News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(Nov 29)|All Major U.S. Stock Indices Closed Lower; Next Year’s FOMC Voters Emphasize Inflation Risks and Oppose Further Rate Cuts; 72 out of Top 100 Tokens Down More Than 50% from All-Time Highs2Bitcoin’s Current Correction: At the End of the “Four-Year Cycle,” Government Shutdown Intensifies Liquidity Shock3Zcash Price Prediction 2025: Why ZEC Might Hit $360, Shedding 35% From ATH?

2025 Digital Asset Treasury Company (DATCo) Annual Report

ChainFeeds·2025/11/07 03:32

[English Long Tweet] Beyond Simple Betting: A New Expression for Prediction Markets

ChainFeeds·2025/11/07 03:32

Vitalik: Sorting Out the Differences Among Various L2s

L2 projects will become increasingly heterogeneous.

Vitalik Buterin·2025/11/07 03:02

Institutional Outflows Hit Bitcoin and Ether ETFs as Solana Demand Accelerates

Cointribune·2025/11/07 00:48

Bitcoin Price Stalls Below $105K Amid Heavy Selling and Pending Tariff Ruling

Cointribune·2025/11/07 00:48

36 Days of Shutdown in the USA: The Crypto Bill Threatens to Derail for Good

Cointribune·2025/11/07 00:48

Render (RENDER) Holds Key Support — Could This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/11/07 00:45

JPMorgan sees Bitcoin as more attractive than gold after price dip

Coinjournal·2025/11/07 00:24

Dogecoin faces $0.15 test as analysts predict a massive price ‘burst’ ahead

Coinjournal·2025/11/07 00:24

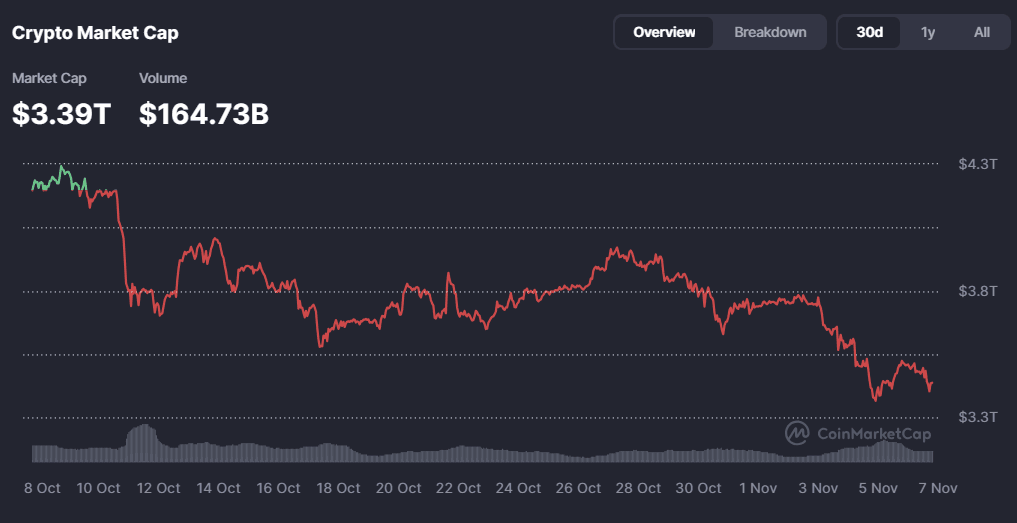

Why Is the Crypto Market Flat Today? November 6, 2025

Cryptoticker·2025/11/07 00:12

Flash

- 03:44DeAgentAI ($AIA) surpasses $10, FDV approaches $9.8 billionsAccording to ChainCatcher, market data shows that Sui ecosystem's leading AI infrastructure DeAgentAI token $AIA has seen a strong price surge, briefly breaking through the $10 mark and reaching a new all-time high. As of press time, $AIA is trading at $9.40, with its circulating market capitalization surpassing $1.26 billions and a 24-hour increase of 496.29%. Its FDV (Fully Diluted Valuation) has reached $9.77 billions, and the number of on-chain holders has exceeded 11,000. Market analysis suggests that this strong price increase may be related to DeAgentAI's developments in the AI oracle sector.

- 03:44Data: Three new addresses withdrew 4,920 ETH from Tornado Cash and sold them, totaling approximately $16.25 million.According to ChainCatcher, monitored by Lookonchain, three new wallets have just withdrawn 4,920 Ethereum (approximately $16.25 million) from Tornado Cash and sold them at around $3,302.

- 03:34Aave founder sharply criticizes Gauntlet for suspending withdrawals from the long-standing DeFi protocol Compound: Assets like deUSD should not be included in major markets.ChainCatcher reported that Aave founder and CEO Stani.eth posted on X that the risk control team Gauntlet has suspended Compound withdrawals; due to the de-pegging of deUSD, users are unable to withdraw funds when there is a risk of bad debt, resulting in a "locked position" status. Gauntlet CBO Nick Cannon responded in the comments, saying "The suspension is proactive, just like what we did for Aave a few years ago, and it reduces the risks highlighted in the screenshot." Stani.eth also commented that "this asset should not be listed in the main market." Data shows that the deUSD stablecoin began to experience severe de-pegging last night, and is now decoupled to $0.1, with its total market cap dropping from tens of millions to millions of dollars.