News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

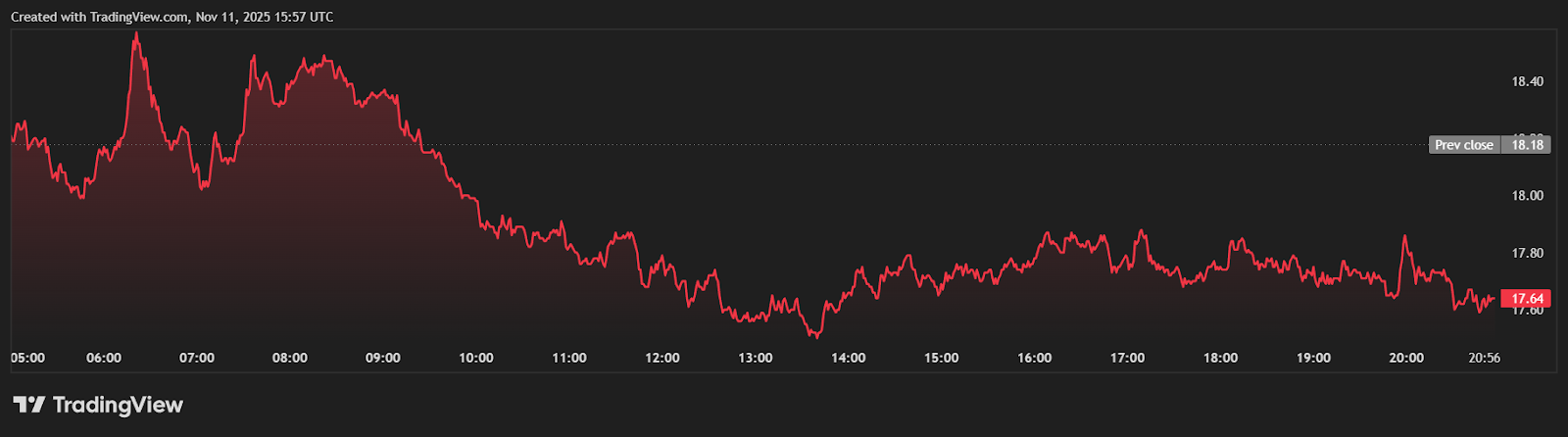

Dogecoin is navigating what many analysts consider its most challenging quarter in years, as the meme coin struggles to maintain strength above the crucial $0.17 support zone.

The UAE has not banned Bitcoin. Authorities clarified that crypto businesses must be licensed, but residents can still buy, hold, and trade Bitcoin freely.

Quick Take Tether “was in discussions” to invest in Neura Robotics, makers of a humanoid robot, at a potential valuation between $9.29 billion and $11.6 billion, FT reported. The stablecoin issuer generated profits of over $10 billion during the first three quarters of this year and is looking to diversify its portfolio.

Quick Take Earlier on Friday, a popular X account said Arkham data showed that Strategy reduced its bitcoin holdings from 484,000 to approximately 437,000. “We are buying. We’re buying quite a lot, actually, and we’ll report our next buys on Monday morning,” Saylor told CNBC.