News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 15)|Hassett stresses Fed independence, says Trump’s views “carry no weight”; Bitcoin OG increases ETH long positions, total exposure reaches $676 million2Bitcoin will ‘dump below $70K’ thanks to hawkish Japan: Macro analysts3Bitcoin ‘extreme low volatility’ to end amid new $50K BTC price target

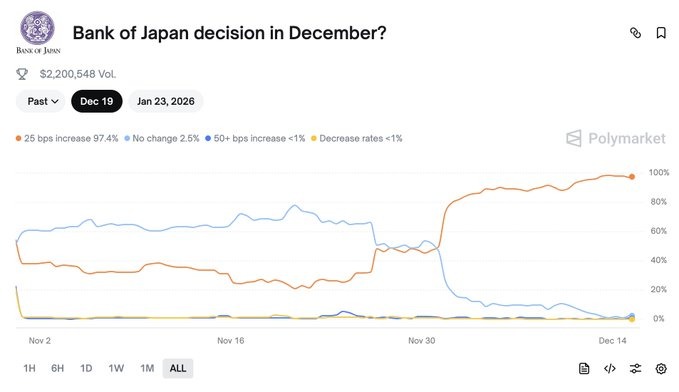

Bitcoin Price To Crash Below $70K as Japan Rate Hike Looms

Coinpedia·2025/12/15 11:21

“Quantum Threat to Bitcoin Is Decades Away”, Says Adam Back

Coinpedia·2025/12/15 11:21

Ethereum Founder Vitalik Buterin Wants Algorithm Transparency on X

Coinpedia·2025/12/15 11:21

“Crypto Cases Were Dropped Under Trump’s Second Term”, NYT Investigation Says

Coinpedia·2025/12/15 11:21

Ondo Price Prediction 2025, 2026 – 2030: Can Ondo Hit $10?

Coinpedia·2025/12/15 11:21

Morning News | Infrared to conduct TGE on December 17; YO Labs completes $10 million Series A financing; US SEC issues crypto asset custody guidelines

A summary of major market events on December 14.

Chaincatcher·2025/12/15 09:50

Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net inflow of $286 million; US Ethereum spot ETFs saw a net inflow of $209 million

Bitwise's top ten crypto index fund has officially been listed and is now trading as an ETF on NYSE Arca.

Chaincatcher·2025/12/15 09:50

Banding Together in the Bear Market to Embrace Investors! Crypto Tycoons Gather in Abu Dhabi, Calling the UAE the "New Wall Street of Crypto"

As the crypto market remains sluggish, industry leaders are pinning their hopes on investors from the UAE.

ForesightNews·2025/12/15 09:42

Behind the Pause in Increasing BTC Holdings: Metaplanet’s Multiple Considerations

AICoin·2025/12/15 09:40

What are crypto moguls talking about lately?

AICoin·2025/12/15 09:40

Flash

- 11:17JPMorgan launches its first tokenized money market fundJinse Finance reported, citing The Wall Street Journal, that JPMorgan has officially launched its first tokenized money market fund, "My OnChain Net Yield Fund" (abbreviated as MONY). This private fund will operate on the Ethereum blockchain and is open to qualified investors. JPMorgan will inject $100 millions of its own capital into the fund as seed funding.

- 11:12Data: CoinShares: Digital asset investment products saw net inflows of $864 million last weekAccording to ChainCatcher, market sources indicate that digital asset investment products saw a total inflow of $864 million last week. This marks the third consecutive week of overall moderate inflows, reflecting a cautious yet increasingly optimistic investor sentiment. Despite the recent interest rate cut by the Federal Reserve, price performance remains sluggish. Market sentiment was mixed in the trading days following the rate cut, and capital flows were uneven. Regionally, the US market was the most positive, with inflows reaching $796 million last week. Germany ($68.6 million) and Canada ($26.8 million) also saw capital inflows. These three countries have dominated this year's capital flows, accounting for 98.6% of year-to-date (YTD) inflows. Bitcoin attracted $522 million in capital inflows, while investment products shorting bitcoin continued to see a total outflow of $1.8 million, indicating a warming market sentiment. Nevertheless, bitcoin's performance this year remains relatively sluggish, with YTD inflows at $27.7 billion, compared to $41 billion in 2024. Ethereum saw $338 million in inflows last week, bringing its YTD inflows to $13.3 billion, a 148% increase compared to 2024. Solana's YTD inflows remain low at $3.5 billion, but this still represents a tenfold increase compared to 2024. Aave and Chainlink attracted $5.9 million and $4.1 million in inflows last week, respectively, while Hyperliquid saw an outflow of $14.1 million.

- 11:02BiyaPay analyst: Circle receives OCC approval to establish a trust bank, long-term positive but short-term stock price remains under pressureBlockBeats News, on December 15, Circle (CRCL) announced that it has received "conditional approval" from the US Office of the Comptroller of the Currency (OCC) to establish a national trust bank. In the future, it will strengthen USDC reserve oversight and institutional-level custody services, but the stock price did not show a significant increase. BiyaPay analysts believe that this news is a "long-term compliance positive," but it is difficult to realize profits directly in the short term, and the market may have already priced it in, with funds choosing to "buy the rumor, sell the news." For users, BiyaPay continues to provide convenient multi-asset trading, supporting USDT trading for US stocks, Hong Kong stocks, futures, as well as zero-fee trading for digital asset spot contracts.

News