News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

How Do Gen Z's 401(k) Savings Measure Up Against Other Age Groups

101 finance·2026/01/12 13:06

T3 FCU hailed as model blockchain crime-fighter by FATF

Crypto.News·2026/01/12 13:06

Ethereum and Pepe Hold Steady, but BlockDAG Eyes Massive 1000x Profits After February Listing

Coinomedia·2026/01/12 13:03

Bitcoin Core expands trusted maintainer set with sixth keyholder

Crypto.News·2026/01/12 13:03

Top 10x Crypto Opportunities for 2026 with IPO Genie ($IPO) Leading Presale Charts

BlockchainReporter·2026/01/12 13:00

Crypto custody startup BitGo aims to raise about $201 million in US IPO

101 finance·2026/01/12 12:57

Render Price Prediction 2026: AI Compute Pivot and Enterprise GPUs Target $5-$8

CryptoNewsNet·2026/01/12 12:54

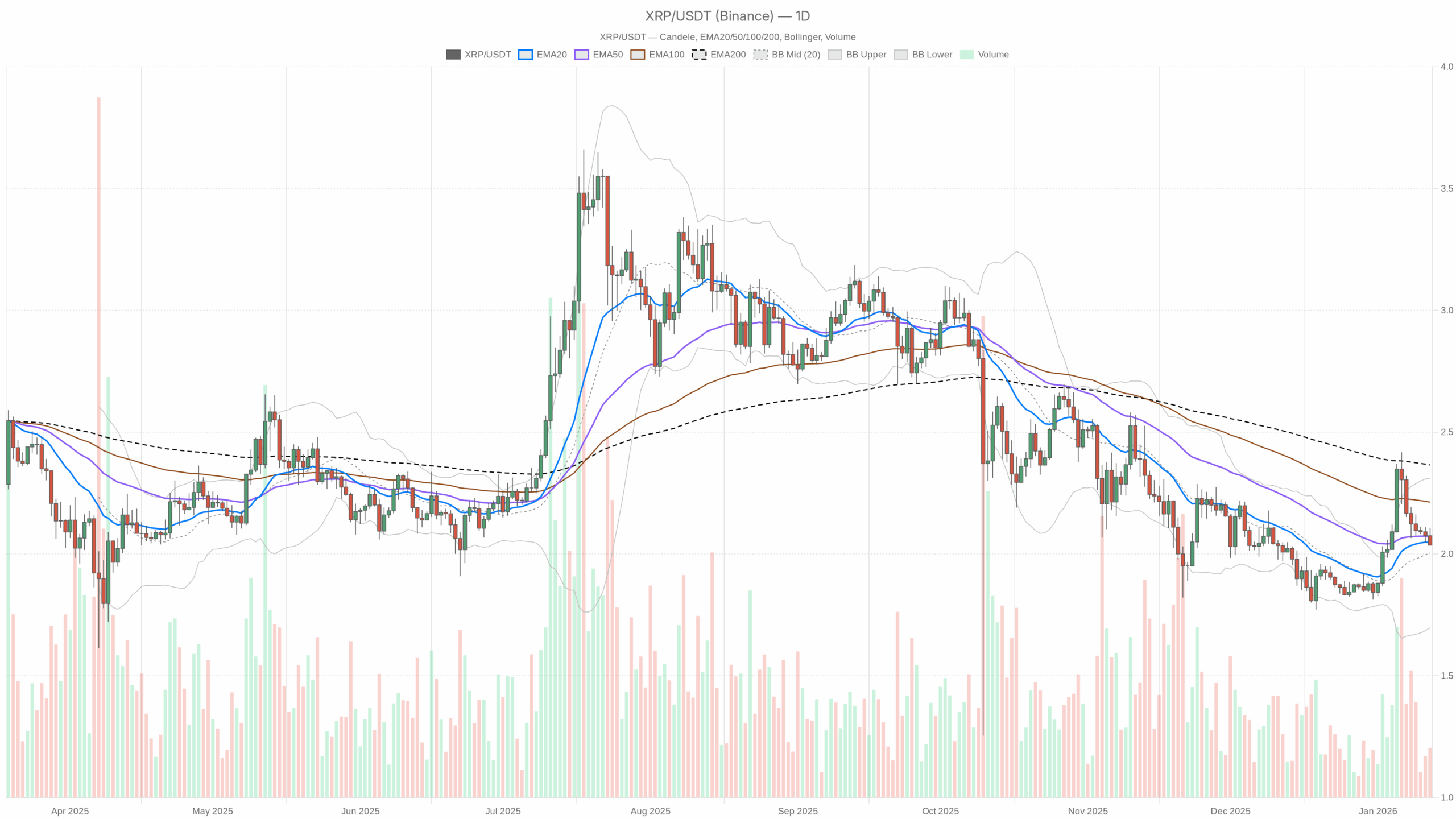

XRPUSDT sits on the edge as Ripple crypto price tests key support zone

CryptoNewsNet·2026/01/12 12:54

Hassett: Still interested in a Fed position

Cointime·2026/01/12 12:52

Flash

14:17

Polygon Labs integrates previously acquired teams and eliminates some overlapping positions to accelerate its transition to the payments sector.Foresight News reported that Polygon Labs CEO Marc Boiron tweeted that during the acquisition and integration of the Coinme and Sequence teams, the company decided to eliminate some overlapping positions. This adjustment aims to support the company’s complete transformation into a blockchain company focused on payments. Marc Boiron emphasized that this job adjustment is a structural change rather than an issue of employee performance. Although the total number of employees is expected to remain at a similar level, the team's professional background will shift more towards payments, wallets, and blockchain infrastructure. Previously, on December 13, Polygon Labs acquired cryptocurrency payment infrastructure Coinme and blockchain development platform Sequence for $250 million.

14:13

Hyperliquid converts $FOGO from pre-market contract to regular contract, supporting up to 3x leverage tradingPANews reported on January 15 that, according to a Hyperliquid announcement, $FOGO has been converted from a pre-market contract (hyperm) to a regular perpetual contract, and now supports up to 3x leverage for long or short positions.

14:08

Anchorage partners with Spark to launch on-chain lending services for institutional usersForesight News reported that Anchorage Digital has launched an on-chain lending service in collaboration with Spark (formerly MakerDAO), allowing institutions to borrow through the on-chain lending platform while having their assets under custody. Spark developer Phoenix will obtain "direct legal ownership" of the staked assets, while Anchorage Digital's collateral management and secure settlement infrastructure, Atlas, will be responsible for overseeing collateral management functions, including forced liquidation.