News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

Michael Saylor says quantum will “harden” Bitcoin, but he’s ignoring the 1.7 million coins already at risk

CryptoSlate·2025/12/17 16:30

Buy or sell? What do technical indicators suggest for Shiba Inu (SHIB)?

币界网·2025/12/17 16:30

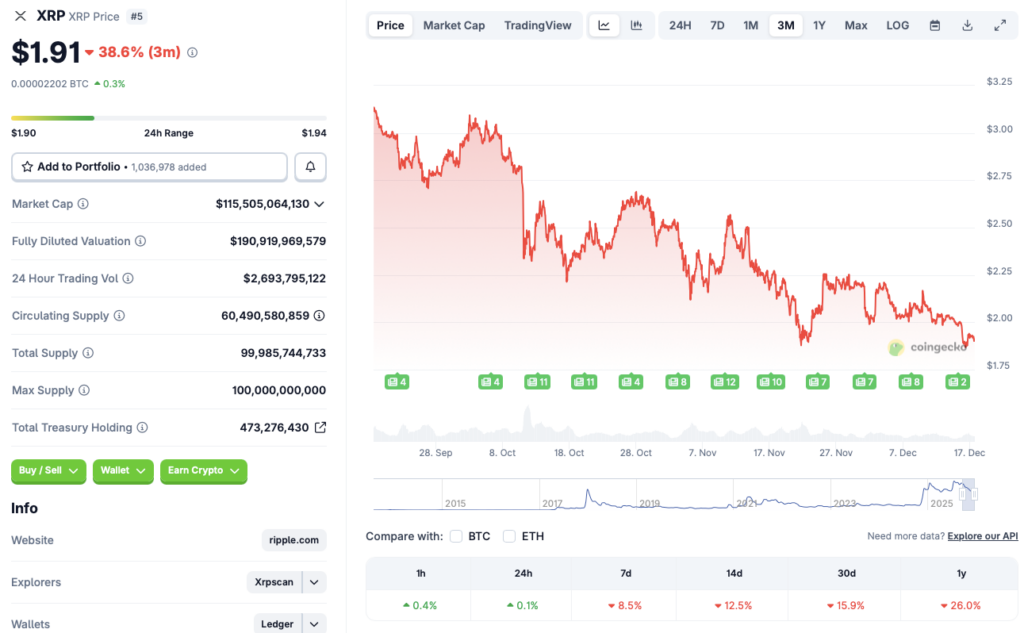

XRP may fall below $1 as whales sell: Here’s what you need to know

币界网·2025/12/17 16:29

Stunning Bitcoin Whale Transfer: $380 Million in BTC Vanishes Into New Wallet

Bitcoinworld·2025/12/17 16:27

Bitcoin Price Plummets: BTC Falls Below $88,000 in Sharp Market Correction

Bitcoinworld·2025/12/17 16:12

DOGE Hangs on $0.074 “Supply Wall” as Traders Watch for a Bounce

BlockchainReporter·2025/12/17 16:12

Bitcoin Miner Hut 8's Stock Soars After Inking $7 Billion Google-Backed AI Deal

Decrypt·2025/12/17 16:12

Analyst Who Accurately Forecasted XRP Price Crash to $1.88 Sets Next Price Target

