News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(Nov 29)|All Major U.S. Stock Indices Closed Lower; Next Year’s FOMC Voters Emphasize Inflation Risks and Oppose Further Rate Cuts; 72 out of Top 100 Tokens Down More Than 50% from All-Time Highs2Bitcoin’s Current Correction: At the End of the “Four-Year Cycle,” Government Shutdown Intensifies Liquidity Shock3Zcash Price Prediction 2025: Why ZEC Might Hit $360, Shedding 35% From ATH?

2025 Digital Asset Treasury Company (DATCo) Annual Report

ChainFeeds·2025/11/07 03:32

[English Long Tweet] Beyond Simple Betting: A New Expression for Prediction Markets

ChainFeeds·2025/11/07 03:32

Vitalik: Sorting Out the Differences Among Various L2s

L2 projects will become increasingly heterogeneous.

Vitalik Buterin·2025/11/07 03:02

Institutional Outflows Hit Bitcoin and Ether ETFs as Solana Demand Accelerates

Cointribune·2025/11/07 00:48

Bitcoin Price Stalls Below $105K Amid Heavy Selling and Pending Tariff Ruling

Cointribune·2025/11/07 00:48

36 Days of Shutdown in the USA: The Crypto Bill Threatens to Derail for Good

Cointribune·2025/11/07 00:48

Render (RENDER) Holds Key Support — Could This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/11/07 00:45

JPMorgan sees Bitcoin as more attractive than gold after price dip

Coinjournal·2025/11/07 00:24

Dogecoin faces $0.15 test as analysts predict a massive price ‘burst’ ahead

Coinjournal·2025/11/07 00:24

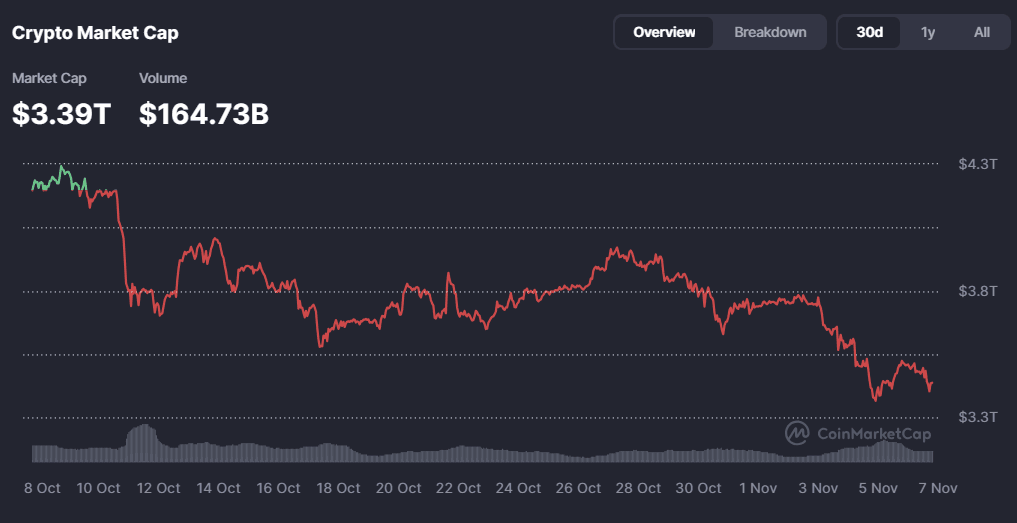

Why Is the Crypto Market Flat Today? November 6, 2025

Cryptoticker·2025/11/07 00:12

Flash

- 04:20The correction in the US stock market reflects valuation adjustments, not a deterioration of fundamentals.Jinse Finance reported that the US stock market remained under pressure this week, as investors questioned the sustainability of high valuations in technology stocks. Pepperstone research strategist Ahmad Assiri stated that this pullback is not a structural collapse, but rather a reality check. He pointed out that the approximately 2% decline in the Nasdaq reflects more of a reaction to market valuations rather than a deterioration in fundamentals, and the VIX index has not seen a significant surge, further supporting this view. (Golden Ten Data)

- 04:14Galaxy Research: 72 out of the top 100 cryptocurrencies by market cap have dropped more than 50% from their peakAccording to a report by Jinse Finance, Galaxy Research states that in the current cryptocurrency market, 72 out of the top 100 cryptocurrencies by market capitalization have fallen more than 50% from their all-time highs.

- 04:11Galaxy CEO: This Cycle Has Not Peaked Yet, a New Fed Chair Could Drive the Next RallyChainCatcher News, Galaxy Digital founder and CEO Mike Novogratz stated on social media, "Currently, our company's employee shareholding ratio is the highest in both the cryptocurrency and data center industries. The crypto market has been performing quite sluggishly recently. Personally, I believe that after a prolonged bull market, many long-term holders are rebalancing their assets, diversifying some funds from overly concentrated positions. In the medium to long term, this is a healthy development, as these positions will gradually be absorbed by a broader range of investors; but in the short term, this adjustment acts like a wet blanket, suppressing market prices. I do not believe we have reached the peak of this cycle yet. I think by the end of this year, we will see a new Federal Reserve Chair, who may be even more dovish (accommodative) than the market expects. Hopefully, this will provide enough narrative momentum for the market to drive the next wave of gains."