News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 06) | Monad Plans to Launch Mainnet and Native Token MON on November 24; U.S. Government Shutdown May Delay Crypto Market Structure Legislation Until 20262Bitcoin and Ether ETFs record fifth consecutive day of outflows as crypto prices remain under pressure3Monero (XMR) jumps to 5-month high as privacy coins lead surprise market rally

Institutional Outflows Hit Bitcoin and Ether ETFs as Solana Demand Accelerates

Cointribune·2025/11/07 00:48

Bitcoin Price Stalls Below $105K Amid Heavy Selling and Pending Tariff Ruling

Cointribune·2025/11/07 00:48

36 Days of Shutdown in the USA: The Crypto Bill Threatens to Derail for Good

Cointribune·2025/11/07 00:48

Render (RENDER) Holds Key Support — Could This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/11/07 00:45

JPMorgan sees Bitcoin as more attractive than gold after price dip

Coinjournal·2025/11/07 00:24

Dogecoin faces $0.15 test as analysts predict a massive price ‘burst’ ahead

Coinjournal·2025/11/07 00:24

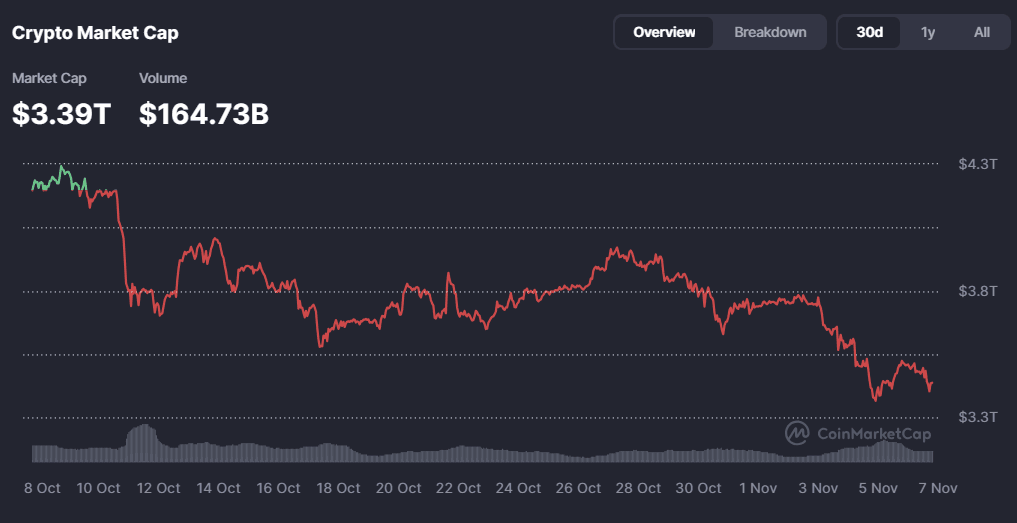

Why Is the Crypto Market Flat Today? November 6, 2025

Cryptoticker·2025/11/07 00:12

Bitcoin holds above $100,000, but for how long?

market pulse·2025/11/06 22:42

Bitcoin’s valuation metric hints at a ‘possible bottom’ forming: Analysis

Cointelegraph·2025/11/06 21:24

Bitcoin ‘$68K too low’ versus gold says JPMorgan as BTC, stocks dip again

Cointelegraph·2025/11/06 21:24

Flash

- 01:37Data: James Wynn closed his HYPE long position and increased his bitcoin long position, with a liquidation price of $93,710.According to ChainCatcher, Hyperbot data shows that about four hours ago, James Wynn closed the HYPE long position he opened earlier this morning, and made a small additional investment in his 40x leveraged bitcoin long position. The current position is valued at approximately $3.96 million, with a liquidation price of $93,710.

- 01:26Australian ASIC Chair: If new technologies such as tokenization are not embraced, its capital markets may be overtaken by other countriesJinse Finance reported that Joe Longo, Chairman of the Australian Securities and Investments Commission (ASIC), stated that unless Australia embraces new technologies, including tokenization, its capital markets may be left behind by other countries. Longo pointed out at the National Press Club on Wednesday: "As other countries adapt and innovate, there is a real risk that Australia will become a 'land of missed opportunities', or merely passively accept overseas developments." According to estimates by Boston Consulting Group (BCG), more than $35.8 billion worth of real-world assets have already been tokenized on-chain, and this figure could rise to $16 trillion by 2030; McKinsey & Co offers a more conservative estimate of $2 trillion. U.S. market regulators have also proposed the concept of 24/7 trading, which "may be more feasible in certain asset classes." Leading financial figures such as BlackRock CEO Larry Fink are promoting the tokenization of everything from stocks and bonds to money market funds, viewing it as a solution.

- 01:05USDC Treasury burns over 100 million USDC on the Solana chainAccording to a report by Jinse Finance, on-chain data tracking service Whale Alert monitored that at around 8:47 AM (GMT+8), USDC Treasury burned 104,314,973 USDC on the Solana chain.