News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The U.S. government shutdown continues, Bitcoin price rebounds; Meteora founder accused of token manipulation; Hyperliquid Strategies plans to raise 1 billion USD; Tesla’s Bitcoin holdings have yielded an 80 million USD profit; crypto industry leaders discuss regulatory legislation. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

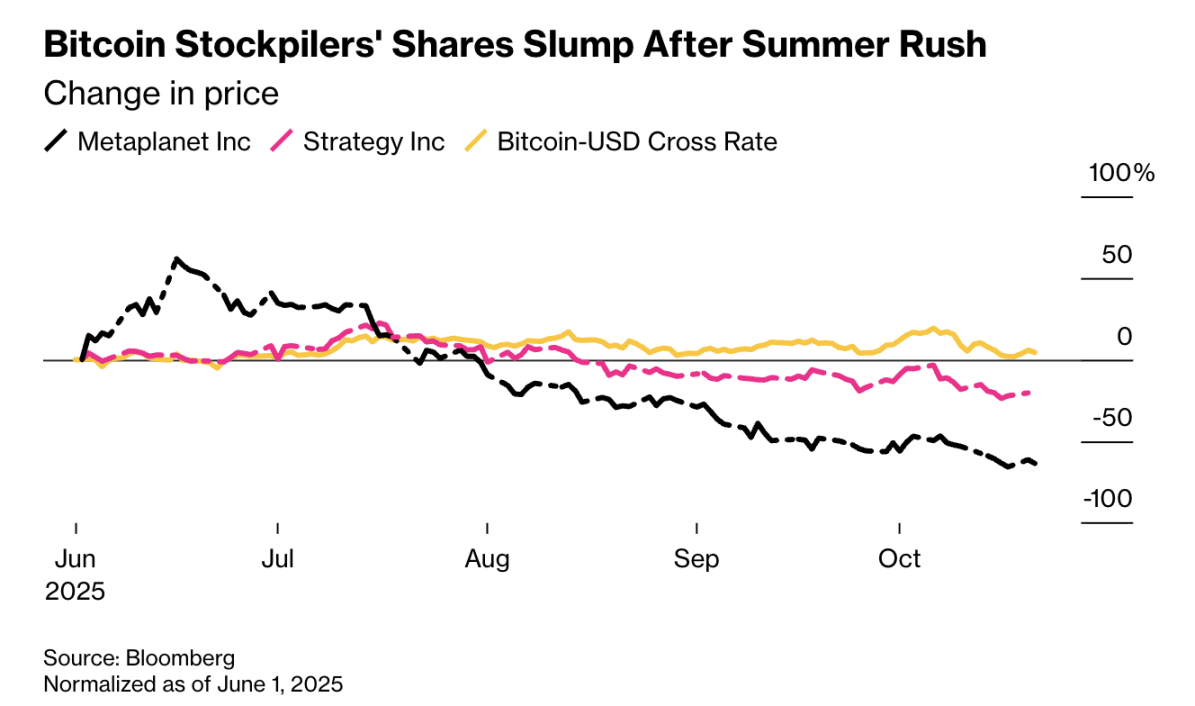

Several Asia-Pacific countries, including Hong Kong, India, Mumbai, and Australia, are resisting corporate hoarding of cryptocurrencies.

At this new historical starting point, the entire industry is working together to move toward a more open, interconnected, and efficient future.

Investing globally no longer requires a cross-border identity, just a Bitget account.

- 05:14Japan Plans to Ban Banks and Insurance Companies from Selling Cryptocurrencies, Securities Firms May Be PermittedJinse Finance reported that the Financial Services Agency of Japan is advancing a regulatory proposal for financial products, intending to prohibit banks and insurance companies from selling virtual currencies, while allowing securities firms and similar institutions to conduct virtual currency sales. Previously, the Financial Services Agency of Japan had already regarded virtual currencies as investment targets and has been exploring regulatory measures under the Financial Instruments and Exchange Act. The agency believes that virtual currency prices are highly volatile and there is a risk of asset leakage due to cyberattacks, thus it is necessary to protect the interests of depositors and insurance policyholders. However, given that internet securities firms and other institutions are already engaged in virtual currency sales, from the perspective of fair competition, the Financial Services Agency of Japan has preliminarily decided to allow securities subsidiaries under banks or insurance companies to sell virtual currencies. The report also pointed out that "it is expected that only after risk management measures are fully established will the Financial Services Agency of Japan possibly approve banks or insurance companies to hold and operate virtual currencies." The Financial Services Agency of Japan plans to submit relevant legal amendments at next year's regular session of the National Diet.

- 05:09After closing a BTC long position, the whale starting with 0x3fc opened a short position, holding over $80 million.According to ChainCatcher, monitored by HyperInsight, in the past three hours, the whale address starting with 0x3fc, after closing its BTC long position, switched to opening a new BTC short position at an average price of $108,300, with a notional position value reaching $80.28 million. It is currently experiencing a floating loss of over 20%, with the current liquidation price at $109,700. In addition, this address had previously chased long positions in BTC and SOL during the market pullback at 4 a.m. today, and closed those positions three hours ago. Over the past week, the cumulative loss for this address has reached $3.64 million.

- 04:54Sonic: All mainnet and testnet nodes must upgrade to 2.1.2 immediately to avoid disconnectionChainCatcher news, Sonic has issued an important notice on the X platform stating: All nodes on the mainnet and testnet must immediately upgrade to version 2.1.2 to avoid disconnection. This version introduces native fee subsidies and key security improvements, replacing the earlier v2.1 before the Sonic mainnet is fully upgraded to Pectra compatibility. It applies to validators, RPC providers, archive nodes, exchanges, and other node operators. After upgrading, nodes will continue to operate on the current mainnet until the full transition on November 3, 2025.