News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 10)|Trump Proposes $2,000 Tariff “Dividend” for Every American, Market Sees Potential Boost for Bitcoin; CBOE to Launch Perpetual Bitcoin & Ethereum Futures Contracts2Can Bitcoin bulls avoid the cycle’s fourth ‘death cross’ at $102K?321Shares And Canary Ignite XRP ETF Approval Process

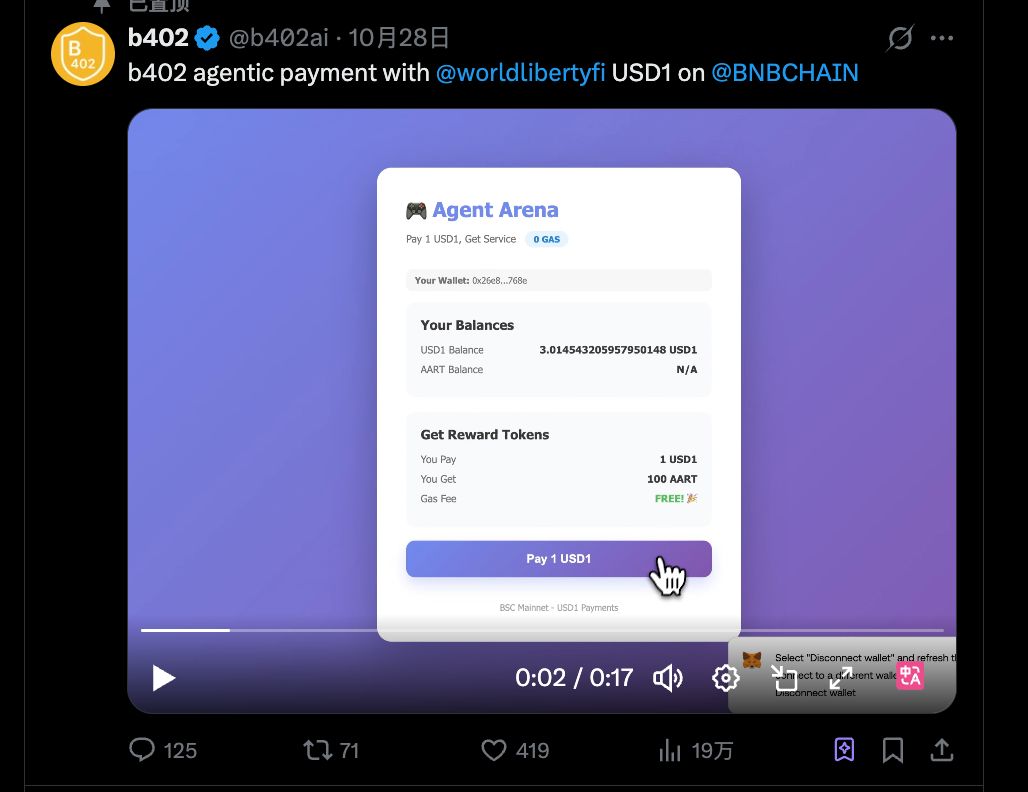

Interpretation of b402: From AI Payment Protocol to Service Marketplace, BNBChain's Infrastructure Ambitions

b402 is not just an alternative to x402 on BSC; it could be the starting point for a much bigger opportunity.

深潮·2025/11/10 04:22

The crypto market suffers consecutive crashes, and the "digital asset treasury company" that "leveraged cryptocurrencies" has collapsed.

Over the past month, MicroStrategy's stock price dropped by 25%, BitMine Immersion fell by more than 30%, while bitcoin declined by 15% during the same period.

ForesightNews·2025/11/10 04:11

Shutdown Leaves Fed Without Key Data as Job Weakness Deepens

Cointribune·2025/11/10 03:48

Institutional Investors Turn Their Backs on Bitcoin and Ethereum

Cointribune·2025/11/10 03:48

Litecoin LTC Price Prediction 2025, 2026 – 2030: Can Litecoin Reach $1000 Dollars?

Coinpedia·2025/11/10 03:39

Decred (DCR) Price Prediction 2025, 2026-2030: Will DCR Break The $50 Mark?

Coinpedia·2025/11/10 03:39

How did the LuBian mining pool lose nearly 130,000 bitcoins to theft in 2020?

Using a predictable pseudo-random number generator led to private keys being compromised, and the "culprit" may be the US government.

ForesightNews·2025/11/10 03:32

Coretime + Elastic Scaling: Building a Productized and Sustainable Web3 Business Logic for Polkadot!

PolkaWorld·2025/11/10 03:13

Key News from Last Night and This Morning (November 9th - November 10th)

PANews·2025/11/10 02:51

Flash

- 05:53Trump Media & Technology Group Q3 Financial Report: Bitcoin Investment Reaches $1.3 BillionBlockBeats News, November 10, Trump Media & Technology Group released its third-quarter financial report. The company reported a third-quarter loss of $54.8 million, compared to $19.3 million in the same period last year; revenue was $972,900, compared to over $1 million in the same period last year. It is worth noting that the company reported its bitcoin investment reached $1.3 billion; bitcoin options investments achieved a profit of $15.3 million, and it holds more than 746 million Cronos, with an unrealized gain of $33 million.

- 05:53Overview of Major Contract Whales: "1011 Insider Whale" Holds Position After Turning Losses Around, "Maji" Increases Holdings After SuccessBlockBeats News, November 10, according to HyperInsight monitoring, as the U.S. government shutdown sees a glimmer of resolution, the crypto market rebounded rapidly last night and this morning. Here is an overview of the on-chain activities of major active contract whales: The "1011 Insider Whale" turned a profit on its $140 million Ethereum long position, but has not taken any action for now, with an unrealized profit exceeding $7 million; "Maji" increased their ETH long position by 25 times after realizing an unrealized profit on their previous Ethereum long. As of press time, their ETH long position amounts to $19.196 million, with an unrealized profit of $1.02 million. In addition, the battle between longs and shorts on ZEC continues: On Hyperliquid, the largest ZEC short position is still increasing and adding margin. As of press time, the unrealized loss on this ZEC short position is $18.32 million.

- 05:53The Hong Kong government plans to issue digital green bonds denominated in US dollars, Hong Kong dollars, euros, and RMB.BlockBeats News, November 10, according to a report by Bloomberg citing sources, the Hong Kong government plans to issue digital green bonds denominated in US dollars, Hong Kong dollars, euros, and renminbi, with pricing expected as soon as today. This will be the third time since 2023 that the Hong Kong government has issued digital bonds. If this bond issuance proceeds successfully, it will mark an important step towards the normalization of bond tokenization and the tokenization of real-world assets (RWA) by the government. Analysts from CITIC Securities stated that it is expected that within the next 2 to 3 years, native digital bonds in Hong Kong will transition from pilot projects to one of the standard options for high-quality corporate financing.