News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Robert Kiyosaki Predicts Dollar Collapse and Bets on Bitcoin and Ethereum

Portalcripto·2025/10/12 02:03

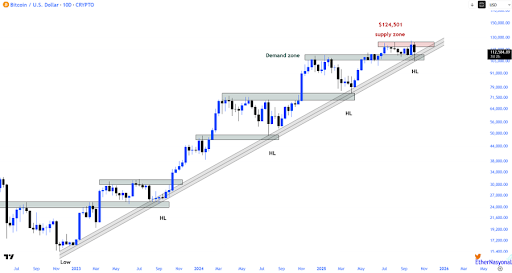

Bitcoin’s Pullback A Healthy One? Chart Signals Move To New All-Time High

CryptoNewsNet·2025/10/12 02:03

464.7 Million Dogecoin (DOGE) Pulled Between Unknown Wallets: Details

CryptoNewsNet·2025/10/12 02:03

Did Trump’s Tariff Trigger A Crypto Purge Or Just A Panic?

CryptoNewsNet·2025/10/12 02:03

Dogecoin Price: ‘$6.9 Is A Magnet’, Analyst Predicts

CryptoNewsNet·2025/10/12 02:03

Ethereum Dual Chart Recovery: ETH And ETH/BTC Signal Strength Despite Bearish Close

CryptoNewsNet·2025/10/12 02:03

Crypto traders blame Trump’s tariffs in search of ‘singular event’: Santiment

CryptoNewsNet·2025/10/12 02:03

Weekly Recap | Cryptocurrency Market Faces Epic Crash Leading to 1.6 Million Liquidations; Monad Airdrop Claim Portal to Open on October 14th

After Bitcoin hit a new all-time high of $126,000, the crypto market experienced an epic crash, the U.S. Bureau of Labor Statistics is set to release the CPI report during the government shutdown, Binance Alpha and futures launched multiple Chinese narrative Meme coins

BlockBeats·2025/10/12 02:00

3 Altcoins That Escaped The Crypto Market Crash and Look Extremely Bullish

While most of the crypto market is still struggling after the crash, Radiant Capital (RDNT), Morpho (MORPHO), and Succinct (PROVE) have already outperformed. On-chain and technical data show how these altcoins beat the crypto market crash and where their next key price levels lie.

BeInCrypto·2025/10/12 01:53

Bitcoin Flash Crash Confirms a Reset Before the Next Rally...Here's Why

Cryptoticker·2025/10/12 01:39

Flash

17:39

Arthur Hayes says Fed's new policy could push BTC to $200,000 in 2026Arthur Hayes pointed out that the Fed's new reserve management purchases are actually another form of quantitative easing, warning that this policy allows for unlimited money printing and could push the price of BTC to $200,000 by 2026. (Cointelegraph)

17:07

US Stock Crypto Stocks Rally, BMNR Up 9.94%BlockBeats News, December 20th, according to market data, US stock cryptocurrency-related stocks saw a general rise, including:

Bitmine (BMNR) rose by 9.94%

Bit Digital (BTBT) rose by 9.65%

SharpLink Gaming (SBET) rose by 7.98%

American Bitcoin (ABTC) rose by 7.23%

MicroStrategy (MSTR) rose by 4.08%

16:58

Fundstrat analyst: The crypto market may experience a significant decline in the first half of next year, with bitcoin possibly falling to $60,000–$65,000According to Odaily, Sean Farrell, Head of Crypto Strategy at Tom Lee’s Fundstrat, stated in the “2026 Crypto Outlook” report: “Although I believe that bitcoin and the entire crypto market still have strong long-term bullish factors, and liquidity-driven support is likely to emerge in 2026, there may still be several risks to digest in the first and second quarters of 2026, which could provide more attractive entry points. My base case is: a relatively significant decline in the first half of 2026, with bitcoin possibly dropping to $60,000–$65,000, ethereum possibly dropping to $1,800–$2,000, and SOL possibly dropping to $50–$75. These price levels will offer good opportunities for positioning before the end of the year. If this judgment proves to be wrong, I would still prefer to maintain a defensive stance and wait for confirmation signals of a strengthening trend. The year-end target for bitcoin is around $115,000, and ethereum’s year-end target could reach $4,500. Within this framework, ETH’s relative strength will become even more prominent. I think this is reasonable, as ethereum has more favorable structural capital flow characteristics, including: no miner selling pressure, not being affected by MSTR-related factors, and relatively lower concerns about quantum risks.”

News