News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

SentismAI Collaborates With Ultiland to Expand DeFi Into Art and Culture

BlockchainReporter·2025/12/17 18:00

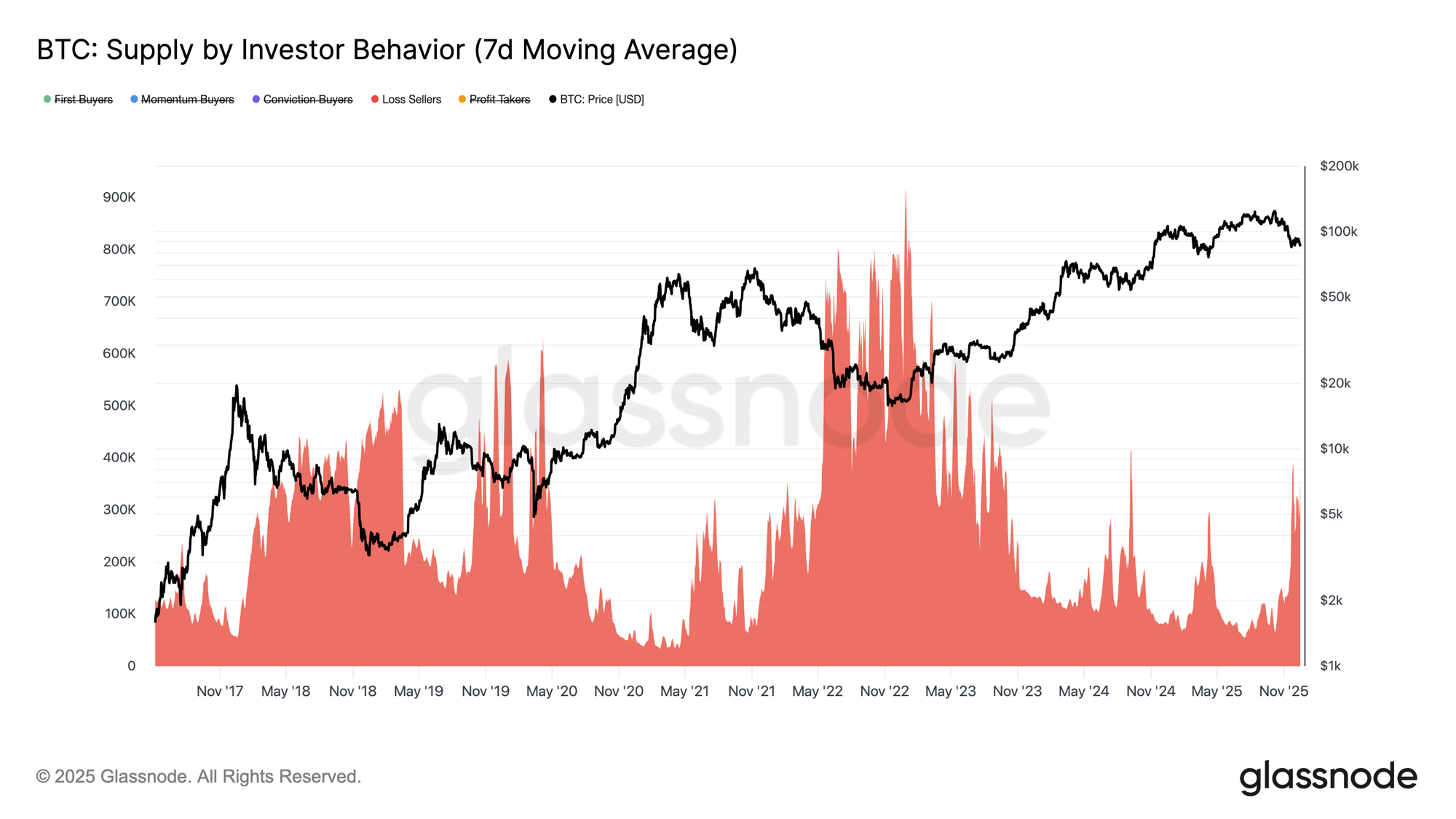

Trapped Under Overhead Supply

Glassnode·2025/12/17 17:57

Bitcoin Price Drop Alert: Why a Sharp Correction to $60K Is a Real Possibility

Bitcoinworld·2025/12/17 17:57

Theta Labs CEO Sued for Alleged Token Manipulation and Fraud

Cryptotale·2025/12/17 17:15

Urgent Crypto Market Structure Bill Talks: Industry Leaders Make Final Push With US Senators

