News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

You Need to Hold At Least 2,314 XRP. Here’s Why

TimesTabloid·2025/12/20 00:00

Bitcoin Recent Dips Reveal Market Structure Issue Not Coming From Selling Pressure

Newsbtc·2025/12/19 23:18

Top 5 Best Cryptos to Trade In as the Altcoin Market Trades at 40%+ Discounts

Cryptonewsland·2025/12/19 23:18

Building venture-backable companies in heavily regulated spaces

TechCrunch·2025/12/19 23:18

Rocket Lab wins another defense-related space contract

TechCrunch·2025/12/19 23:18

3 Altcoins To Watch This Weekend | December 20 – 21

BeInCrypto·2025/12/19 23:18

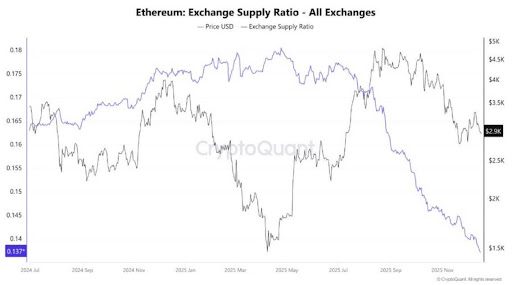

Ethereum Exchange Supply Just Crashed To New Lows, Why This Is Bullish For Price

Newsbtc·2025/12/19 22:21

Where are investors placing their bets next year? AI, AI, AI.

TechCrunch·2025/12/19 22:18

Former Patagonia CEO Rose Marcario resigns from Rivian’s board

TechCrunch·2025/12/19 22:18

XRP ETFs surpass $60m in assets as token price declines

Crypto.News·2025/12/19 22:06

Flash

12:46

The U.S. Department of Justice has released nearly 30,000 pages of new Epstein case files, including allegations against Trump.BlockBeats News, December 23, the U.S. Department of Justice announced the official release of nearly 30,000 pages of documents related to Jeffrey Epstein. These documents include false and sensational allegations against Trump, which were submitted to the FBI on the eve of the 2020 election. The U.S. Department of Justice stated that these allegations are baseless and purely fabricated. If they had any credibility, they would have already been used to attack President Trump. However, in line with its commitment to the law and transparency, the Department of Justice will release these documents while lawfully protecting Epstein's victims. The U.S. Department of Justice had already begun releasing investigation documents related to the Epstein case on December 19, in accordance with the requirements of the Epstein Files Transparency Act, which was passed by Congress in November and signed by Trump. This act mandates the Department of Justice to publicly release all non-confidential related records, including investigation, prosecution, and incarceration materials, by December 19.

12:46

Vitalik responds to Ethereum's contract size limit: Due to DoS risk considerations, it may be lifted after EIP-7864According to Odaily, in response to the community's discussion on "Ethereum still setting a contract size limit," Vitalik Buterin explained that this is due to considerations of DoS risk. He stated that once Ethereum's state structure is upgraded to a unified binary tree (EIP-7864), it is expected that there will be no limit on contract size. However, issues such as gas fees and mechanism design for deploying extremely large contracts still need to be addressed. Currently, based on the cost per byte for contract creation, the actual contract size limit is about 82KB.

12:39

IG releases 2026 commodity outlook: gold rally expected to continue, gold rally expected to continuePANews, December 23 – IG market analysts Farah Mourad and Ye Weiwen released their 2026 commodity outlook report, pointing out that the precious metals and energy markets will continue to diverge: Gold: Benefiting from declining real yields, high government spending, and continued central bank demand for gold, the upward trend in gold prices is expected to continue. Major investment banks forecast a gold price range of $4,500–$4,700 in 2026, and under favorable macro conditions, it may break through $5,000. Silver: After surging 120% in 2025, silver has entered a price discovery phase. With supply in deficit for the fifth consecutive year and accelerating industrial demand, the target price is expected to break through $65, with technical models pointing to $72 or even $88. Energy: The oil market is under pressure as supply growth far outpaces demand. The average price of Brent crude oil in 2026 is expected to be $62.23, and WTI crude oil is expected to average $59. JPMorgan warns that if the supply glut worsens, Brent crude prices could fall to the $30 range. The report points out that the precious metals sector is driven by real macro demand and has long-term structural support, while the energy market faces structural downward pressure, with geopolitical risks potentially limiting the downside for oil prices.