News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Overnight, the US stock market experienced its worst trading day since April, with the retail-heavy stock index plunging 3.6% and the Nasdaq dropping more than 2%. Poor earnings from Palantir and bearish bets by Michael Burry triggered a sell-off, while increased volatility in the cryptocurrency market added to retail investor pressure. Market sentiment remains tense, and further declines may follow. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

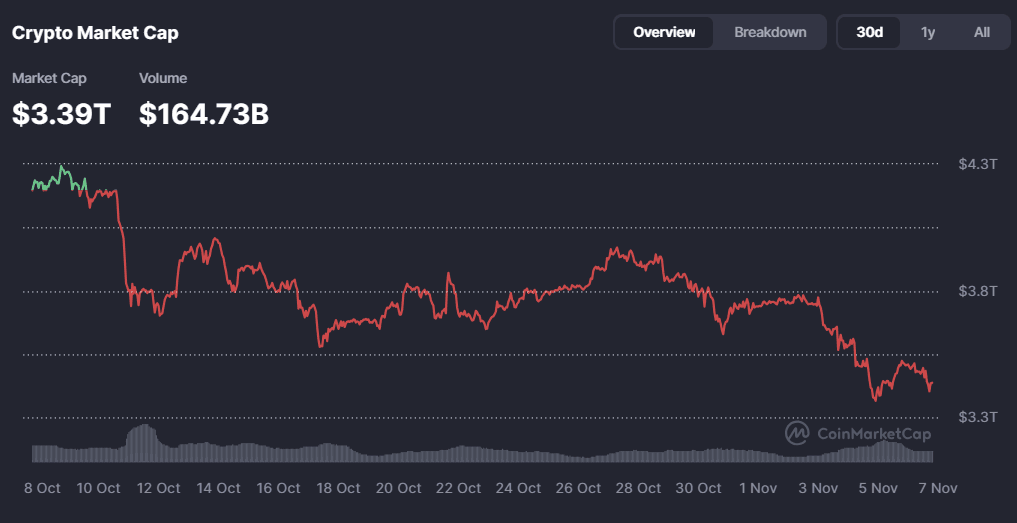

In November 2025, the crypto market experienced a structural turning point. The U.S. government shutdown led to a contraction in liquidity, pulling about 20 billions USD out of the market and intensifying capital shortages in the venture capital sector. The macro environment remains pessimistic.

- 00:23Tether BTC reserve address holds 87,296 BTC, with an average purchase price of approximately $49,121Jinse Finance reported that, according to on-chain analyst Yujin's monitoring, USDT issuer Tether's BTC reserve address withdrew 961 BTC (97.18 million USD) from a certain exchange one hour ago. The BTC stored in this wallet has been purchased using 15% of the company's profits since 2023, and previously, they only withdrew the BTC purchased each quarter from an exchange on the last day of each quarter. Currently, their BTC reserve address holds 87,296 BTC (8.84 billions USD), making it the sixth largest BTC wallet. Based on the price at which they withdrew from the exchange, the average purchase price of these BTC is about 49,121 USD, with an unrealized profit of 4.549 billions USD.

- 00:23FIL surpasses $2.1, with a 24-hour increase of 47.99%Jinse Finance reported that according to market data, FIL has surpassed $2.1 and is now quoted at $2.054, with a 24-hour increase of 47.99%. The market is experiencing significant volatility, so please manage your risks accordingly.

- 00:11Tether increases its holdings by 961 bitcoins, worth approximately $97.34 million.According to Jinse Finance, Onchain Lens monitoring shows that Tether has increased its holdings by 961 bitcoins, equivalent to approximately $97.34 million. Tether currently holds 87,290 bitcoins, with a total value of $8.84 billion.