News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.16)|CME to Launch ADA, LINK and XLM Futures on Feb 9; Bitmine Purchases 24,068 ETH; Polygon Lays Off 30% to Pivot Toward Stablecoin Payments2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

DDC Enterprise makes its initial treasury purchase of 200 bitcoin in 2026

101 finance·2026/01/16 15:03

NEXST Brings KISS OF LIFE to Life: Debut VR Concerts on the Ultimate Web3 Entertainment Platform

BlockchainReporter·2026/01/16 15:03

Qnity Electronics’ Fourth Quarter 2025 Financial Results: What Should You Anticipate

101 finance·2026/01/16 15:03

Hollywood tycoon’s high-stakes showdown for Warner Bros heads to the UK

101 finance·2026/01/16 14:45

Dos Equis brings back ‘Most Interesting Man’ commercials amid declining beer sales

101 finance·2026/01/16 14:21

InfoFi Hit as X Revokes API Access for Incentive Projects

Cryptotale·2026/01/16 14:15

Morning Minute: Tom Lee Supports Mr. Beast with a $200 Million Investment

101 finance·2026/01/16 14:12

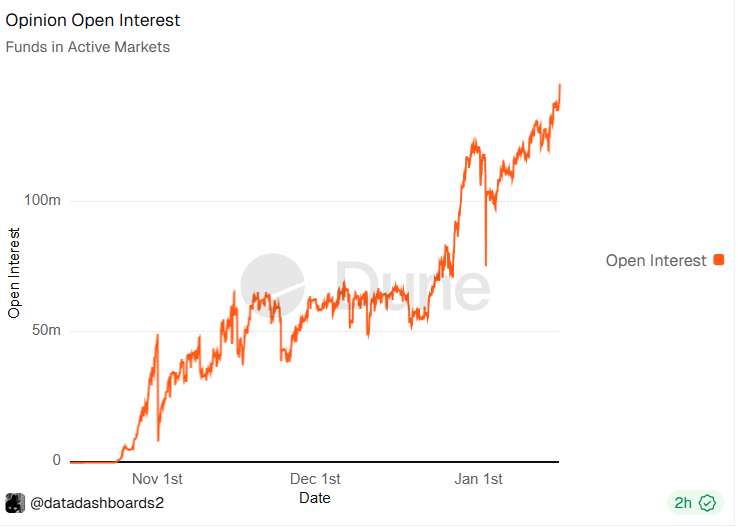

Opinion prediction platform reaches record open interest

Cointelegraph·2026/01/16 14:00

Swiss Franc gains slightly while the US Dollar takes a breather following a surge fueled by economic data

101 finance·2026/01/16 14:00

Flash

15:07

Orderly launches native points module, allowing ecosystem exchanges to customize incentive rulesForesight News reports that the omnichain derivatives liquidity layer Orderly Network has announced the launch of its native points module, enabling decentralized exchanges (Brokers) built on its infrastructure to quickly deploy customized incentive systems. Each trading platform can independently set activity rules, duration, and weighting, with points data settled daily at 16:00. Brokers can freely determine the start and end times, weighting ratios, and rules for their activities. Rule modifications only take effect in the future, and historical points records remain unchanged. The points calculation consists of four components: trading volume (positions must be held for more than 1 minute); absolute PnL value (points are awarded regardless of profit or loss); two-level referral rewards (receiving 10% and 5% of the invitee's points, respectively); and daily tasks. This system operates without the need to issue tokens, and points can be used in the future to unlock fee rebates, VIP tiers, airdrops, or offline rewards.

15:06

Cyvers Alert: User mistakenly sent over $500,000 USDT to an "address poisoning" scam addressAccording to ChainCatcher, market sources report that a so-called "address poisoning" attack involving a total of approximately $509,000 USDT has been detected by system monitoring. The victim originally intended to transfer funds to address 0xe842…D3E6F, but due to the extremely similar case at the end of the address, mistakenly sent the funds to a forged address 0xe842…f3e6F. After an initial mistaken transfer of 5,000 USDT, another 509,000 USDT was transferred within two minutes. Cyvers reminds users to stay vigilant and beware of fake address scams.

14:43

Galaxy Head of Research: Stablecoin Yields Are the Key Sticking Point in U.S. Crypto Framework Bill NegotiationsJinse Finance reported that Alex Thorn, Head of Research at Galaxy, posted on X that Tim Scott, Chairman of the U.S. Senate Banking Committee, has announced the postponement of the crypto market structure bill hearing. It is reported that the issue of stablecoin yields is a key sticking point in the negotiations. Banking lobby groups are actively pushing to restrict stablecoin rewards, fearing that interest-bearing stablecoins could siphon off bank deposits and undermine the stability of the banking system. The compromise proposal put forward to win lawmakers’ support was ultimately deemed unacceptable by the stablecoin industry, with some considering the issue a matter of survival. Other unresolved issues include restrictions on DeFi and illicit activities, as well as limitations on tokenized securities innovation. In addition, Alex Thorn revealed that although Tim Scott has not yet announced a new hearing date, since the Senate will be in recess next week, the earliest the Banking Committee could reconvene for a revised hearing would be the week of January 26 to 30. The Senate Agriculture Committee, which is responsible for CFTC-related matters, has also postponed its revised hearing to January 27.

News