News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

PEPE Holds $0.055969 Tight Range Near Key Levels Despite 2% Dollar Decline

Cryptonewsland·2026/01/12 19:33

CPI outlook: December inflation likely to remain subdued as economic indicators normalize

101 finance·2026/01/12 19:30

Bitcoin Prices Remain Stable with Significant Support Point Against Market Uncertainty

BlockchainReporter·2026/01/12 19:27

Why American Express (AXP) Stock Is Declining Today

101 finance·2026/01/12 19:21

FX Today: US inflation takes center stage

101 finance·2026/01/12 19:21

Congress Stock Trading Ban Faces Critical 60% Passage Odds as Kalshi Data Signals Historic Shift

Bitcoinworld·2026/01/12 19:21

Institutional Crypto Adoption Accelerates: Wall Street’s Pivotal Shift to Digital Asset Leadership

Bitcoinworld·2026/01/12 19:21

Story Protocol’s IP token surges 22%, outpacing top altcoins: check forecast

CryptoNewsNet·2026/01/12 19:15

Litecoin price outlook: is $80 next as BTC reclaims $92k?

CryptoNewsNet·2026/01/12 19:15

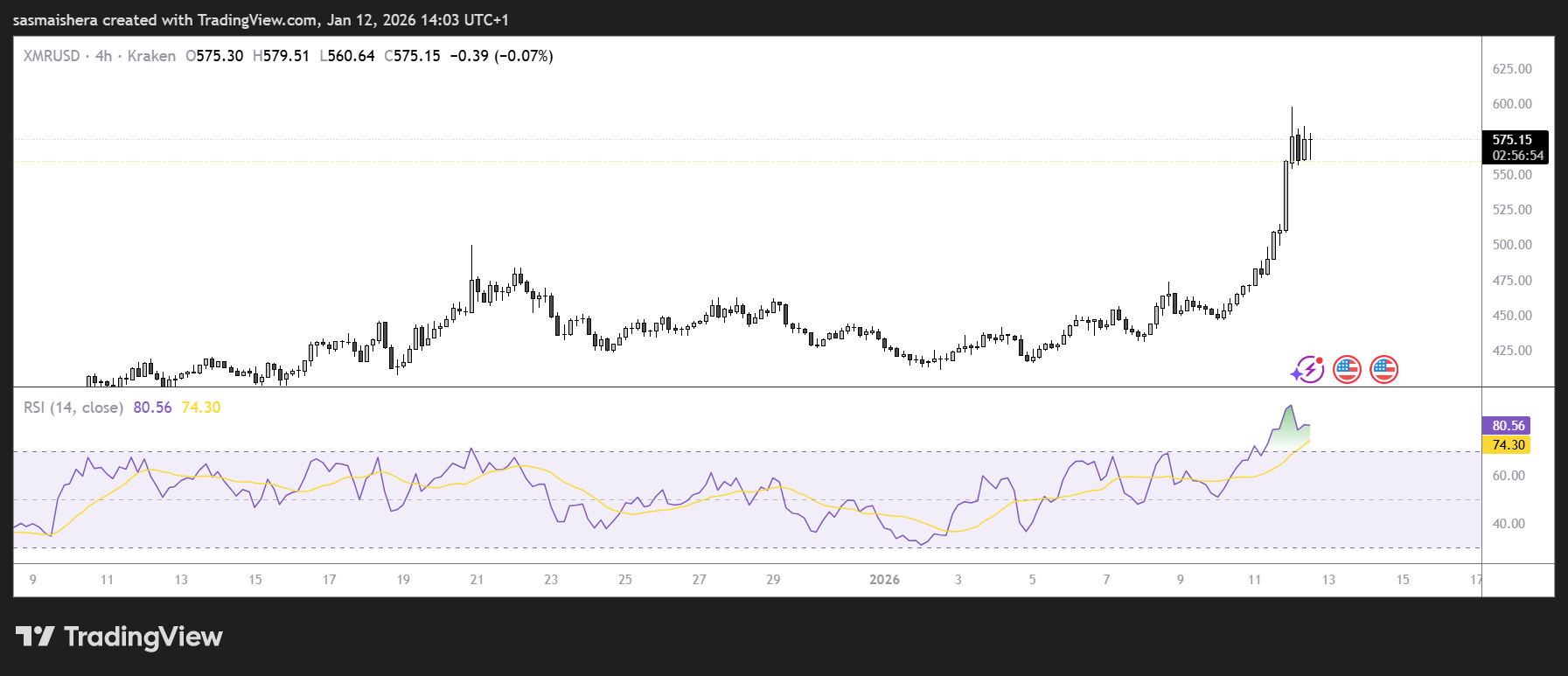

Monero price forecast: Is XMR heading towards $700?

CryptoNewsNet·2026/01/12 19:15

Flash

01:47

Bitwise: If ETF demand remains strong in the long term, BTC price will enter a parabolic growth phaseAccording to Odaily, Bitwise Chief Information Officer Matt Hougan stated on the X platform that if ETF demand continues in the long term, the price of BTC will enter a parabolic growth phase. Matt Hougan cited the 65% increase in gold prices in 2025 as an example, pointing out that both gold and BTC prices are determined by supply and demand. After the United States confiscated Russian sovereign bond deposits in 2022, annual gold purchases by central banks around the world increased from about 500 tons to about 1,000 tons and have remained stable. This change in demand altered the supply-demand balance, but was not immediately reflected in the price. Gold prices rose by 2% in 2022, 13% in 2023, and 27% in 2024, only entering a parabolic growth phase in 2025. This is because the demand in the previous years was met by holders willing to sell gold. When the selling pressure from sellers was exhausted and demand persisted, prices rose sharply. Currently, a similar situation exists with BTC and ETFs. Since the debut of ETFs in January 2024, their purchase volume has already exceeded 100% of the new supply of BTC. Because existing holders are willing to sell, the price has not yet entered the parabolic phase. If ETF demand continues, the selling pressure from existing sellers will eventually be exhausted.

01:46

French AMF: 30% of unlicensed crypto companies have not disclosed whether they plan to apply for a license and may cease operations before JulyForesight News reported, according to Reuters, that the French Financial Markets Authority (AMF) stated on Tuesday that nearly one-third of crypto companies in France without an EU license have yet to inform regulators whether they plan to apply for a license or will cease operations before July. Of the approximately 90 unlicensed companies, 30% have applied, 40% have clearly stated they will not apply, and the remaining 30% have not provided feedback on their plans. France's crypto regulatory transition period will end on June 30, and ESMA requires unauthorized firms to formulate or implement an "orderly exit" plan before the deadline. Previously, certain exchanges, Circle, Revolut, and other companies have already obtained MiCA licenses.

01:43

BitMine has once again staked 94,400 Ether, surpassing a total staking amount of 1.53 million Ether.BlockBeats News, January 14th, according to Onchain lens monitoring, BitMine has just added an additional 94,400 Ethereum to its staking, worth approximately $314 million.

As of now, the company's total staked Ethereum amount has reached 1,530,784 ETH, with a total value of about $5.1 billion.