News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Former officials say DOJ probe threatens Fed indepence, has 'no place in the United States'

101 finance·2026/01/12 19:00

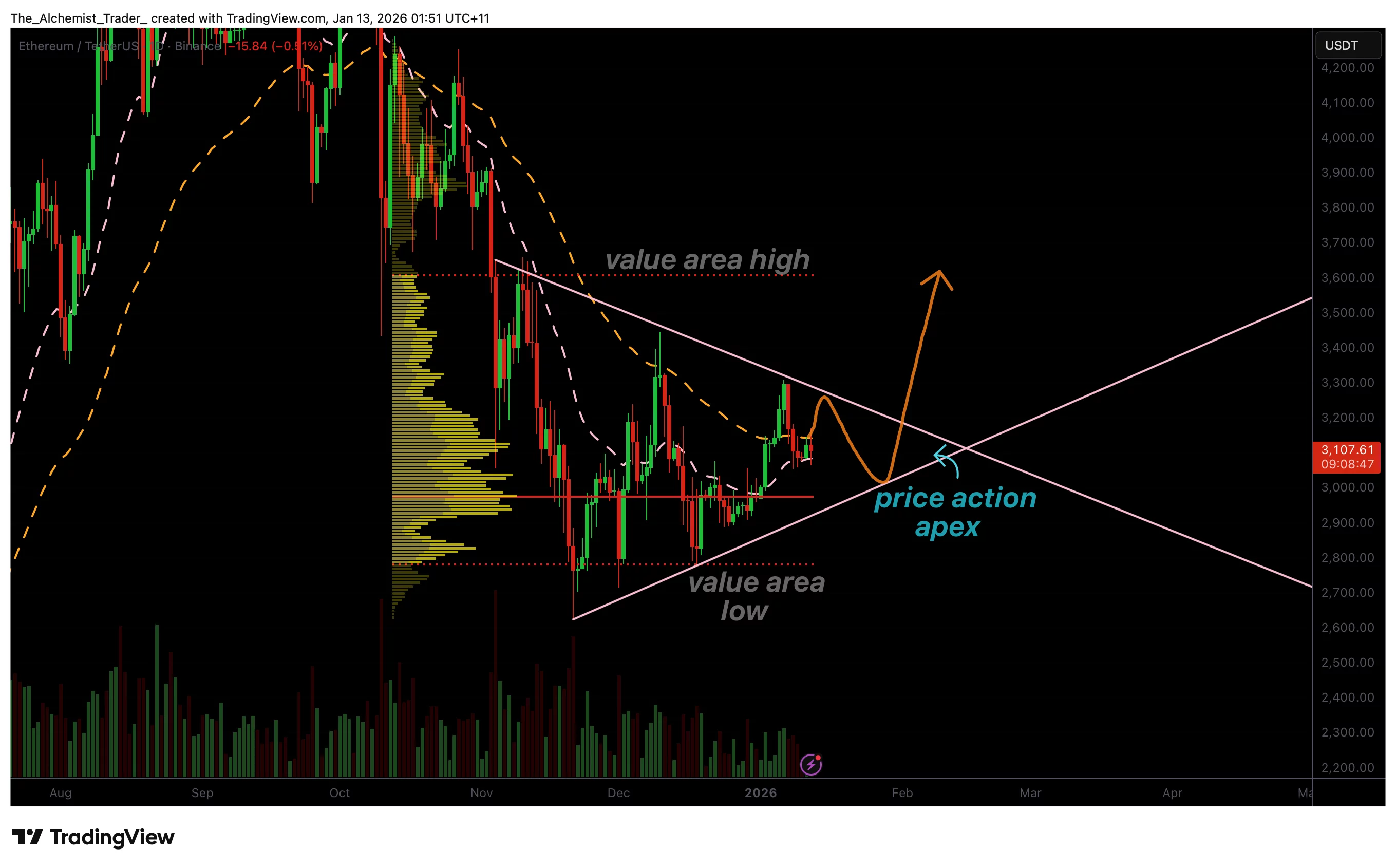

Ethereum price compresses into triangle structure, why breakout is approaching

Crypto.News·2026/01/12 19:00

Trump’s clash with Federal Reserve Chairman Jerome Powell could trigger an unexpected economic outcome

101 finance·2026/01/12 18:54

Fed's dispute with the DOJ may reduce the likelihood of additional interest rate reductions

101 finance·2026/01/12 18:48

Why Synchrony Financial (SYF) Stock Is Dropping Sharply Today

101 finance·2026/01/12 18:48

K-Shaped Economy Persists as Goldman’s Consumer Dashboard Highlights Widening Gap

101 finance·2026/01/12 18:42

AUD/USD bounces back as US Dollar slips amid worries over Fed’s autonomy

101 finance·2026/01/12 18:39

XRP Holds Reaccumulation Structure Amid Tight $2.08–$2.15 Range

Cryptonewsland·2026/01/12 18:33

Meta to build gigawatt-scale computing capacity under Meta Compute effort

101 finance·2026/01/12 18:21

Standard Chartered Sets Ambitious Ethereum Target

Cointurk·2026/01/12 18:21

Flash

18:27

Short-term holder cost distribution shows price consolidating in the $80,000 to $95,000 rangeRecently, the short-term holder cost distribution heatmap shows that the consolidation in the $80,000 to $95,000 range reflects a concentration of cost structure at higher levels, while demand has rebounded above $80,000. The supply from recent buyers has absorbed attempts at a rebound, and although buying continued after selling, the price remains anchored within the current range. (glassnode)

18:05

Trump says strong inflation and growth data should prompt Powell to make significant rate cutsU.S. President Trump stated that strong inflation and economic growth data mean that Federal Reserve Chairman Powell should "meaningfully" lower interest rates. (Cointelegraph)

17:59

The number of new Ethereum wallets reaches a record highIn the past week, the average number of new Ethereum wallets created daily reached 327,100, with 393,600 new wallets added on Sunday, marking a historical high. (Santiment)