News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

This article provides an in-depth analysis of the rise of Perp DEX, using SunPerp as an example to explore how it drives Perp DEX towards mainstream adoption through innovation across multiple dimensions, including technology, ecosystem, and user experience.

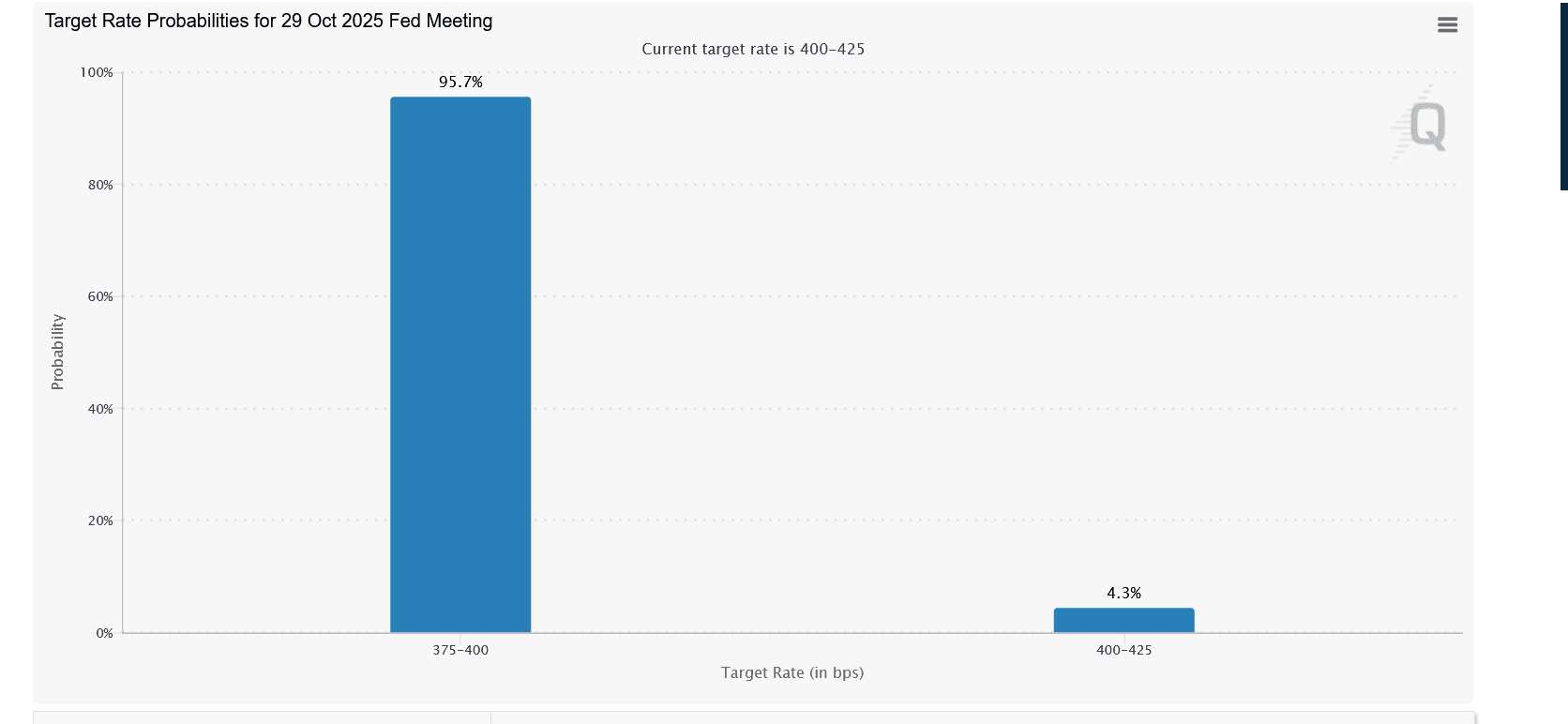

Jerome Powell's latest remarks suggest that the Federal Reserve may cut interest rates again this month.

Quick Take Summary is AI generated, newsroom reviewed. Fidelity clients invested $154.6 million in Ethereum, signaling strong institutional interest. The move boosts overall crypto market confidence and mainstream adoption. Ethereum institutional investment continues to grow due to staking rewards and network upgrades. Fidelity’s participation highlights the merging of traditional finance and blockchain innovation.References JUST IN: Fidelity clients buy $154.6 million worth of $ETH.

Quick Take Summary is AI generated, newsroom reviewed. Tom Lee and Arthur Hayes predict Ethereum could reach $10,000 by end of 2025. Institutional adoption and clearer regulations support growth. Ethereum upgrades improve speed, efficiency, and scalability. Investors should research and diversify before investing.References BULLISH: Tom Lee and Arthur Hayes call for a $10k $ETH price.

- 13:31Forward Industries discloses total SOL holdings have exceeded 6.87 million tokensJinse Finance reported that Nasdaq-listed company Forward Industries has released an update on its digital asset treasury, disclosing that it has invested over $1.59 billion to purchase SOL, with an average purchase cost of $232.08. As of October 15, 2025, the company holds 6,871,599.06 SOL, with almost all SOL holdings currently staked, generating approximately 7.01% in staking rewards.

- 13:05Data: A newly created address has withdrawn over 10,000 ETH from an exchangeChainCatcher news, according to on-chain data analyst Yujin's monitoring, a newly created wallet just 3 hours ago withdrew 10,008 ETH (approximately $41.07 millions) from an exchange, with an average withdrawal price of $4,104.

- 13:05Data: The mysterious address that opened $140 million BTC short positions today has already made a floating profit of about $1.3 millionAccording to ChainCatcher, on-chain analyst @ai_9684xtpa has monitored that after a mysterious new address opened a $140 million short position, BTC has fallen below $112,000, currently yielding a floating profit of $1.298 million. This address currently has $348 million in perpetual contract accounts, with a margin utilization rate of 79.43%.