News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Global tech elites gather to spark new ideas, driving a new chapter in the digital future.

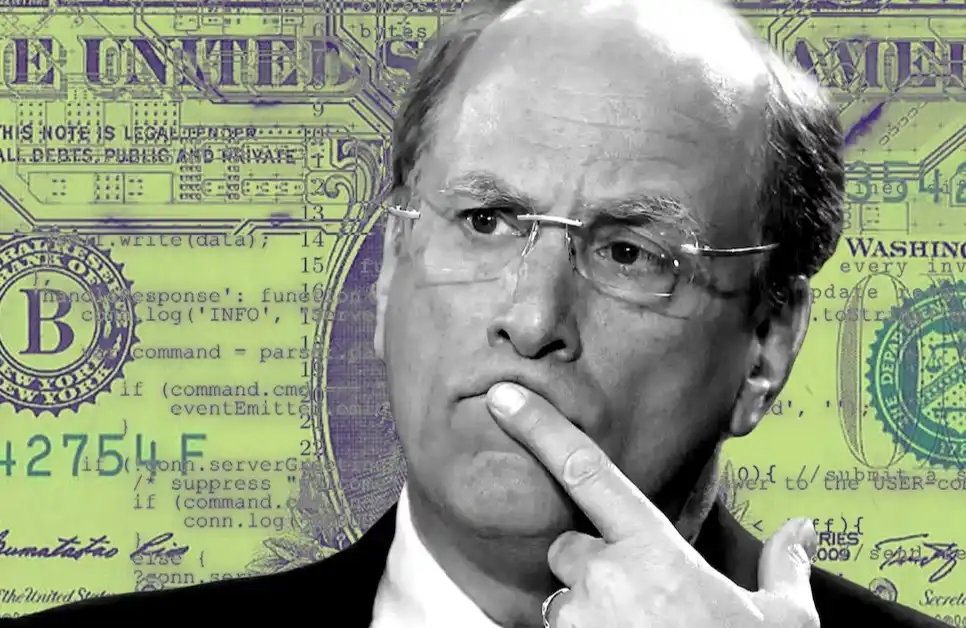

BlackRock has revealed its goal to bring traditional investment products such as stocks and bonds into digital wallets, targeting an ecosystem worth over $4 trillions.

Setting a high-performance standard: Chainlink oracle network brings ultra-low latency market data to the first real-time blockchain, ushering in a new narrative for on-chain finance.

The development of this stablecoin will depend on the extent to which it is adopted by payment providers and investors, who are seeking a reliable euro-denominated alternative asset in the digital economy.

Traders' desire for high-yield investment opportunities has not diminished; they are shifting from perpetual contracts to Memecoin.