News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Bitmine’s Stunning Progress: 66% Towards Controlling 5% of Total Ethereum Supply

Bitcoinworld·2025/12/20 11:27

Retail Is Staring At XRP Price Chart. Institutions Are Staring at D.C

TimesTabloid·2025/12/20 11:12

Citigroup Cuts Crypto Targets While Keeping Long-Term Faith

Cryptotale·2025/12/20 11:06

Bitcoin after the October 2025 crash: causes, consequences, and year-end outlook

Cryptonomist·2025/12/20 11:03

Collably Network and WAVES AI Unite to Launch World’s First Cultural Oracle for Web3 Content Intelligence

BlockchainReporter·2025/12/20 11:00

The Most Controversial FED Member Made a Statement About Cryptocurrencies

BitcoinSistemi·2025/12/20 10:42

Bitwise Files Spot SUI ETF With SEC, Offering Direct Exposure and Staking Yield to Tap a $5B Token Market

CryptoNinjas·2025/12/20 10:21

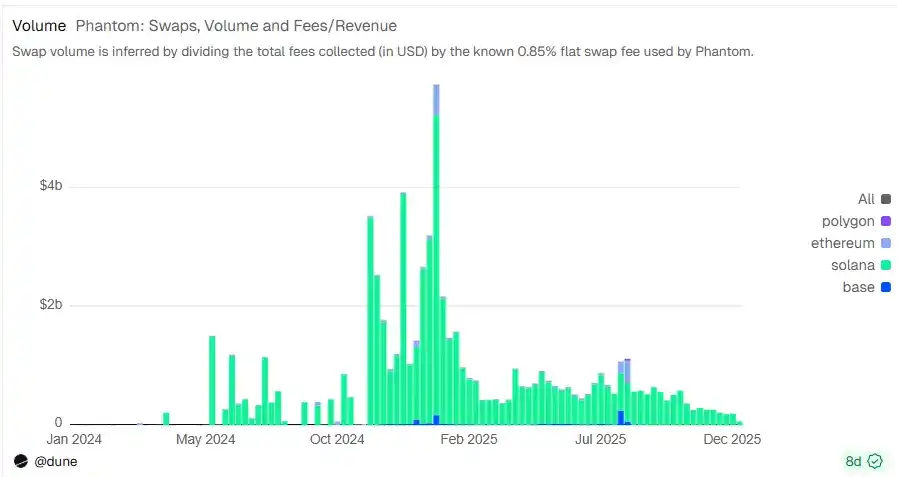

Behind the $3 billion valuation: Phantom's growth anxiety and multi-chain breakout

BlockBeats·2025/12/20 10:02

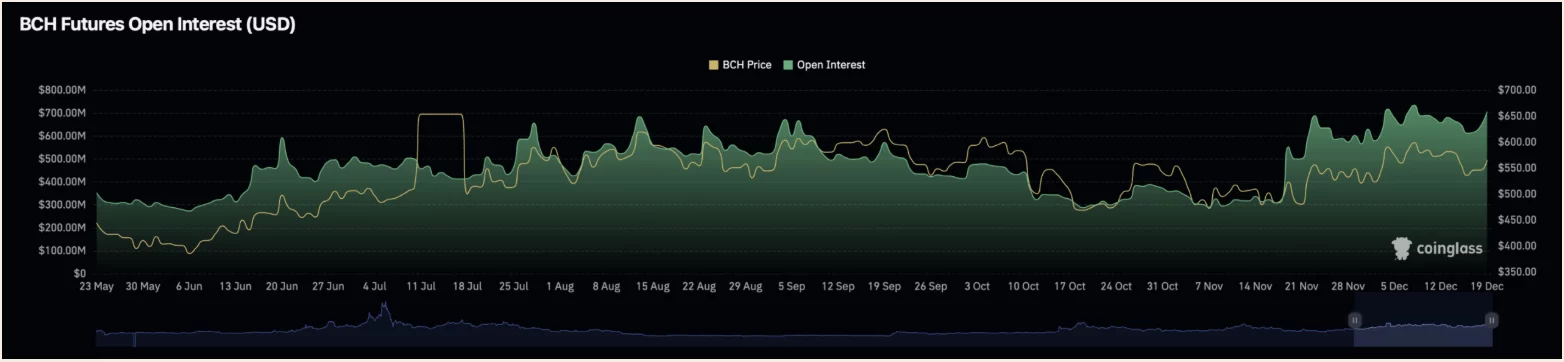

Bitcoin Cash Surges: BCH’s Mixed Market Reaction

Cointurk·2025/12/20 10:01

Pepecoin (PEPE) vs $0.035 DeFi Coin: Which Has the Cleaner Long-Term Setup as Market Conditions Shift?

TimesTabloid·2025/12/20 10:00

Flash

11:51

140.41 BTC transferred from an anonymous address, with part of it flowing into an exchangeAccording to Arkham data, 140.41 BTC (worth approximately $12.37 million) were transferred from an anonymous address starting with 3McvtV to another anonymous address starting with 3FKFjA. Subsequently, the receiving address transferred 2.5 BTC to an exchange.

11:39

The New York Times: SBF Provides Legal Advice to Other Inmates in Prison, but with Poor ResultsPANews, December 20 – According to The New York Times, FTX founder Sam Bankman-Fried has begun offering legal advice to other inmates during his prison sentence. His clients include former Honduran President Juan Orlando Hernández, music producer Sean Combs, and several others. However, the effectiveness of his services has been poor. Reportedly, Juan Orlando Hernández followed SBF's testimony advice but was ultimately still convicted. Nevertheless, some people have expressed gratitude for SBF's legal advice.

11:34

China Merchants Bank: Japan's interest rate hike may tighten global financial conditionsAccording to Odaily, China Merchants Bank released a research report stating that on December 19, the Bank of Japan raised interest rates by 25bp, increasing the policy rate to 0.75%. Although the Bank of Japan is highly likely to remain very cautious in its rate hike pace, the reversal of yen liquidity and the Japanese bond market will continue to exert pressure on global financial conditions. First, yen carry trades may continue to unwind, putting long-term pressure on global asset liquidity. As of the end of 2024, there are still approximately $9 trillion in positions using low-interest yen as a source of liquidity, and this portion of liquidity may steadily contract as the US-Japan interest rate differential narrows. Second, risks in Japanese bonds may further escalate. In the short term, the Kishida government has approved a supplementary fiscal budget equivalent to 2.8% of nominal GDP; in the long term, Japan plans to increase defense spending to 3% of nominal GDP and permanently reduce consumption tax. The Japanese government's untimely fiscal expansion stance may trigger greater market concerns, and in the medium to long term, Japanese bond yields may rise sharply, with the curve steepening at an accelerated pace. (Golden Ten Data)

News