News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Crypto Market Cap Crashes: 8-Month Low Sparks Panic and Opportunity

Bitcoinworld·2025/12/19 05:06

The New York Times: Trump is pushing cryptocurrency toward a capital frenzy

BlockBeats·2025/12/19 05:04

Metya Joins Forces With 4AIBSC To Power Decentralized AI Agents in Web3 SocialFi Platform

BlockchainReporter·2025/12/19 05:00

Stunning Bitcoin Price Prediction: BOJ Policy Could Catapult BTC to $1 Million, Says Arthur Hayes

Bitcoinworld·2025/12/19 04:55

Spot Ethereum ETFs Face Alarming Sixth Day of Net Outflows: What’s Driving the Exodus?

Bitcoinworld·2025/12/19 04:45

ECB Says Digital Euro Is Ready as Decision Shifts to EU Lawmakers

Decrypt·2025/12/19 04:20

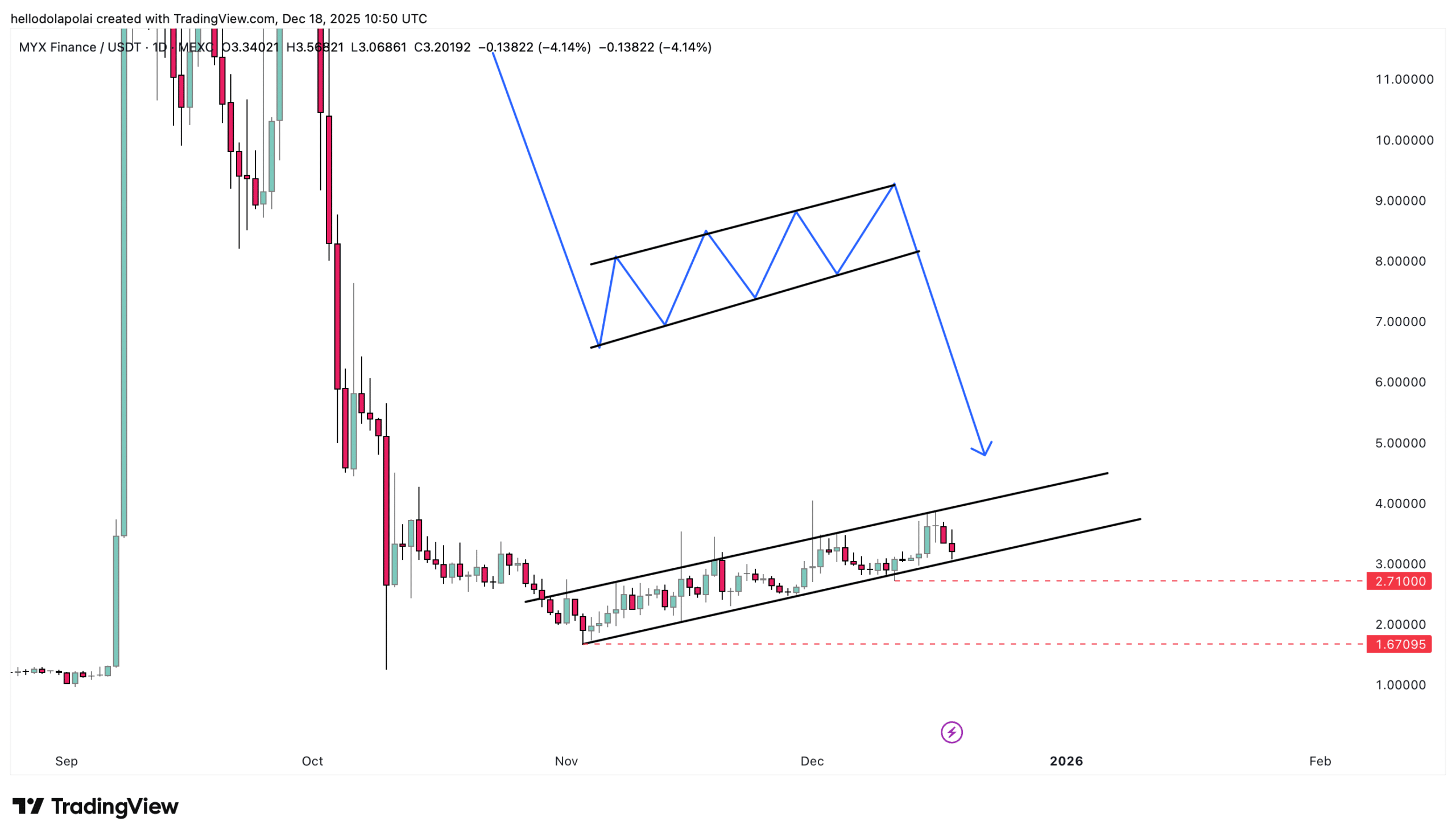

MYX drops 11% as liquidity dries up – Can bulls defend THIS support?

AMBCrypto·2025/12/19 04:03

Take Down OpenAI? The Ambition of the Open-Source AI Platform Sentient Goes Beyond That

Odaily星球日报·2025/12/19 03:44

Historic Shift: Bank of Japan Raises Key Interest Rate to 30-Year High

Bitcoinworld·2025/12/19 03:42

Flash

05:09

A whale deposited and sold 255 BTC on Hyperliquid, exchanging them for 21.77 million USDC.According to ChainCatcher, market sources report that a whale has deposited and sold 255 BTC on Hyperliquid, exchanging them for 21.77 million USDC.

05:08

A certain whale sold 255 BTC and took 10x short positions on BTC and ETH.BlockBeats News, December 19, according to monitoring by Onchain Lens, a certain whale deposited and sold 255 BTC on HyperLiquid, worth $21.77 million. Subsequently, this whale opened BTC and ETH short positions with 10x leverage, currently valued at $77.4 million, including: 876.27 BTC ($76 million); 372.78 ETH ($1 million).

05:08

Over $161 million flowed out of the US spot BTC ETF marketAccording to AiCoin monitoring, there was a large outflow of funds from the US spot BTC ETF market yesterday, with a net outflow reaching $161 million. Among them, the largest outflow came from FBTC, with a single-day net outflow of $170 million; followed by ARKB, with a total of $12.3 million. According to the [Spot BTC ETF Tracking] live trading strategy developed by AiCoin, ETF fund inflows are significantly positively correlated with the price of BTC. You can subscribe to the indicator to enable automatic order placement by the program based on fund flows. Data is for reference only.

News