News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 11)|Uniswap Proposal Activates Protocol Fee Switch & UNI Burn; Monad Announces Tokenomics, 3% Airdropped to Community; Strive Increases BTC Holdings to 7,5252Zcash may see ‘violent end’ as ZEC price rallies 1500% in just two months3Bitcoin ‘double bottom’ eyes $110K, but CME gap may postpone rally

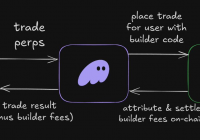

ERC-8021: Ethereum’s ‘copy Hyperliquid’ moment, a new way for developers to make a fortune?

Bitpush·2025/11/11 07:36

Morgan Stanley: The End of Fed QT ≠ Restart of QE, Treasury's Issuance Strategy Is the Key

Morgan Stanley believes that the end of the Federal Reserve's quantitative tightening does not mean a restart of quantitative easing.

ForesightNews·2025/11/11 07:01

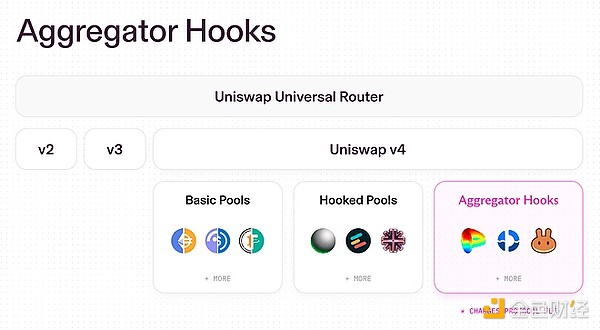

UNI surges nearly 50%: Details of the Uniswap joint governance proposal

金色财经·2025/11/11 06:56

Burning is Uniswap's final trump card

Hayden’s new proposal may not necessarily be able to save Uniswap.

BlockBeats·2025/11/11 06:33

The surge of ZEC has fueled NEAR

Focus on creating a good product, regardless of its application scenarios.

ForesightNews 速递·2025/11/11 06:11

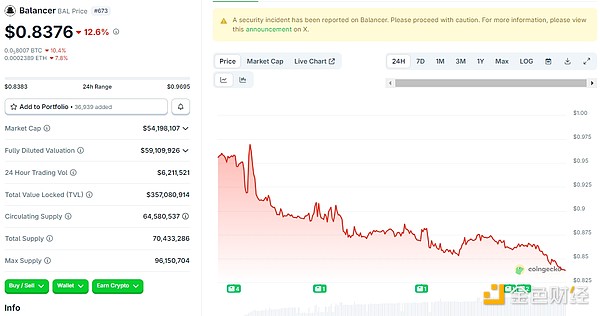

Behind the surge in privacy coins: a flash in the pan or the dawn of a new era?

金色财经·2025/11/11 06:09

What has the Trump family been up to recently?

金色财经·2025/11/11 06:09

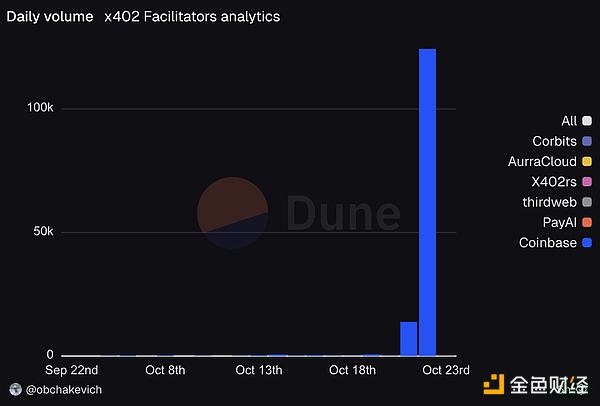

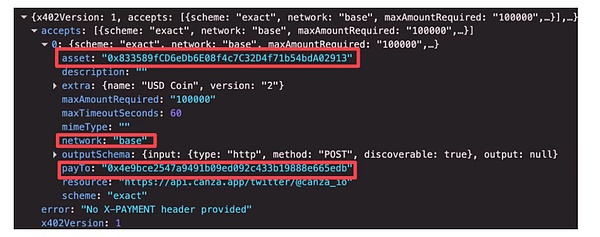

Speculation or real value? Will x402 trigger another Meme wave?

金色财经·2025/11/11 06:09

Flash

- 07:42Argentine judge freezes funds related to LIBRA tokenForesight News reported, citing Cryptopolitan, that Argentine judge Marcelo Giorgi has ordered the freezing of assets related to the Meme token LIBRA incident, and has imposed an indefinite asset freeze on the property and financial accounts of Hayden Davis and two crypto practitioners, Orlando Mellino and Favio Rodriguez. Federal prosecutor Eduardo Taino submitted the relevant application, supported by technical reports from the Financial Investigation and Illicit Asset Recovery Agency. The reports indicated abnormal transactions in the crypto wallets of the three individuals, with investor losses possibly reaching 100 millions to 120 millions USD. The court determined that the case met the conditions of "reasonable suspicion and potential risk," approved the freeze order, and requested that the National Securities Commission extend the measures to all related domestic platforms.

- 07:42Orama Labs completes first PYTHIA buyback and burn, destroying a total of 215,310 tokensForesight News reported that DeSci and AI asset issuance protocol Orama Labs announced today the execution of the first burn of its governance token PYTHIA, with a total of 215,310 PYTHIA tokens burned. This burn took place after the launch of Orama Labs' first ecosystem project, ZENO. According to the previously released tokenomics, the platform will return 50% of fee income directly to project creators to continuously support the development of ecosystem projects, while the remaining portion will be used to drive value-enhancing measures, including buyback and burn initiatives.

- 07:35Data: A certain whale/institution has cumulatively deposited 892 million USDT into a certain exchange and withdrawn 266,895 ETH in the past week.According to ChainCatcher, on-chain data analyst Yu Jin has monitored that the whale/institutional address, which previously made a profit of $24.48 million by shorting ETH and then switched to going long, has cumulatively borrowed 190 million USDT from Aave and transferred it to a certain exchange, then withdrew 75,418 ETH (approximately $269 million). Over the past week, a total of 892 million USDT has been transferred into a certain exchange platform, and 266,895 ETH has been withdrawn at an average price of $3,402.