News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(Nov 29)|All Major U.S. Stock Indices Closed Lower; Next Year’s FOMC Voters Emphasize Inflation Risks and Oppose Further Rate Cuts; 72 out of Top 100 Tokens Down More Than 50% from All-Time Highs2Bitcoin’s Current Correction: At the End of the “Four-Year Cycle,” Government Shutdown Intensifies Liquidity Shock3Zcash Price Prediction 2025: Why ZEC Might Hit $360, Shedding 35% From ATH?

2025 Digital Asset Treasury Company (DATCo) Annual Report

ChainFeeds·2025/11/07 03:32

[English Long Tweet] Beyond Simple Betting: A New Expression for Prediction Markets

ChainFeeds·2025/11/07 03:32

Vitalik: Sorting Out the Differences Among Various L2s

L2 projects will become increasingly heterogeneous.

Vitalik Buterin·2025/11/07 03:02

Institutional Outflows Hit Bitcoin and Ether ETFs as Solana Demand Accelerates

Cointribune·2025/11/07 00:48

Bitcoin Price Stalls Below $105K Amid Heavy Selling and Pending Tariff Ruling

Cointribune·2025/11/07 00:48

36 Days of Shutdown in the USA: The Crypto Bill Threatens to Derail for Good

Cointribune·2025/11/07 00:48

Render (RENDER) Holds Key Support — Could This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/11/07 00:45

JPMorgan sees Bitcoin as more attractive than gold after price dip

Coinjournal·2025/11/07 00:24

Dogecoin faces $0.15 test as analysts predict a massive price ‘burst’ ahead

Coinjournal·2025/11/07 00:24

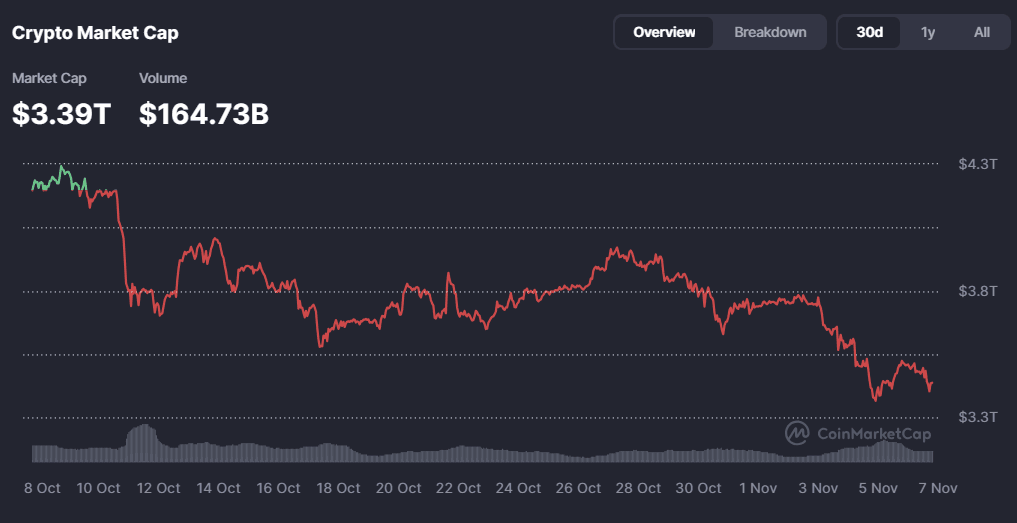

Why Is the Crypto Market Flat Today? November 6, 2025

Cryptoticker·2025/11/07 00:12

Flash

- 03:52Wall Street giants issue warning: mounting pressure in the money market could trigger another crisis, forcing the Federal Reserve to interveneBlockBeats News, November 7, according to the Financial Times, several Wall Street banks have warned that pressure in the US money markets may erupt again, prompting the Federal Reserve to take swifter action to curb a new round of short-term interest rate increases. Short-term financing rates have stabilized this week, but signs of tension in key parts of the financial system last month have raised concerns among some bankers and policymakers. However, market participants remain worried about the risk of repo rates spiking again in the coming weeks. "I don't think this is just an isolated abnormal fluctuation lasting a few days," said Deirdre Dunn, head of rates at Citi on Wall Street and chair of the Treasury Borrowing Advisory Committee. Scott Skyrm, Executive Vice President at repo market specialist Curvature Securities, added that although the market has "returned to normal," partly because banks have used the Fed's funding mechanisms to ease money market pressure, "funding pressure will at least return at the end of next month and at year-end." Meghan Swiber, US rates strategist at Bank of America, said: "Such an aggressive scale of Treasury issuance is high by historical standards and could exhaust traditional investors' demand for Treasuries. To better balance Treasury supply and demand, we believe a long-dormant buyer will likely need to step in: that is the Federal Reserve."

- 03:52The bottom-fishing whale "7 Siblings" has accumulated another 1,601 ETH, worth approximately $5.25 million.BlockBeats News, November 7, according to Ember monitoring, the bottom-fishing whale "7 Siblings" purchased another 1,601 ETH today, worth approximately $5.25 million. Since the sharp drop on October 11, they have spent a total of 163 million USDC to purchase 45,800 ETH.

- 03:51Sky community releases proposal to deprecate sUSDS and sDAI as SparkLend collateralBlockBeats News, November 7, according to the official forum, the Sky community has released a proposal titled "SparkLend Deprecates sUSDS and sDAI Collateral." The proposal suggests that SparkLend should stop accepting sUSDS and sDAI as collateral in order to reduce SparkLend's exposure to risk factors from other assets. After the parameter changes are implemented, third-party users of SparkLend will be largely protected from the solvency and liquidity risks of DAI, USDS, and the broader Sky ecosystem. The team will implement the update through the following measures: setting the supply cap for each asset to 1 token (to prevent new supply), and setting the maximum LTV for each asset to 0%, thereby prohibiting new borrowing using sDAI or sUSDS as collateral.