News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 06) | Monad Plans to Launch Mainnet and Native Token MON on November 24; U.S. Government Shutdown May Delay Crypto Market Structure Legislation Until 20262Bitcoin and Ether ETFs record fifth consecutive day of outflows as crypto prices remain under pressure3Monero (XMR) jumps to 5-month high as privacy coins lead surprise market rally

Bitcoin’s Current Correction: At the End of the “Four-Year Cycle,” Government Shutdown Intensifies Liquidity Shock

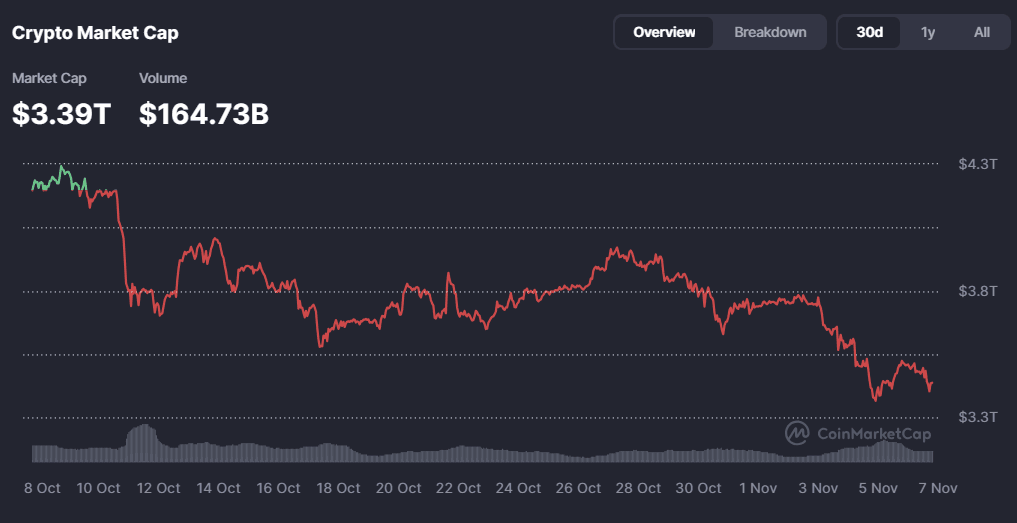

A Citi report indicates that the liquidation event in the crypto market on October 10 may have damaged investors' risk appetite.

ForesightNews·2025/11/07 02:13

Institutional Outflows Hit Bitcoin and Ether ETFs as Solana Demand Accelerates

Cointribune·2025/11/07 00:48

Bitcoin Price Stalls Below $105K Amid Heavy Selling and Pending Tariff Ruling

Cointribune·2025/11/07 00:48

36 Days of Shutdown in the USA: The Crypto Bill Threatens to Derail for Good

Cointribune·2025/11/07 00:48

Render (RENDER) Holds Key Support — Could This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/11/07 00:45

JPMorgan sees Bitcoin as more attractive than gold after price dip

Coinjournal·2025/11/07 00:24

Dogecoin faces $0.15 test as analysts predict a massive price ‘burst’ ahead

Coinjournal·2025/11/07 00:24

Why Is the Crypto Market Flat Today? November 6, 2025

Cryptoticker·2025/11/07 00:12

Bitcoin holds above $100,000, but for how long?

market pulse·2025/11/06 22:42

Bitcoin’s valuation metric hints at a ‘possible bottom’ forming: Analysis

Cointelegraph·2025/11/06 21:24

Flash

- 02:44ether.fi discloses that the platform's liquidity vault currently has no security issues and provides a portal for checking risk exposureJinse Finance reported that ether.fi, the Ethereum restaking protocol, posted on X stating that over the past few weeks, the DeFi ecosystem (especially vaults) has faced significant pressure, and the platform has received a large number of vault status inquiries. Due to the conservative setting of risk parameters, there are currently no security issues with ether.fi's liquidity vaults. At the same time, the platform has also published portals for vault status and risk exposure inquiries. Previously, it was reported that several Curator vaults on the crypto lending protocol Euler reached 100% utilization. Yesterday, the utilization rate of the pool managed by Lista DAO reached 99% by MEV Capital and Re7 Labs, triggering a forced liquidation.

- 02:44Google to Integrate Kalshi and Polymarket Prediction Data into Google FinanceForesight News reported, according to Bloomberg, that Google has partnered with Kalshi and Polymarket to integrate data from both prediction market platforms into Google Finance. When users search for future events such as GDP growth, real-time odds will be displayed, aiming to provide more probabilistic information by leveraging the wisdom of the crowd.

- 02:43Sam Altman: OpenAI does not seek government guarantees for data centers, expects revenue to grow to $100 billions by 2030Foresight News reported that Sam Altman published a lengthy article stating that OpenAI does not seek or wish for government guarantees for data centers, and believes that governments should not pick winners or use taxpayer funds to bail out failing companies. If OpenAI fails, other companies will continue the work. He suggested that governments should build and own AI infrastructure themselves, with the profits belonging to the government, and may provide low-cost capital to establish a national reserve of computing power, but this should be for the benefit of the government rather than private companies. OpenAI expects its annualized revenue to exceed $20 billions this year and reach several hundred billions of dollars by 2030, with approximately $1.4 trillions in investment commitments anticipated over the next eight years. Revenue sources will include enterprise products, new consumer devices, robotics, AI scientific discoveries, and other categories; direct sales of computing power; and possible future issuance of equity or debt. OpenAI does not seek to be "too big to fail"; if it fails, the market should handle it. In addition, it hopes that artificial intelligence can be widely accessible and affordable. This technology is expected to have enormous market demand and improve people's lives in many ways.