News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin Community Split Over Purpose May Coincide With Outperformance Versus Major Assets, Mow and JAN3 Say2Ethereum Near $4,475: Clearing $4,500 or Holding $4,362–$4,200 Could Determine Next Direction3Must-Read Before WLFI Launch: 20 Q&As Fully Explain the Governance Model

Going Global: Architecture Selection and Tax Optimization Strategies

How important is having an appropriate corporate structure?

深潮·2025/09/02 07:03

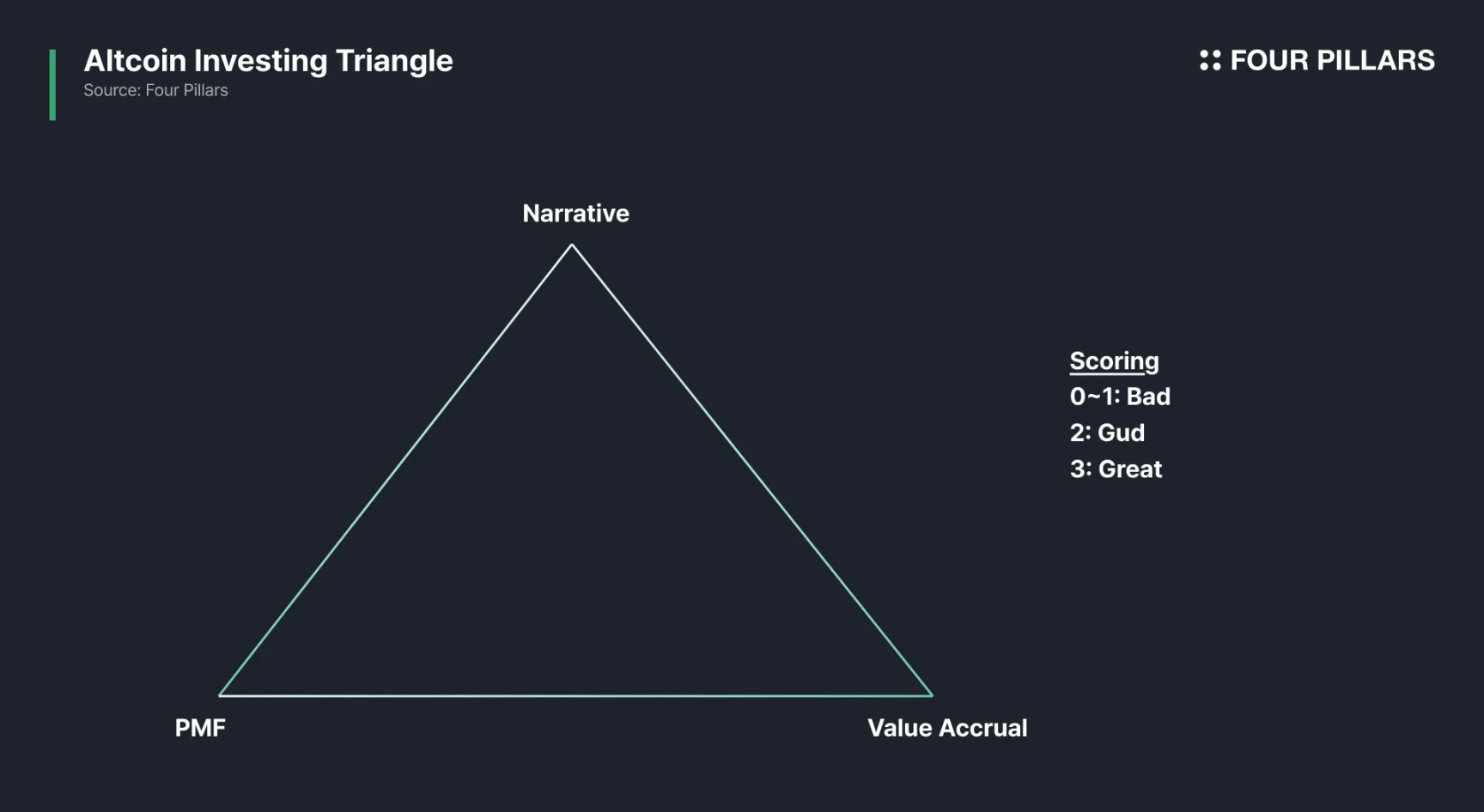

The Evolution of Altcoin Investment from the Perspective of $HYPE

In an era where indicators can be manipulated, how can we see through the narrative fog surrounding token economics?

深潮·2025/09/02 07:03

Paraguay Launches Tokenized Innovation Hub on Polkadot

Coinspaidmedia·2025/09/02 05:40

The underestimated Malaysian Chinese: the invisible infrastructure builders of the crypto world

The foundational infrastructures and emerging narratives in the crypto industry, such as CoinGecko, Etherscan, and Virtuals Protocol, all originate from Malaysian Chinese teams.

BlockBeats·2025/09/02 05:13

Interpretation of AAVE Horizon: Trillions Market Awaiting Unlock, the Key Piece for RWA On-Chain?

What does it mean when U.S. Treasury bonds and stock funds can both be used as collateral in DeFi?

BlockBeats·2025/09/02 05:12

Flash

- 07:18The top Ethena address received approximately $1.85 million worth of WLFI tokens yesterday and has not sold them yet.Jinse Finance reported that, according to on-chain analyst Ai Yi (@ai_9684xtpa), the address ranked first on the Ethena leaderboard, AndreIsBack (0x9cb...c06ce), has received an unlocked 7.74 million WLFI tokens, currently valued at approximately $1.85 million. Previously, this address invested 170 ETH (about $580,000) in the first phase of the WLFI public sale and received 38.71 million tokens. On-chain data shows that this address currently holds a 3x leveraged short position on the Hyperliquid platform, with an unrealized profit of $585,000. The address holds assets exceeding $41.69 million, has participated in 21 decentralized finance projects, ranks first in the Ethena Season 3 leaderboard with 1.28 trillion points, accounting for 3.57% of the total prize pool.

- 06:56lxuan.eth spent $8.51 million in the past hour to repeatedly go long on 77.21 cbBTCAccording to Jinse Finance, on-chain analyst @ai_9684xtpa monitored that lxuan.eth spent $8.51 million in the past hour to repeatedly go long on 77.21 cbBTC during the rebound trend, with an average price of $110,230. Currently, the floating profit is $18,000. At present, he has staked a total of 77.21 cbBTC to borrow 5,318,000 USDC, with a health factor of 1.25.

- 06:26Yei Finance launches cross-chain settlement execution layer Clovis, with two rounds of pre-deposits sold out in 90 minutes and 30 minutes respectivelyChainCatcher reported that Yei Finance has announced the official launch of its cross-chain liquidation and execution layer product, Clovis. The first batch of pre-deposit quotas sold out within 90 minutes, and the second round of quotas sold out within 30 minutes, with deposits from over a thousand users. According to official sources, the third wave of pre-deposit quotas is expected to open again next week. As the largest lending, DEX, and cross-chain integrated protocol by TVL on Sei, the core of Yei Finance's newly launched Clovis lies in building a cross-chain liquidation and execution layer in the DeFi sector. The goal is to break down barriers between chains and integrate cross-chain liquidity, thereby significantly improving capital efficiency.