News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

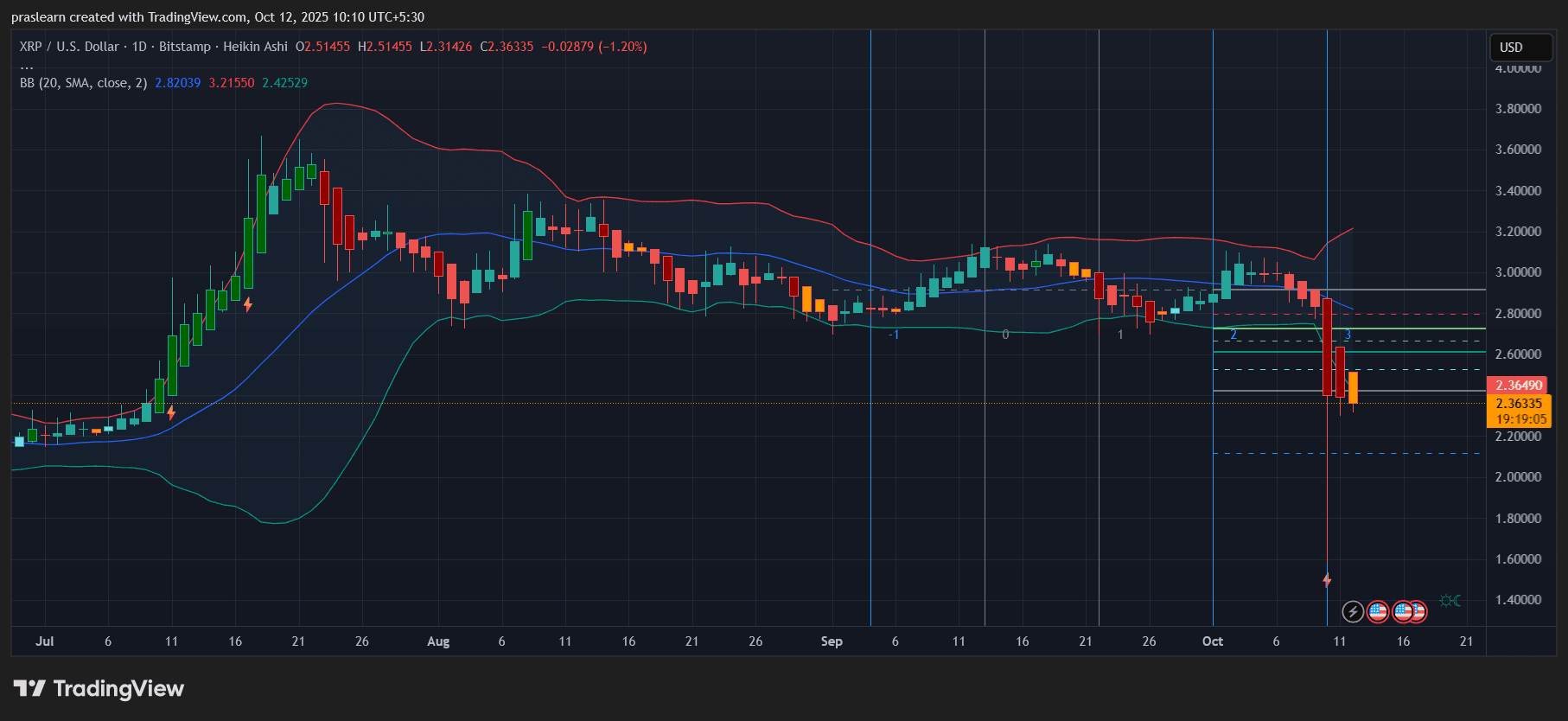

Quick Take The two platforms combined for a record-setting $1.44 billion in volume during September, reflecting surging mainstream interest. The following is excerpted from The Block’s Data and Insights newsletter.

Quick Take Republicans and Democrats are negotiating how the cryptocurrency industry should be regulated — and it’s not going well. “We are not suggesting there is no path forward for action in the next 12 months,” said TD Cowen’s Washington Research Group, led by Jaret Seiberg, on Monday. “Our point is that there are more reasons for senators to delay action than to move quickly.”

Quick Take The crypto crime investigation unit unveiled a new way to report potential phishing sites that use increasingly sophisticated ways for hackers to conceal their tracks. SEAL’s Verifiable Phishing Reporter uses a cryptographic scheme designed by the team called “TLS attestations” that proves whitehat researchers see what victims see.

Quick Take TAO Synergies entered a share purchase agreement with existing investors and a new investor, DCG. The company’s shares rose 38.5% on Monday, while the announcement was made after the markets closed.