News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

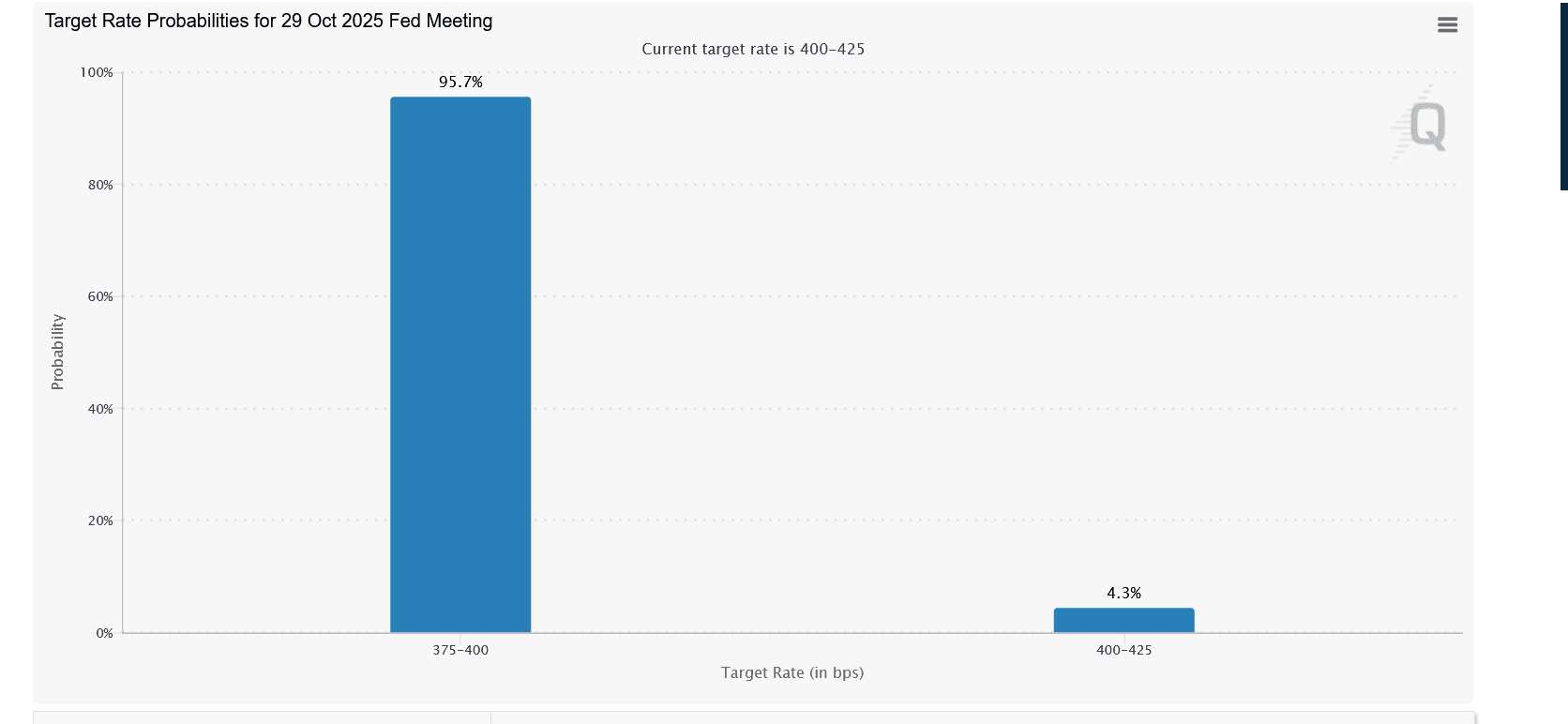

Jerome Powell's latest remarks suggest that the Federal Reserve may cut interest rates again this month.

Quick Take Summary is AI generated, newsroom reviewed. Fidelity clients invested $154.6 million in Ethereum, signaling strong institutional interest. The move boosts overall crypto market confidence and mainstream adoption. Ethereum institutional investment continues to grow due to staking rewards and network upgrades. Fidelity’s participation highlights the merging of traditional finance and blockchain innovation.References JUST IN: Fidelity clients buy $154.6 million worth of $ETH.

Quick Take Summary is AI generated, newsroom reviewed. Tom Lee and Arthur Hayes predict Ethereum could reach $10,000 by end of 2025. Institutional adoption and clearer regulations support growth. Ethereum upgrades improve speed, efficiency, and scalability. Investors should research and diversify before investing.References BULLISH: Tom Lee and Arthur Hayes call for a $10k $ETH price.

1. The blockchain project Megaeth recently reached a key milestone with its public sale, marking the project's official start on its journey to build the world's fastest public chain, aiming to address the "last mile" problem of linking the world's assets. 2. Industry observations indicate that the crypto punk spirit is weakening year by year, with the industry's focus shifting towards high-performance infrastructure. Megaeth is advancing its project in this context, emphasizing that the blockchain industr

The 2025 Aptos Experience Conference will be held in New York City on October 15-16, aiming to bring together the global Web3 community and showcase Aptos's impact outside the ecosystem. Confirmed attending guest institutions include a16z, Aave, BlackRock, Chainlink, Circle, among others, covering various fields such as investment, finance, and technology.

1. On-chain Funds: $142.3M USD inflow to Arbitrum today; $126.7M USD outflow from Hyperliquid 2. Largest Price Swings: $CLO, $H 3. Top News: Base Co-Founders Reaffirm Base Token Launch

If DeFi has another summer, its name might be Hyperliquid HIP-3