News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The US crypto regulatory framework is undergoing a redistribution of authority, with clear divisions of responsibility between the CFTC and SEC: the SEC focuses on securities, while the CFTC is responsible for the spot market of digital commodities. The advancement of new bills and the arrangement of hearings indicate that the regulatory boundaries have been formally clarified in official documents for the first time. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

A Ukrainian drone attack has caused the suspension of oil exports at Russia's Novorossiysk port, interrupting a daily supply of 2.2 million barrels. As a result, international oil prices surged by over 2%.

The twilight of financialization: when debt cycles can only create nominal growth.

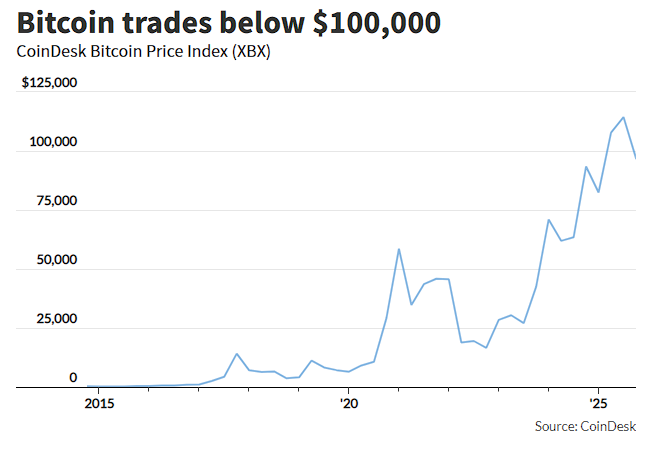

Compared with the capital inflows into tech stocks and gold's sharp rebound after a plunge, bitcoin was a clear exception in Friday's market: it defied the trend by dropping 5%, hitting a six-month low, and has now declined for three consecutive weeks. This contrast highlights the unusual situation in the bitcoin market: even as it maintains a high correlation of 0.8 with the Nasdaq 100 Index, bitcoin exhibits an asymmetric pattern of "falling more on declines and rising less on rallies." Meanwhile, intensified whale sell-offs and concentrated selling by long-term holders are jointly suppressing bitcoin.

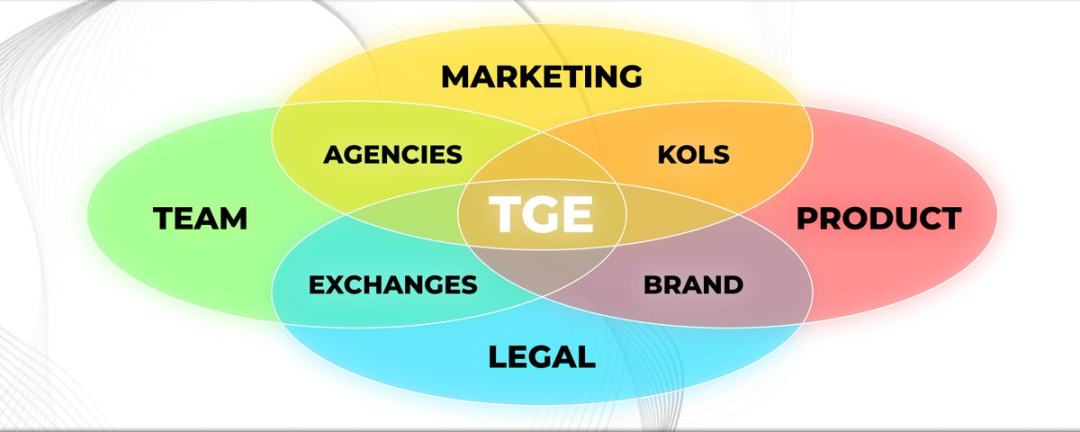

Doing these things is a prerequisite for a successful TGE.