News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Jasmy price soars: Here’s why it may crash soon

Crypto.News·2026/01/09 16:12

Top 10 Free Bitcoin Cloud Mining Software in 2026: Effortlessly Start Mining Without Hardware

BlockchainReporter·2026/01/09 16:06

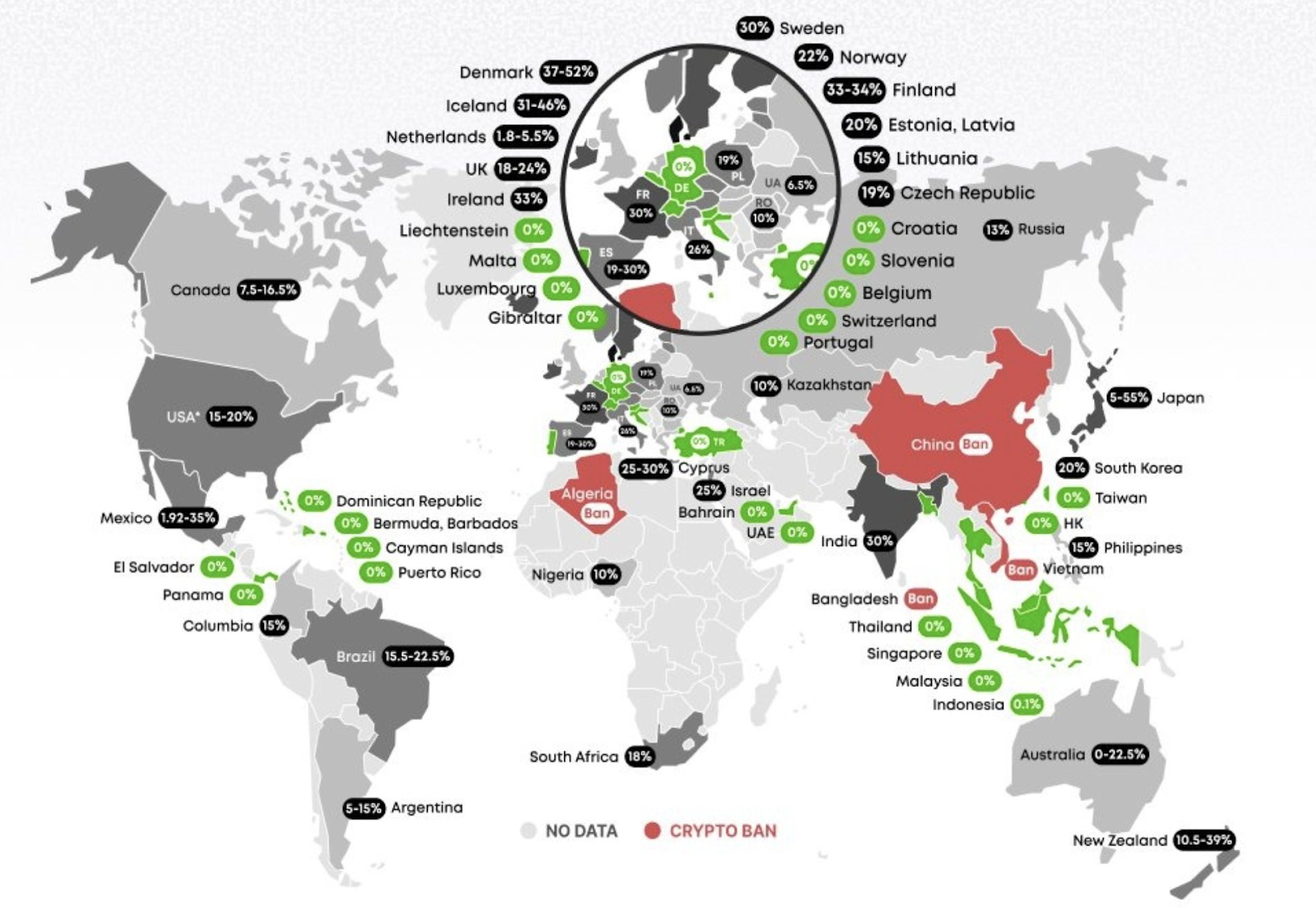

Top Countries with Zero Bitcoin Tax Enter a New Era of Global Reporting

CoinEdition·2026/01/09 16:06

Is Iran’s latest crisis a threat to its Bitcoin mining industry?

AMBCrypto·2026/01/09 16:03

How the Largest Transfer of Wealth in History Might Transform Your Financial Prospects

101 finance·2026/01/09 16:00

Canada employment data highlights an inconsistent rebound in the labor market – RBC Economics

101 finance·2026/01/09 15:48

US UoM Consumer Sentiment Index rises to 54 in January vs. 53.5 expected

101 finance·2026/01/09 15:48

White House economic advisor Hassett: The Federal Reserve needs to cut interest rates further.

Cointime·2026/01/09 15:42

Flash

05:14

U.S. Treasury Secretary: Trump's MMT Plan Aims to Combat Fed Balance Sheet ContractionBlockBeats News, January 12, U.S. Treasury Secretary Scott Bessent said last Friday that the goal of the Trump administration's mortgage-backed securities (MBS) purchase program is to roughly match the pace of its purchases with the pace of these bonds "rolling off" the Fed's balance sheet.

Bessent said in an interview with Reuters, "The reality is that the Fed is shrinking by about $15 billion of bonds a month, so the idea is to roughly match the Fed's actions, which have been pushing in the opposite direction."

05:08

The former largest PEPE bull goes 4x long on ETH, with an unrealized profit of $330,000.BlockBeats News, January 12, according to monitoring, the "former largest PEPE bull" has closed their PEPE long position, realizing a loss of $314,500. Currently, they are long on 5,618.97 ETH (approximately $17.75 million) with 4x leverage, with an average entry price of $3,097.29, and an unrealized profit of $330,000.

05:06

「Former PEPE Top Bull」 Goes 4x Long on ETH, Unrealized Gain of $330,000BlockBeats News, January 12th, according to Hyperinsight monitoring, the "Former PEPE Top Long" has closed the PEPE long position with a realized loss of $314,500. Currently, the position is 4x leveraged long on 5618.97 ETH (approximately $17.75 million), with an entry price of $3097.29, and an unrealized profit of $330,000.