News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 17)|Grayscale XRP Spot ETF Ruling Imminent; SEC to Rule on 16 Major Crypto ETFs;2Massive $536M Outflow Hits Spot Bitcoin ETFs3Research Report|In-Depth Analysis and Market Cap of Meteora(MET)

Estimates show U.S. jobless claims fell to around 215,000 last week

Cointime·2025/10/17 14:48

Ethereum Price Slides Below $4,000 Support As Sellers Tighten Their Grip

Newsbtc·2025/10/17 14:27

Bitcoin falls below $110,000, whose wallet is losing money again?

Market sentiment has fallen into extreme fear.

ForesightNews 速递·2025/10/17 14:23

21Shares Files with SEC for 2x Leveraged HYPE ETF Tracking Hyperliquid Index Performance

Cryptonewsland·2025/10/17 14:06

Ghana Targets December 2025 for Crypto Rules as Enforcement Team Remains Unfilled

Cryptonewsland·2025/10/17 14:06

ACI Worldwide and BitPay Partner to Enable Merchants to Accept Crypto and Stablecoin Payments Globally

Cryptonewsland·2025/10/17 14:06

SEC’s Hester Peirce Calls for Financial Privacy as Tokenization Gains Momentum

Cryptonewsland·2025/10/17 14:06

France Boosts AML Checks on Crypto Exchanges

France’s ACPR tightens AML rules on crypto firms like Binance amid MiCA compliance efforts.Major Exchanges Face Regulatory ReviewMiCA Brings a New Compliance Era

Coinomedia·2025/10/17 14:06

Japanese banks to launch yen and dollar stablecoins

Portalcripto·2025/10/17 14:00

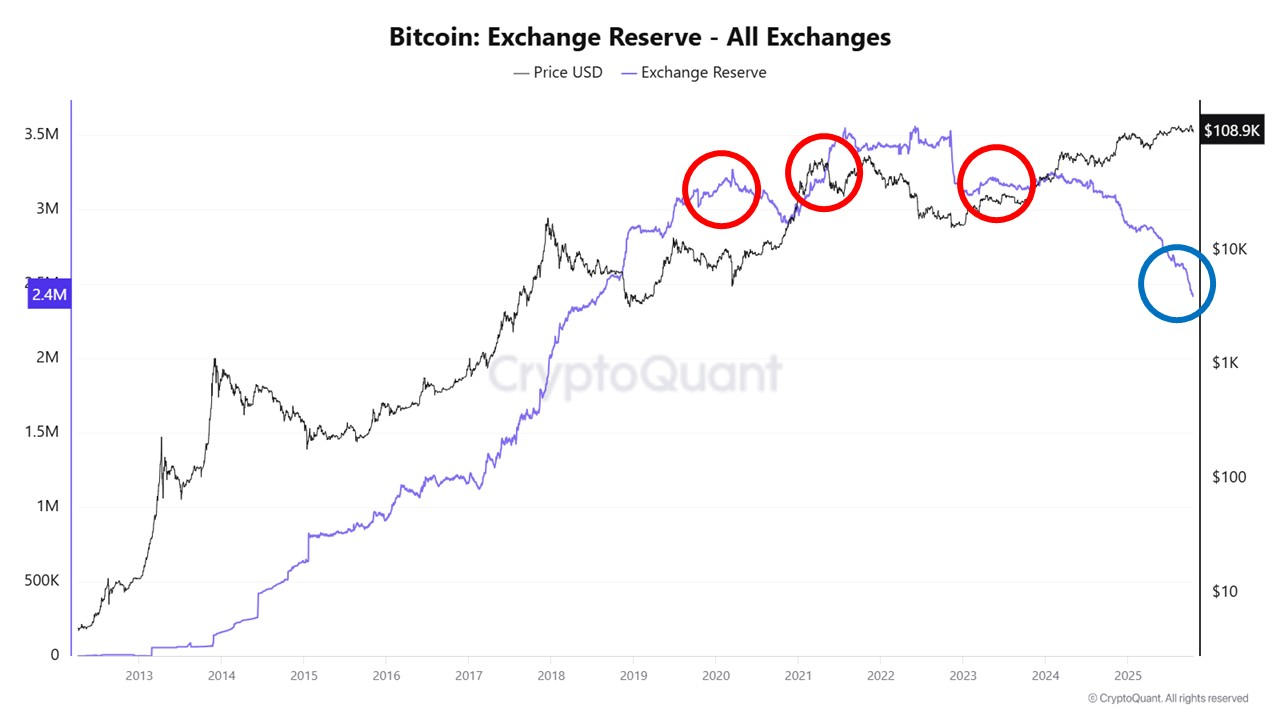

October Crypto Crash Shows Stark Contrast to 2021 Selloffs, Analyst Finds

CryptoNewsNet·2025/10/17 13:57

Flash

- 16:15Bitcoin market sentiment turns defensive as options market reflects rising demand for hedgingForesight News reported, citing glassnode analysis, that ongoing macro uncertainty continues to weigh on Bitcoin (BTC) performance. Data shows that over the past week, gold has outperformed Bitcoin by more than 20%, with some "store of value" funds flowing into the gold market. Options market data reflects a clear shift in market sentiment: overnight volatility triggered a sharp surge in short-term volatility, with BTC front-end options volatility around 50, indicating that traders are paying a premium for immediate protection; BTC option skew continues to exhibit macro asset characteristics, with a clear preference for put options, and the cost of downside protection is higher than upside risk exposure; capital flows are relatively balanced, with some accounts reducing protective positions, some accounts selling volatility on the decline, and others selectively buying call options; overall volatility structure remains defensive, showing a preference for put options, marginally rising volatility, and high demand for tail hedging. Analysis shows that although many accounts hold year-end upside risk exposure, the resilience of downside volatility has weakened this momentum. In the current market environment, selling put options or put spreads to fund potential upside in November remains attractive, provided traders can tolerate the associated risks.

- 16:15Bloomberg: Arthur Hayes plans to raise $250 million to establish a private equity firm focused on the crypto sectorForesight News reported, according to Bloomberg, that Arthur Hayes is seeking to raise $250 million to establish a private equity firm, which will focus on acquiring small and medium-sized cryptocurrency companies.

- 16:14MegaETH repurchases 4.75% equity and token warrants from early investorsForesight News reported that MegaETH has announced the repurchase of 4.75% of its equity and token warrants from Pre-Seed round investors. The terms of the transaction, including the total size, financing details, and valuation, have not been disclosed. The valuation for this repurchase is higher than that of the seed round, during which MegaETH raised $20 million at a "nine-figure" token valuation (at least $100 million). When asked why some investors exited before the token launch, the founder of MegaETH stated: "Some of our investors have closed their funds and are trying to liquidate all positions. Since there is no secondary market, the MegaETH team is the only available buyer."