News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Cardano Price Prediction: Can ADA Reach $2 by 2030?

Bitcoinworld·2025/12/19 05:27

Crypto Market Cap Crashes: 8-Month Low Sparks Panic and Opportunity

Bitcoinworld·2025/12/19 05:06

The New York Times: Trump is pushing cryptocurrency toward a capital frenzy

BlockBeats·2025/12/19 05:04

Metya Joins Forces With 4AIBSC To Power Decentralized AI Agents in Web3 SocialFi Platform

BlockchainReporter·2025/12/19 05:00

Stunning Bitcoin Price Prediction: BOJ Policy Could Catapult BTC to $1 Million, Says Arthur Hayes

Bitcoinworld·2025/12/19 04:55

Spot Ethereum ETFs Face Alarming Sixth Day of Net Outflows: What’s Driving the Exodus?

Bitcoinworld·2025/12/19 04:45

ECB Says Digital Euro Is Ready as Decision Shifts to EU Lawmakers

Decrypt·2025/12/19 04:20

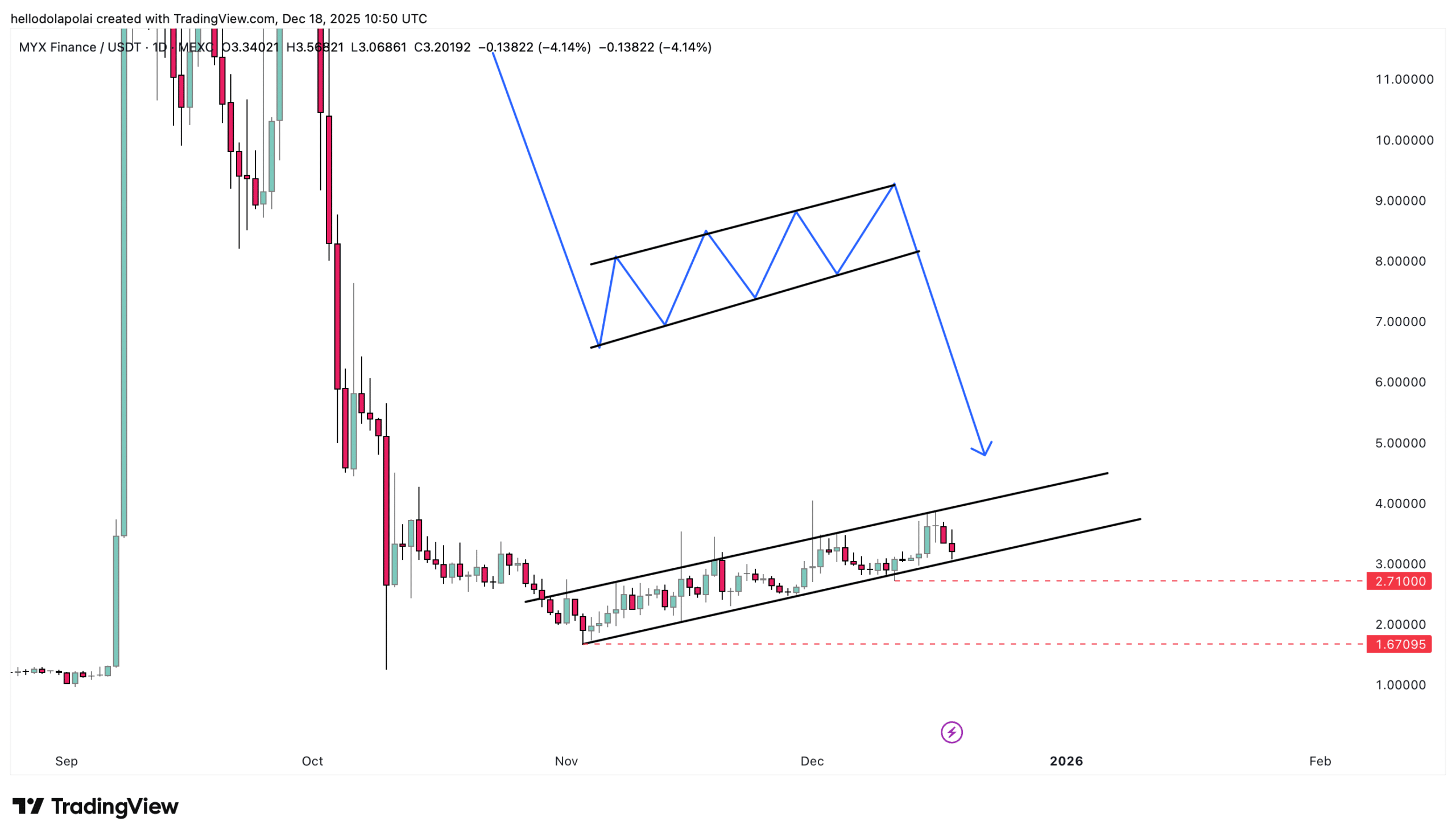

MYX drops 11% as liquidity dries up – Can bulls defend THIS support?

AMBCrypto·2025/12/19 04:03

Take Down OpenAI? The Ambition of the Open-Source AI Platform Sentient Goes Beyond That

Odaily星球日报·2025/12/19 03:44

Flash

05:34

Suspected "1011 Insider Whale" Garrett Jin: The Bitcoin/Ethereum bull market has arrived, and there are no major systemic risks in the US stock market.According to TechFlow, on December 19, the suspected "1011 Insider Whale" Garrett Jin posted on X, stating that the Bitcoin/Ethereum bull market has arrived, with the first price targets being: Bitcoin at $106,000 and Ethereum at $4,500. He also added that there is currently no significant systemic risk in the US stock market, and artificial intelligence will continue to receive policy support in the coming years. Over the next 5-10 years, the demand for power, chips, and memory will far exceed supply, indicating that we are still in the early to mid-stage of the artificial intelligence cycle's boom phase.

05:34

State Street: Convergence of US and Japanese Interest Rates May AccelerateAccording to Odaily, Krishna Bhimavarapu, an economist for Asia-Pacific at State Street Global Advisors, stated that after the Bank of Japan raised the overnight call rate to 0.75%, reaching its highest level in 30 years, the convergence of interest rates between the United States and Japan may accelerate. Japan will face strong macroeconomic tailwinds next year, which could strengthen the Bank of Japan's commitment to normalizing interest rates as the Federal Reserve moves to cut rates. (Golden Ten Data)

05:31

The probability of "Bank of Japan keeping interest rates unchanged in January" reaches 91% on PolymarketBlockBeats News, December 19, according to Polymarket data, the current market predicts a 91% probability that the Bank of Japan will keep interest rates unchanged in January, while the probability of a 25 basis point rate hike is 8%.

News