration" list for the first quarter of 2026, covering 36 potential altcoins across six major blockchain industry sectors. Compared to the 32 assets in the fourth quarter of 2025, this list has seen a slight expansion.

The Smart Contracts sector has added Tron (TRX); the Consumer & Culture sector has added ARIA Protocol (ARIAIP). The Artificial Intelligence sector has added Nous Research and Poseidon, while removing Prime Intellect. The Public Utility & Services sector has added DoubleZero (2Z). Inclusion on the list does not necessarily mean the launch of a product, but indicates that the assets are actively being evaluated.

News

![[Bitpush Daily News Selection] Financial Times: Tether is considering leading a funding round of approximately $1.16 billion for German tech startup Neura Robotics; the US SEC has issued post-shutdown document processing guidance, and multiple crypto ETFs may be expedited; US Bureau of Labor Statistics: September 2025 employment data will be released on November 20, and October state employment and unemployment data will be released on November 21.](https://img.bgstatic.com/multiLang/image/social/06829a455cc5ced5cafaf4b9bf53d5281763243641786.png)