News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Imposes 25% Tariffs on Iran's Trade Partners; Google Market Cap Breaks $4 Trillion for the First Time; Gold Surpasses $4600 Threshold (Jan,13, 2026)2Bitget Daily Digest (Jan.13)|Market Risk-Off Triggered by Fed Independence Dispute; Meta Plans to Cut Metaverse Investment; Strategy Added 13,627 BTC Last Week

SEC’s Crypto Task Force Takes Conversations on the Road: What Traders Should Know

Coinpedia·2026/01/08 12:42

Why Zcash Is Crashing Today: ECC Exit Triggers Major Sell-Off

Coinpedia·2026/01/08 12:42

Vitalik Buterin Shares Ethereum Roadmap: BitTorrent-Style Scale, Linux-Level Adoption

Coinpedia·2026/01/08 12:42

Tezos Price Prediction 2025, 2026 - 2030: How High Will XTZ Price Go?

Coinpedia·2026/01/08 12:42

South Korea’s Won Stablecoin Bill Triggers Political Pushback

Cryptotale·2026/01/08 12:36

Mike Fay Says XRP Price Is Driven By ETFs, Not Network Usage

CoinEdition·2026/01/08 12:36

TD SYNNEX: Fiscal Fourth Quarter Earnings Overview

101 finance·2026/01/08 12:27

Neogen: Fiscal Second Quarter Earnings Overview

101 finance·2026/01/08 12:21

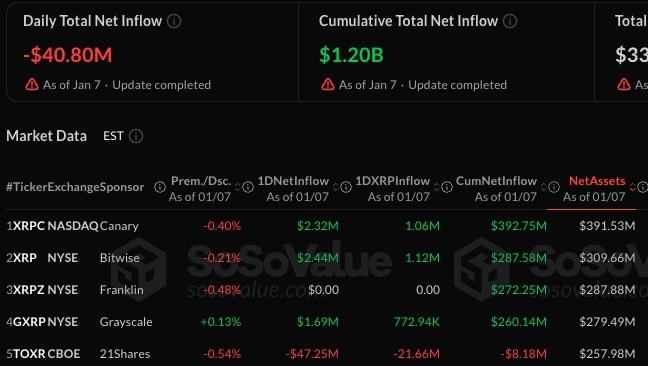

XRP ETFs See First Outflows since Inception as Crypto ETF Market Suffers

Coinspeaker·2026/01/08 12:18

Flash

02:49

Tether Freezes 182 Million USDT from 5 Addresses on the Tron NetworkBlockBeats News, January 13th, according to Whale monitoring, Tether froze 5 distinct addresses on the Tron network on January 11th, totaling 182 million USDT. The affected addresses held between 12 million and 50 million USDT. This action is in line with Tether's wallet freeze protocol introduced in December 2023, designed to comply with the sanction requirements of the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC). As of mid-2025, Tether has cumulatively frozen over $3 billion USDT and collaborated with over 310 law enforcement agencies in more than 62 countries.

02:48

The US spot XRP ETF saw a net inflow of $15.04 million yesterday. according to SoSoValue data, yesterday (January 12, Eastern Time) the spot XRP ETF had a net inflow of 15.04 million USD.

02:47

A major whale has established $140 million in short positions in BTC, SOL, and ETH. according to The Data Nerd monitoring, a certain whale (0x94d3...3814) has established three large short positions, with a total value of about 140 million USD. Specifically, these include: shorting BTC worth 69.93 million USD with 20x leverage, shorting SOL worth 50.3 million USD with 20x leverage, and shorting ETH worth 20 million USD with 20x leverage.

News