News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(Nov 29)|All Major U.S. Stock Indices Closed Lower; Next Year’s FOMC Voters Emphasize Inflation Risks and Oppose Further Rate Cuts; 72 out of Top 100 Tokens Down More Than 50% from All-Time Highs2Bitcoin’s Current Correction: At the End of the “Four-Year Cycle,” Government Shutdown Intensifies Liquidity Shock3Zcash Price Prediction 2025: Why ZEC Might Hit $360, Shedding 35% From ATH?

2025 Digital Asset Treasury Company (DATCo) Annual Report

ChainFeeds·2025/11/07 03:32

[English Long Tweet] Beyond Simple Betting: A New Expression for Prediction Markets

ChainFeeds·2025/11/07 03:32

Vitalik: Sorting Out the Differences Among Various L2s

L2 projects will become increasingly heterogeneous.

Vitalik Buterin·2025/11/07 03:02

Institutional Outflows Hit Bitcoin and Ether ETFs as Solana Demand Accelerates

Cointribune·2025/11/07 00:48

Bitcoin Price Stalls Below $105K Amid Heavy Selling and Pending Tariff Ruling

Cointribune·2025/11/07 00:48

36 Days of Shutdown in the USA: The Crypto Bill Threatens to Derail for Good

Cointribune·2025/11/07 00:48

Render (RENDER) Holds Key Support — Could This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/11/07 00:45

JPMorgan sees Bitcoin as more attractive than gold after price dip

Coinjournal·2025/11/07 00:24

Dogecoin faces $0.15 test as analysts predict a massive price ‘burst’ ahead

Coinjournal·2025/11/07 00:24

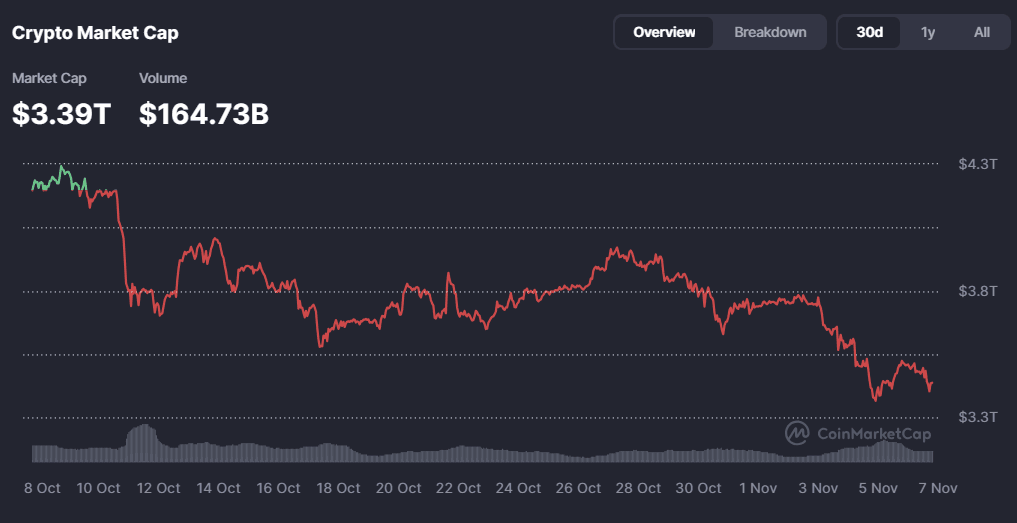

Why Is the Crypto Market Flat Today? November 6, 2025

Cryptoticker·2025/11/07 00:12

Flash

- 03:59Three new wallets withdrew 4,920 ETH from TornadoCash and sold themJinse Finance reported that, according to on-chain analytics platform Lookonchain (@lookonchain), three new wallets withdrew 4,920 ETH (approximately $16.25 million) from TornadoCash and sold them at an average price of about $3,302. It is still unclear whether this operation was carried out by Richard Heart or by hackers. Previously, Richard Heart purchased 162,937 ETH (about $619 million) at a price of $3,800.

- 03:53DeFi domino effect raises concerns, with potential hidden crises lurking beneath the surfaceBlockBeats News, November 7 — Recently, concerns about a chain of DeFi liquidations leading to further liquidity crises have been spreading throughout the crypto community. On November 3, Stream Finance suddenly announced the suspension of deposits and withdrawals, pushing the storm sweeping the DeFi world to a climax. An external fund manager suffered a liquidation during the sharp market fluctuations on October 11, resulting in a loss of approximately $93 million in fund assets. The entire DeFi ecosystem may be facing a systemic crisis involving $8 billion TVL (Total Value Locked), with only about $100 million in losses currently reported. DeFi liquidity protocol Elixir was affected by this, resulting in a $68 million risk exposure. Morpho’s co-founder also responded to the “insufficient liquidity” in some pools, stating that it was not due to a system vulnerability. Yield stablecoins have experienced the largest single-week outflow of funds since the Luna collapse, totaling $1 billion, while the market cap of Ethena Labs’ flagship stablecoin product USDe has also fallen below $9 billion, down about 45% over the past month. Compound has suspended several stablecoin lending markets on Ethereum to cope with the liquidity crisis, and the stablecoin USDX under Stables Labs also experienced a sharp depeg early this morning, dropping to $0.314. Whether the crisis caused by asset leverage nesting and lack of transparency in management is just the tip of the iceberg remains to be seen. For more detailed coverage, see “DeFi’s Potential $8 Billion Bomb, Only $100 Million Has Exploded So Far”.

- 03:52Wall Street giants issue warning: mounting pressure in the money market could trigger another crisis, forcing the Federal Reserve to interveneBlockBeats News, November 7, according to the Financial Times, several Wall Street banks have warned that pressure in the US money markets may erupt again, prompting the Federal Reserve to take swifter action to curb a new round of short-term interest rate increases. Short-term financing rates have stabilized this week, but signs of tension in key parts of the financial system last month have raised concerns among some bankers and policymakers. However, market participants remain worried about the risk of repo rates spiking again in the coming weeks. "I don't think this is just an isolated abnormal fluctuation lasting a few days," said Deirdre Dunn, head of rates at Citi on Wall Street and chair of the Treasury Borrowing Advisory Committee. Scott Skyrm, Executive Vice President at repo market specialist Curvature Securities, added that although the market has "returned to normal," partly because banks have used the Fed's funding mechanisms to ease money market pressure, "funding pressure will at least return at the end of next month and at year-end." Meghan Swiber, US rates strategist at Bank of America, said: "Such an aggressive scale of Treasury issuance is high by historical standards and could exhaust traditional investors' demand for Treasuries. To better balance Treasury supply and demand, we believe a long-dormant buyer will likely need to step in: that is the Federal Reserve."