Bitcoinworld·2025/12/17 17:12

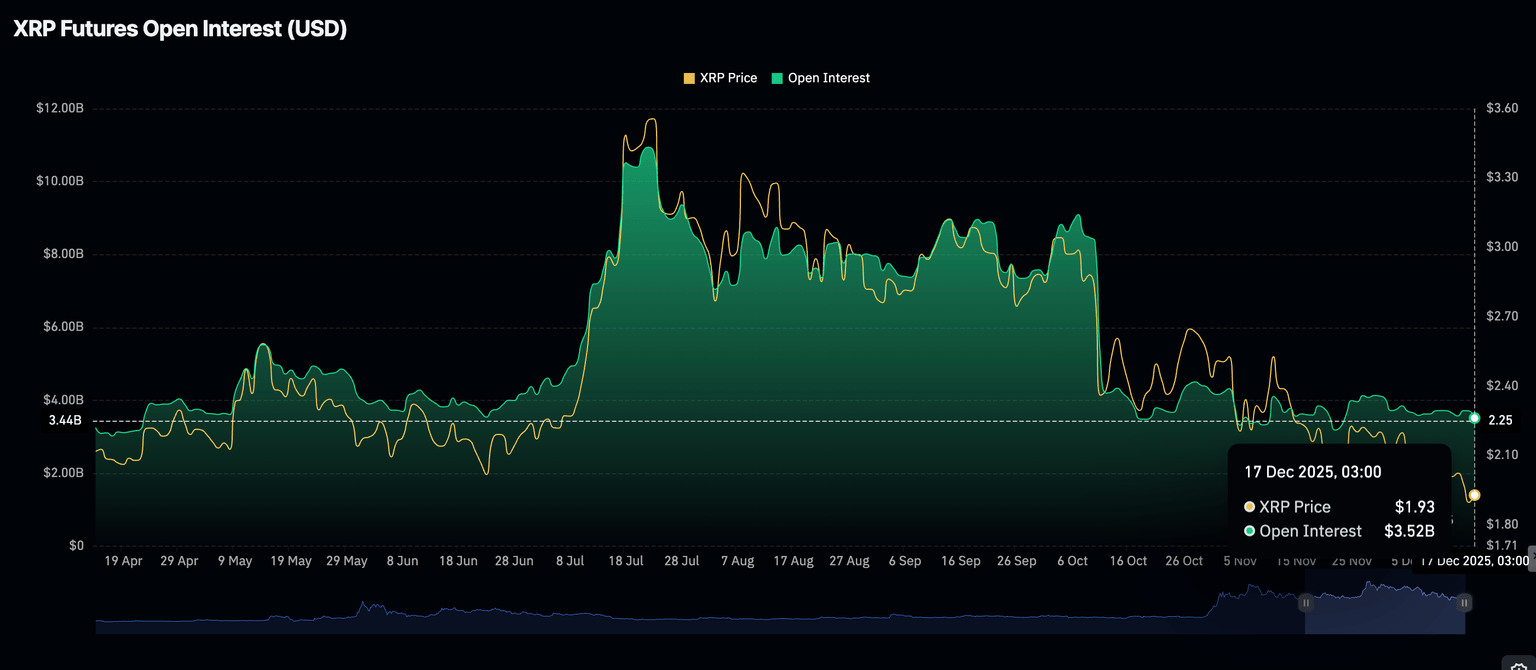

Pundit: Bitcoin Was the Test Run. XRP Is the Upgrade

TimesTabloid·2025/12/17 17:06

Flash

02:03

A wallet associated with Justin Bram received 5.37 million WLD from World Coin, of which 943,000 WLD have already been sold.PANews, December 27th – According to monitoring by Onchain Lens, a wallet associated with Justin Bram received 5.37 million WLD (worth $2.6 million) from the World Coin Vesting wallet. Among them, 943,000 WLD were directly transferred to Justin Bram, who subsequently sold them for $458,814. In addition, he also sold 23.84 million FAI for $54,629.

02:00

Lighter: The final batch of points for Season 2 has been distributed, with witch points removed and redistributed.According to Odaily, Lighter officials stated in the Discord community: "Today we have distributed the final batch of points for Season 2. At the same time, we have removed and redistributed points originating from sybil behavior, self-trading, and wash-trading."

02:00

"The Big Short" prototype Michael Burry: Bitcoin is worthlessMichael Burry, the hedge fund manager who inspired the movie "The Big Short," stated on the podcast "Against the Rules" that bitcoin is worthless and compared it to the tulip mania of this era. He believes that bitcoin rising to $100,000 is absurd and criticized some people for downplaying bitcoin's price volatility on television.

News