News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

Bitcoin’s $3,000 Up-and-Down Swing Liquidates 123,200 Traders in Volatile Pump and Dump

Coinspeaker·2025/12/17 18:45

Bitcoin Demand Cycle Warning: Why Analysts See a Steep Decline Ahead

Bitcoinworld·2025/12/17 18:42

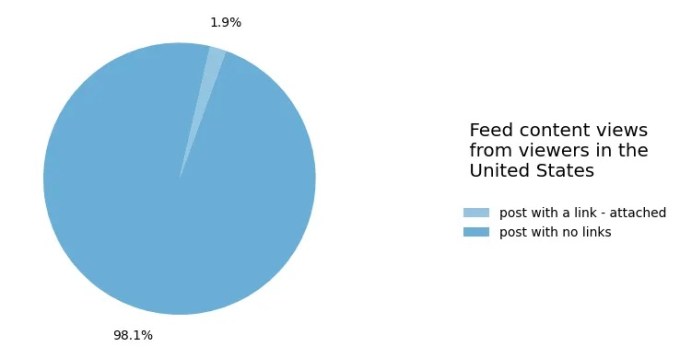

Facebook is testing a link posting limit for professional accounts and pages

TechCrunch·2025/12/17 18:39

This is why Dogecoin whales are now going all in.

币界网·2025/12/17 18:34

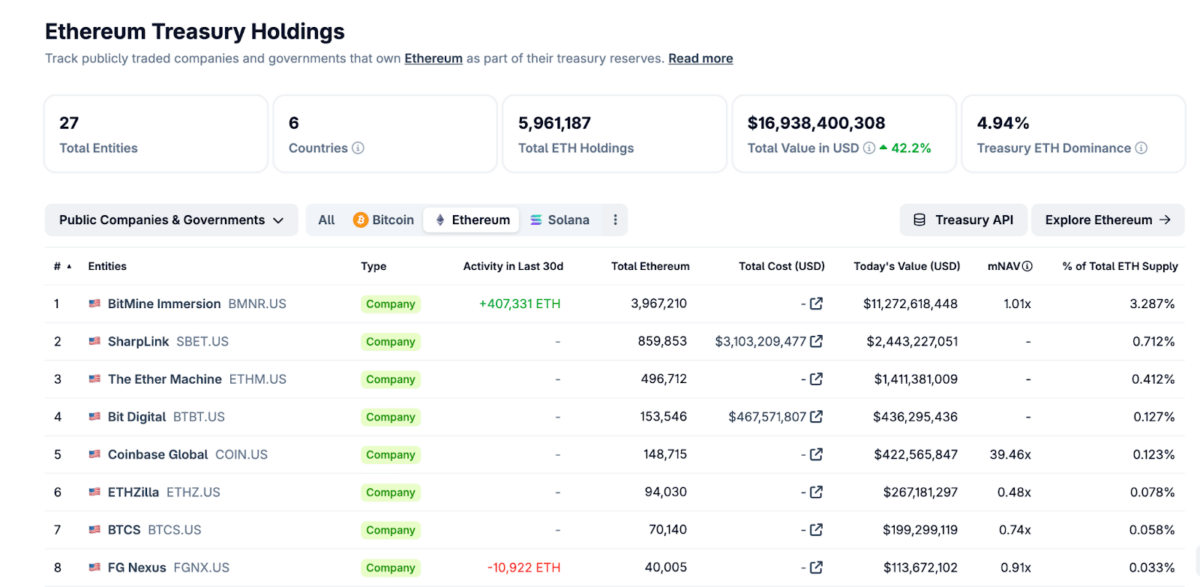

SharpLink Gaming Appoints New CEO as Ethereum Treasury Surpasses 863K ETH

Coinspeaker·2025/12/17 18:18

Critical Challenge for Bitcoin Miners in 2026: The AI Temptation

Bitcoinworld·2025/12/17 18:12

Bhutan says 10,000 bitcoins will be used to build its new administrative city

币界网·2025/12/17 18:08

Analyst to XRP Holders: Hold On to Your Hats. We Wait for a Decision

TimesTabloid·2025/12/17 18:06

XRP Price Stalls at $1.80 Key Support: Freefall Ahead or Fresh Bounce?

Cryptotale·2025/12/17 18:00

Flash

2025/12/26 18:27

The Federal Reserve reverse repo operation accepted $20.339 billionThe Federal Reserve accepted $2.0339 billion from 16 counterparties in its fixed-rate reverse repurchase operations.

2025/12/26 17:34

Data: 31.4049 million SKY transferred from an anonymous address, worth approximately $2.1 millionAccording to ChainCatcher, Arkham data shows that at 01:25, 31.4049 million SKY (worth approximately $2.1 million) were transferred from an anonymous address (starting with 0xaae3...) to another anonymous address (starting with 0x2F86...).

2025/12/26 17:34

The intraday gain of USD/JPY has expanded to 0.5%, now quoted at 156.66.ChainCatcher News, according to Golden Ten Data, the intraday gain of USD/JPY has expanded to 0.5%, now quoted at 156.66.

News