TimesTabloid·2025/12/17 16:06

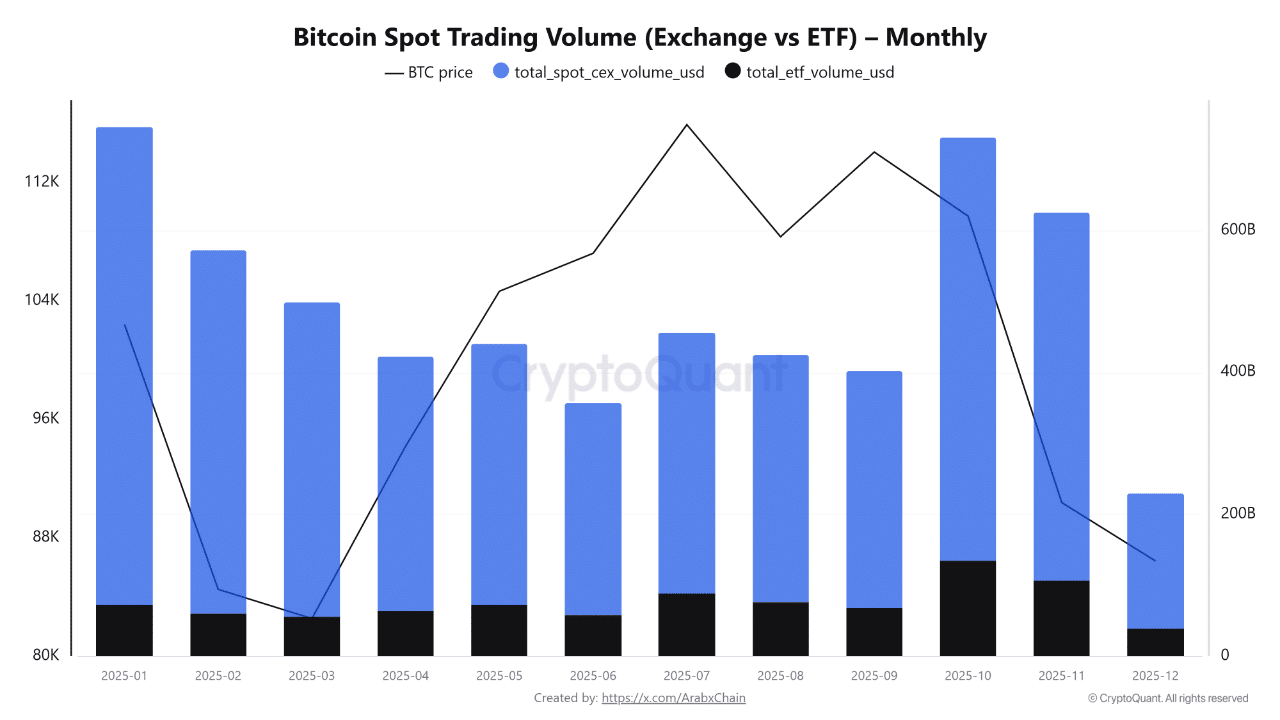

Mapping Bitcoin’s year-end slowdown as leverage exits the market

AMBCrypto·2025/12/17 16:03

Two Key Reasons Why Bitcoin Has Entered a Bear Market: Wall Street Veteran

币界网·2025/12/17 16:02

Flash

04:08

Galaxy Head of Research: US ETPs Perform Steadily, It's Only a Matter of Time Before Bitcoin Follows Gold as a Hedge Against Currency DepreciationPANews reported on December 27 that Alex Thorn, Head of Research at Galaxy, stated on the X platform that for bitcoin to achieve a positive return in 2025, its closing price on the last day of the year must be above $93,389. However, the sentiment among bitcoin investors is undoubtedly rather subdued at the moment. Still, some portfolio managers may revisit bitcoin in January 2026. This year, bitcoin has seen many positive developments, and such “good news” seems to have become the norm. Despite a lackluster year-end performance, the performance of US bitcoin ETPs has been much more stable. Since the historical high of $62 billion set in October, cumulative inflows have only declined by 9%, further highlighting the increasing maturity of this asset class. Galaxy believes that it may only be a matter of time before bitcoin follows gold as a hedge against currency devaluation, and several large asset allocators and central banks could ignite this trend.

03:55

Former Russian traffic police officer sentenced to 7 years for stealing bitcoinOn December 27, a former traffic police officer in Ufa, Russia, was sentenced to 7 years in prison for stealing approximately 20 million rubles (equivalent to several hundred thousand US dollars) in bitcoin. The case occurred in 2022, when the officer illegally obtained access to the mobile phones of two detained individuals during an investigation, transferred BTC through messaging apps and crypto wallets, and used violence during evidence collection. The court sentenced him to 7 years in a general regime prison, ordered him to compensate the victims about 20 million rubles, and stripped him of his police rank.

03:54

Russian Traffic Police Officer Extorts Value Worth Hundreds of Thousands of Dollars in Bitcoin through Violence, Receives 7-Year Prison SentenceBlockBeats News, December 27: A traffic police officer in Ufa, Russia, has been sentenced to 7 years in prison for stealing around 20 million rubles (hundreds of thousands of dollars) worth of Bitcoin. The case dates back to 2022 when the police officer illegally gained access to the mobile phones of two detainees while handling a case, used a messaging app to transfer the BTC from their encrypted wallets, and engaged in violent evidence collection. The court sentenced him to 7 years in a regular regime colony, ordered him to compensate the victims with around 20 million rubles, and stripped him of his rank. (Bits.media)

News